- Japan

- /

- Hospitality

- /

- TSE:3543

Komeda Holdings (TSE:3543) Margin Decline Challenges Defensive Narrative Despite Valuation Discount

Reviewed by Simply Wall St

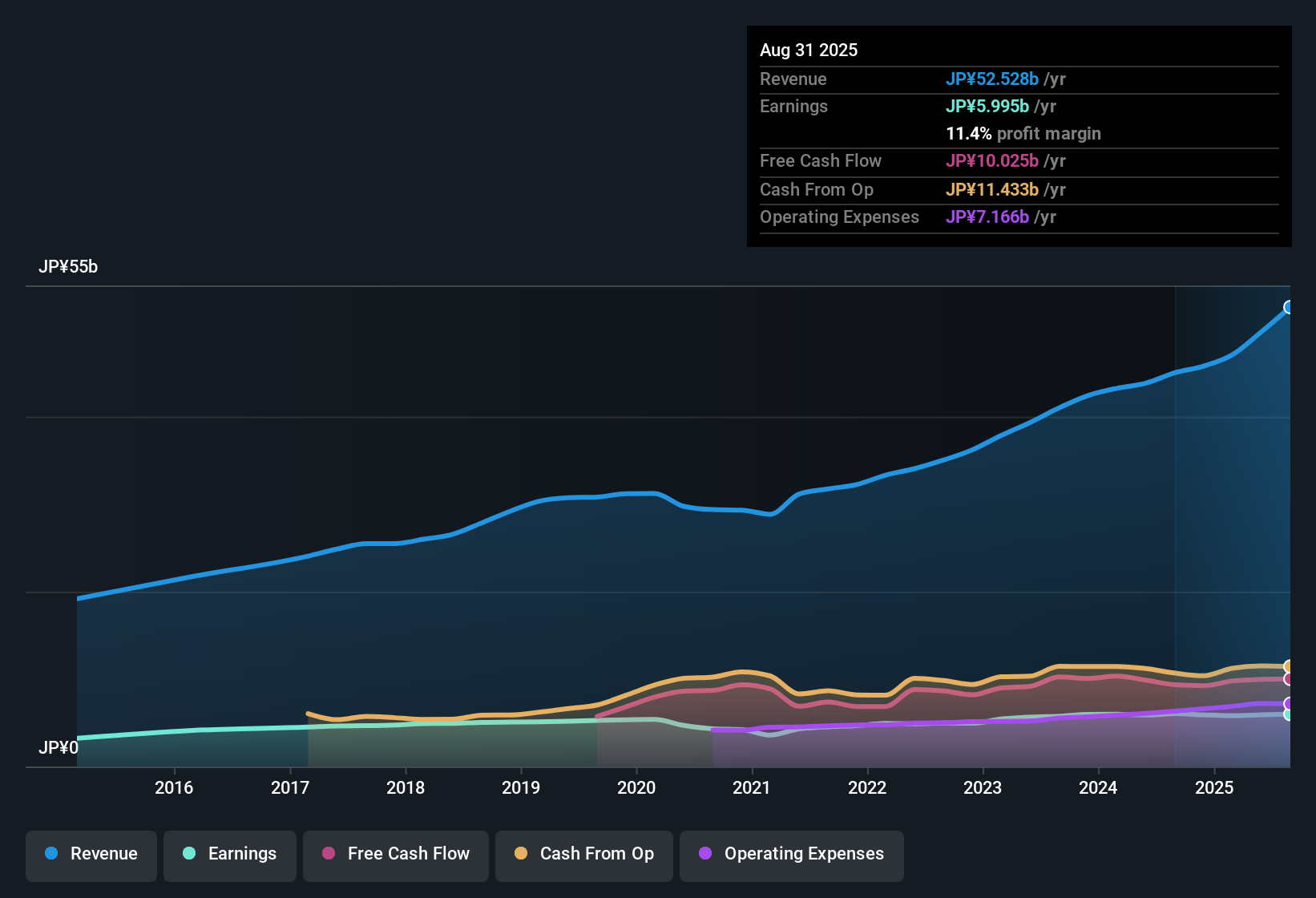

KOMEDA Holdings (TSE:3543) posted a net profit margin of 11.4%, down from last year’s 13.4%, as negative earnings growth weighed on results. Still, revenue is projected to rise 5.8% annually, topping the 4.4% growth expected for the broader Japanese market. Earnings are forecast to increase 6.9% each year, just behind the market’s 8.2% pace. Investors may see an opportunity in the company’s lower price-to-earnings ratio compared to sector peers, despite the recent dip in profitability.

See our full analysis for KOMEDA Holdings.Next, we will dig into how these results compare to the prevailing narratives around KOMEDA Holdings, highlighting where the actual performance supports or challenges investor sentiment.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margin Shrinks Despite Five-Year Earnings Growth

- The latest net profit margin is 11.4%, down from 13.4% last year. This follows five-year annualized earnings growth of 8.5%, which outpaced the current year’s negative direction.

- Despite the recent margin decline, what stands out is that five-year compound earnings growth has been robust at 8.5%. This contrasts sharply with the current year's slip into negative territory and suggests that historical quality still anchors some investor confidence.

- Prevailing analysis points out that the company is perceived as a “defensive café brand,” with resilience highlighted by its reputation for high-quality earnings and a loyal customer base, even as recent performance trails the long-term average.

Revenue Growth to Outpace Industry, but Guidance Trails Broader Market

- Revenue is forecast to rise 5.8% per year, outstripping the 4.4% annual growth expected for the Japanese market. However, earnings growth guidance of 6.9% still lags behind the market’s 8.2%.

- Commentary notes that the business provides “steady returns amid sector normalization” since top-line growth is comfortably above peers. Yet profit expansion does not keep pace with broader expectations, echoing the idea that KOMEDA operates as a defensive, low-risk stock rather than a true growth leader.

- Consensus points to store expansion and digital initiatives as important contributors to outgrowing the sector on revenue, but cautions that without accelerating earnings growth, a major re-rating or premium valuation may remain elusive.

Valuation Discount Widens Versus Peers and Industry

- KOMEDA trades at a price-to-earnings ratio of 22.8x, which is cheaper than both the peer average of 42.9x and the hospitality sector’s 24.2x.

- The current share price of 3,005 is well above the DCF fair value of 2,230.13, but the substantial discount to peer multiples implies many investors see the brand’s stability as underappreciated. Bulls will note this as a sign that there is upside if performance recovers, while others may argue the discount reflects a need for stronger growth.

- The valuation gap means investors get exposure to sector-leading revenue forecasts, yet are paying a more modest multiple relative to competitors. This keeps KOMEDA attractive on a value basis despite near-term margin pressure.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on KOMEDA Holdings's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

KOMEDA’s earnings growth is trailing the broader market, and its margin pressure suggests limited upside until performance improves.

If you’re looking for stronger momentum, check out high growth potential stocks screener to discover established companies expected to deliver the robust growth this one currently lacks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KOMEDA Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3543

KOMEDA Holdings

Operates a coffee shop franchise business under the Komeda Coffee and Okagean brands in Japan.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives