- Japan

- /

- Consumer Services

- /

- TSE:3521

Investor Optimism Abounds Econach Holdings Co.,Ltd. (TSE:3521) But Growth Is Lacking

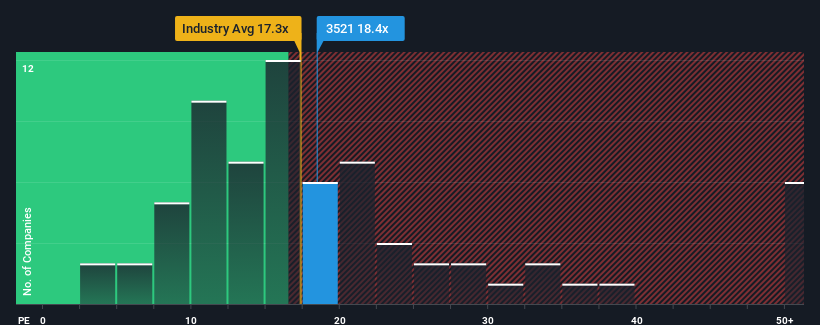

With a price-to-earnings (or "P/E") ratio of 18.4x Econach Holdings Co.,Ltd. (TSE:3521) may be sending bearish signals at the moment, given that almost half of all companies in Japan have P/E ratios under 13x and even P/E's lower than 9x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

Recent times have been quite advantageous for Econach HoldingsLtd as its earnings have been rising very briskly. It seems that many are expecting the strong earnings performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

View our latest analysis for Econach HoldingsLtd

Is There Enough Growth For Econach HoldingsLtd?

Econach HoldingsLtd's P/E ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 78% last year. Still, EPS has barely risen at all from three years ago in total, which is not ideal. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

This is in contrast to the rest of the market, which is expected to grow by 13% over the next year, materially higher than the company's recent medium-term annualised growth rates.

In light of this, it's alarming that Econach HoldingsLtd's P/E sits above the majority of other companies. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh heavily on the share price eventually.

The Final Word

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Econach HoldingsLtd revealed its three-year earnings trends aren't impacting its high P/E anywhere near as much as we would have predicted, given they look worse than current market expectations. Right now we are increasingly uncomfortable with the high P/E as this earnings performance isn't likely to support such positive sentiment for long. If recent medium-term earnings trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

You always need to take note of risks, for example - Econach HoldingsLtd has 1 warning sign we think you should be aware of.

You might be able to find a better investment than Econach HoldingsLtd. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Thermae-Yu Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:3521

Thermae-Yu Holdings

Operates in hot spring facilities and the real estate and businesses in Japan.

Flawless balance sheet second-rate dividend payer.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026