- Japan

- /

- Consumer Services

- /

- TSE:4668

Meiko Network Japan (TSE:4668) One-off Gain Lifts Margins, Challenging Quality of Earnings Narrative

Reviewed by Simply Wall St

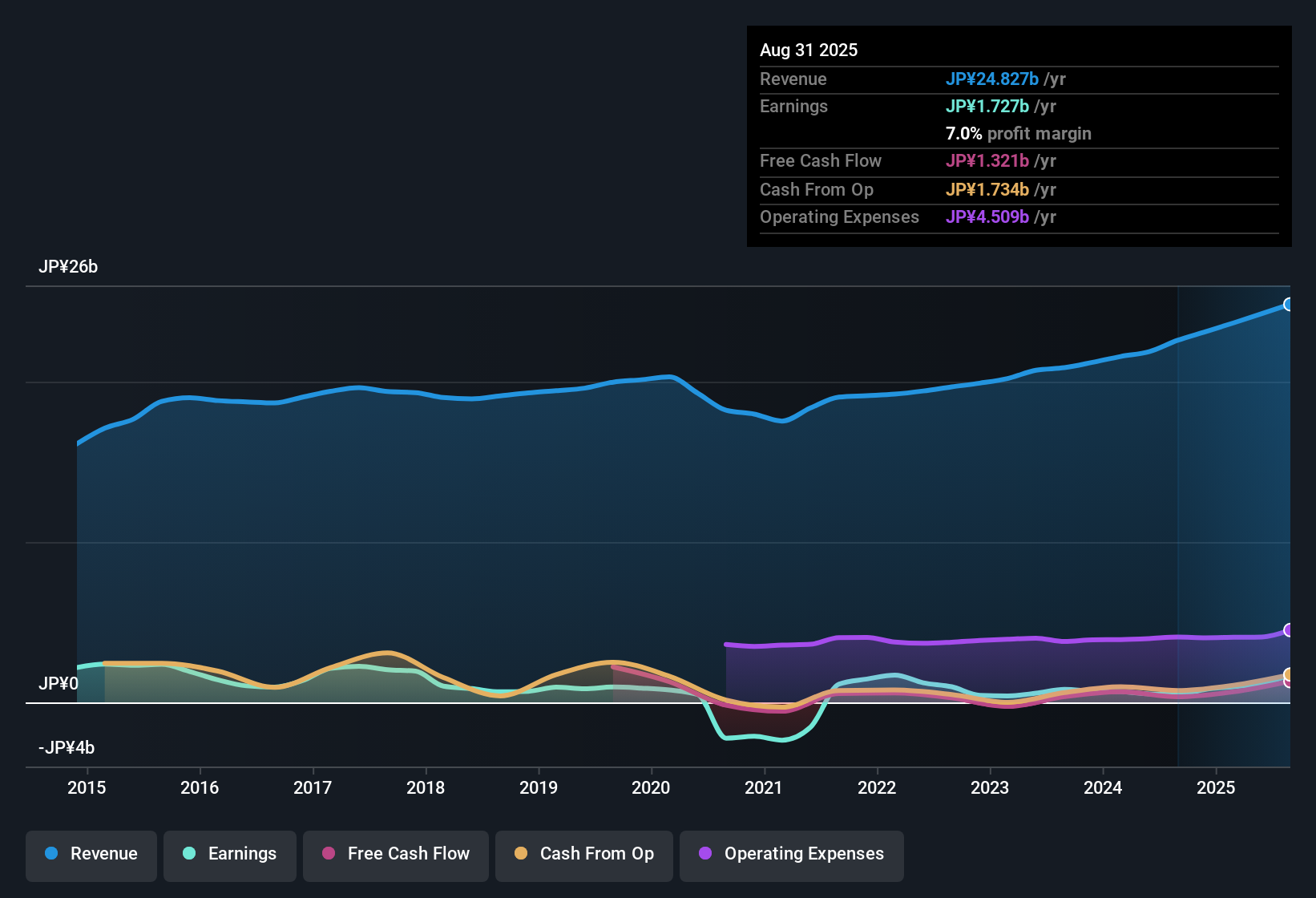

Meiko Network Japan (TSE:4668) posted revenue that is forecast to grow at 5.1% per year, topping the Japanese market’s 4.4% growth forecast. The company saw a remarkable 253.2% earnings growth over the past year, compared to its five-year average of 44.4% annually, and net profit margins jumped to 7% from 2.2% last year. Despite these improvements and with shares trading at ¥731, which is well below the estimated fair value of ¥5,056.62, investors will have to weigh robust profitability and margin expansion against the outlook for a 24.6% annual decline in future earnings and the effect of a one-off ¥710.0 million gain on reported results.

See our full analysis for Meiko Network Japan.The next step is to see how these headline numbers stack up against the most popular narratives. Keep reading as we compare the results to the key stories circulating among analysts and investors.

Curious how numbers become stories that shape markets? Explore Community Narratives

Price-to-Earnings Ratio Well Below Sector

- Meiko Network Japan trades at a Price-To-Earnings (P/E) ratio of 10.7x, which is not only below the broader Japanese Consumer Services industry average of 16.4x but also much lower than the peer group average of 20.4x. This signals a material discount relative to comparable companies.

- Despite the relatively low P/E multiple, which is often cited by bulls as a sign of undervaluation, prevailing analysis underscores that the discount is partly explained by forecasts for a 24.6% annual decline in earnings over the next three years.

- Valuation appears attractive, but continued downward earnings projections challenge the bullish thesis that a re-rating is imminent.

- Bulls must also consider that shares remain well below DCF fair value at ¥5,056.62. Even as profit growth has been driven in part by a one-off gain that could prove nonrecurring, this dynamic adds complexity.

One-off Gain Lifts Margins, But Future Growth Pressured

- Recent net profit margins rose to 7%, up sharply from 2.2% in the previous year. This jump is largely attributable to a one-time gain of ¥710.0 million, rather than purely organic operational improvement.

- With the surge in profit margins boosted by a nonrecurring gain, the prevailing narrative highlights that investors should remain cautious as underlying growth may not reflect these headline improvements.

- Bears argue that true, sustainable progress is difficult to assess when results are distorted by large, one-off items.

- Continued growth in revenue, forecast at 5.1% annually, is a bright spot but does not fully offset the outlook for steep earnings decline once such gains are excluded.

Forecasted Revenue Growth Beats Market Trend

- Meiko’s revenue is forecast to grow at 5.1% annually in the coming years, outpacing the broader Japanese market, which is projected at 4.4% per year.

- Prevailing analysis notes that while higher revenue growth helps the investment case, its impact is reduced by anticipated annual earnings contraction of 24.6%. This reinforces a “show-me” story for investors seeking signs of sustained turnaround.

- Guidance suggests that top-line strength must be accompanied by stable margins to counterbalance the steep profit drop expected ahead.

- Market participants are likely to focus on how well Meiko can convert revenue gains into lasting earnings recovery after the one-off boost fades.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Meiko Network Japan's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Meiko Network Japan faces steep projected earnings declines and nonrecurring gains, which raises doubts about the sustainability of recent improvements.

If consistent performance matters most to you, check out stable growth stocks screener (2096 results) to discover companies delivering reliable revenue and profit growth year after year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4668

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives