- Japan

- /

- Hospitality

- /

- TSE:4343

AEON Fantasy (TSE:4343) Losses Narrow 53% Annually, Challenging Doubts on Profitability Turnaround

Reviewed by Simply Wall St

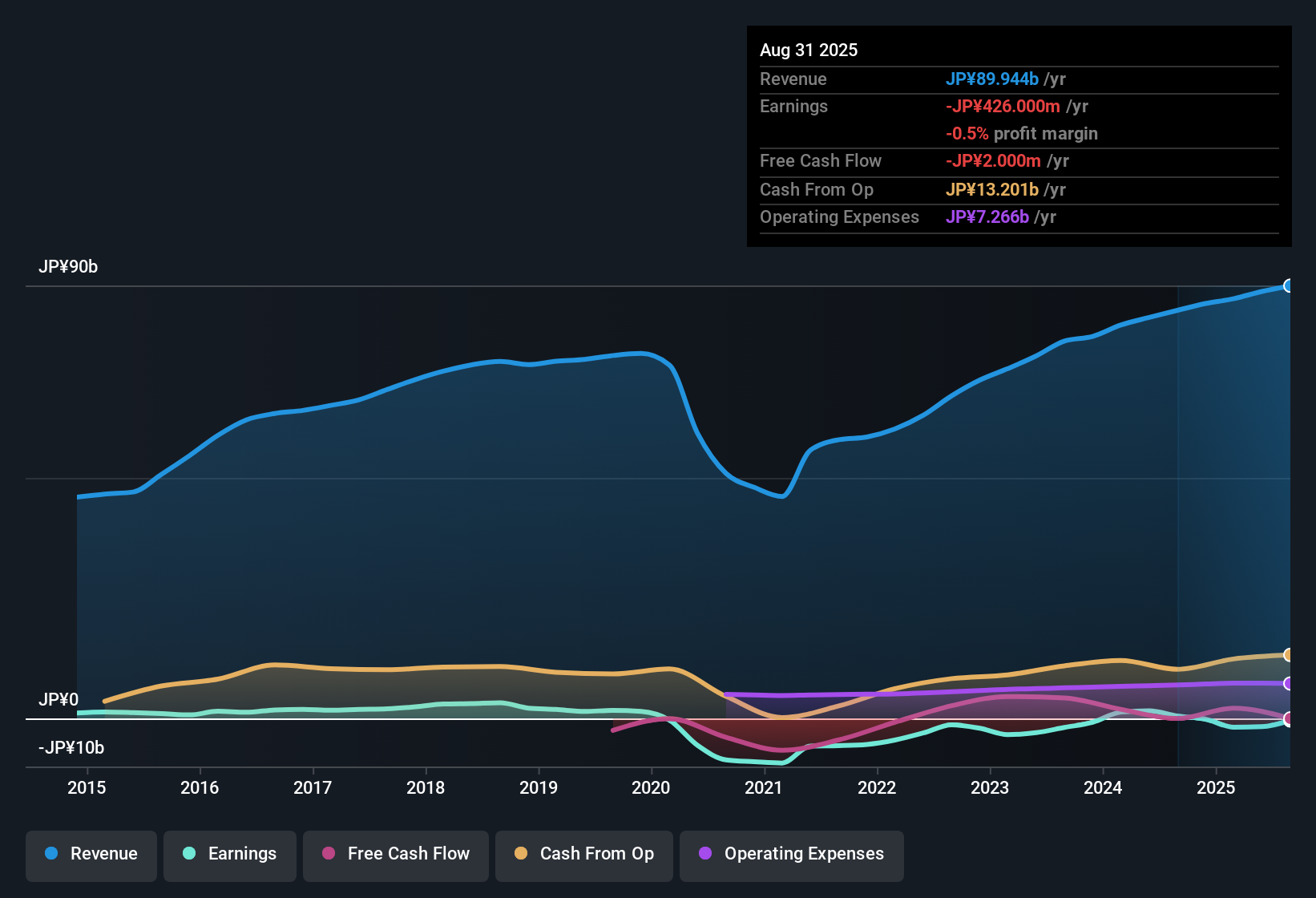

AEON Fantasy LTD (TSE:4343) remains unprofitable, but the company has rapidly narrowed its losses at an average rate of 53% per year over the past five years. Revenue is forecast to grow annually at 2.7%, trailing behind the broader Japanese market’s 4.4% growth. Analysts anticipate a turning point to profitability within three years, with earnings projected to grow by 27.86% per year. Investors are watching closely as attention shifts toward AEON Fantasy LTD's discounted valuation and the potential inflection point for sustained earnings growth.

See our full analysis for AEON FantasyLTD.The next section puts these earnings in context by comparing the results to the major narratives circulating in the market. It spotlights both the places they match up and where the numbers push back against the consensus.

Curious how numbers become stories that shape markets? Explore Community Narratives

Losses Narrow by 53% Annually, Profitability in Sight

- AEON Fantasy LTD has reduced its annual losses at a steep rate of 53% per year over the last five years, pointing to a rapid shift toward breakeven even though it is not yet profitable.

- Forecasts of a move to profitability within three years heavily support the view that operational improvements are translating into real financial gains.

- Expected annual earnings growth of 27.86% aligns with the idea of a swift inflection point in the business.

- The narrowing loss trend gives further credibility to optimism that a turnaround is underway.

Trades at Discounted Sales Multiple

- With a Price-To-Sales Ratio of 0.7x, below the industry average of 0.9x and well under the peer benchmark of 1.9x, AEON Fantasy LTD stands out as attractively valued compared to similar companies.

- Heavily favoring the argument for a value opportunity, the market is pricing in either muted growth or skepticism despite forecasts for strong annual earnings gains.

- The current share price of ¥3,110 is below the DCF fair value of ¥3,358.03.

- This underlines the idea that further upside could be realized if the forecasted profitability improvements are achieved and sustain investor confidence.

No Material Risks Flagged, Rewards Remain the Focus

- There are currently no material risks reported in the data, which shifts investor attention toward AEON Fantasy LTD’s attractive valuation and prospects for earnings growth.

- The prevailing thesis emphasizes that, absent notable headwinds in the risk profile, the company’s accelerating path toward profitability and discounted share price create an appealing setup.

- Investors are likely to watch closely for operational execution and evidence that forecasted growth rates actually materialize.

- As the business trends toward profit and closes the valuation gap, any upside surprise could quickly change sentiment and market action.

AEON Fantasy LTD's undervalued Price-To-Sales multiple and steeply narrowing losses have investors wondering if the inflection point has arrived. See if the growing momentum is enough to challenge past doubts in the latest consensus narrative. 📊 Read the full AEON FantasyLTD Consensus Narrative.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on AEON FantasyLTD's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

While AEON Fantasy LTD is reducing its losses, its slow revenue growth and delayed path to consistent profits set it behind steadier market performers.

If you want to focus on companies showing reliable gains each year, consider shifting your attention to stable growth stocks screener (2090 results) that consistently deliver stable revenue and earnings growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4343

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives