- Japan

- /

- Hospitality

- /

- TSE:3387

Exploring Undiscovered Gems in Global Markets March 2025

Reviewed by Simply Wall St

As global markets grapple with fluctuating consumer confidence and persistent inflationary pressures, many investors are shifting their focus toward small-cap stocks, which have been underperforming in recent weeks. Despite challenges such as policy risks and economic growth concerns, these conditions can create opportunities to uncover lesser-known companies with strong potential for growth. In this environment, a good stock might be one that demonstrates resilience through innovative strategies or niche market positioning, offering a promising outlook even amid broader market uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Ningbo United GroupLtd | 11.97% | -19.47% | -30.66% | ★★★★★★ |

| Pro-Hawk | 17.03% | -6.66% | -2.75% | ★★★★★★ |

| Shenzhen Tongye TechnologyLtd | 5.14% | 3.26% | -17.09% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Suzhou Highfine Biotech | NA | 8.38% | 9.44% | ★★★★★★ |

| Co-Tech Development | 21.93% | 1.57% | 4.27% | ★★★★★☆ |

| Keir International | 23.18% | 49.21% | -17.98% | ★★★★★☆ |

| Silvery Dragon Prestressed MaterialsLTD Tianjin | 31.26% | 0.80% | 0.71% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

| Saudi Chemical Holding | 70.16% | 13.78% | 39.35% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Beijing UniStrong Science&TechnologyLtd (SZSE:002383)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Beijing UniStrong Science & Technology Co., Ltd. specializes in the development and production of satellite navigation systems and has a market capitalization of CN¥6.77 billion.

Operations: UniStrong generates revenue primarily from its Satellite Navigation System segment, which contributed CN¥1.34 billion.

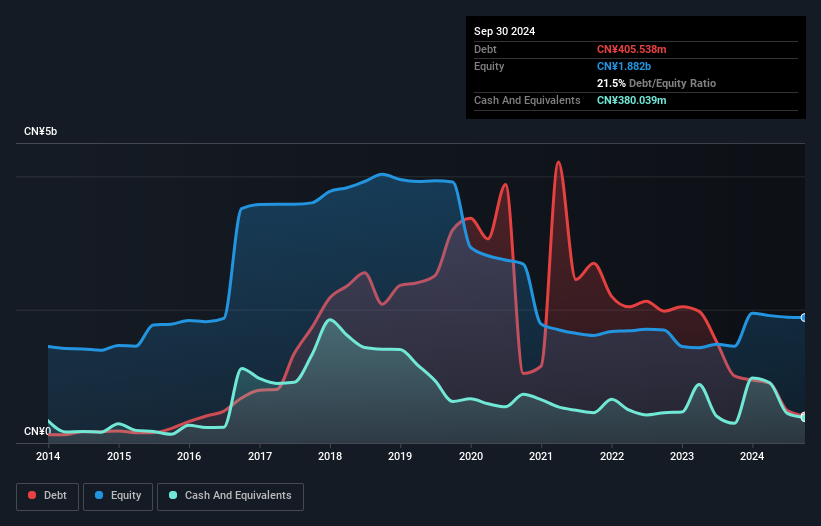

Beijing UniStrong, a relatively small player in its field, has shown promising financial health with a net debt to equity ratio of 1.4%, deemed satisfactory. The company has turned profitable recently, outpacing the communications industry's negative growth rate of -6%. Its price-to-earnings ratio stands at 16.2x, significantly below the broader CN market's 37.9x, suggesting potential undervaluation. Over the past five years, it has successfully reduced its debt to equity from 81.7% to 21.5%, indicating strong fiscal management and positioning itself for continued growth without immediate cash runway concerns due to profitability and positive free cash flow trends.

create restaurants holdings (TSE:3387)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Create Restaurants Holdings Inc. is involved in planning, developing, and managing food courts, izakaya bars, dinner-time restaurants, and bakeries across Japan with a market capitalization of approximately ¥275.21 billion.

Operations: The company's primary revenue stream is derived from its Food and Beverage Business, generating approximately ¥152.71 billion. The segment adjustment accounts for ¥3.03 million.

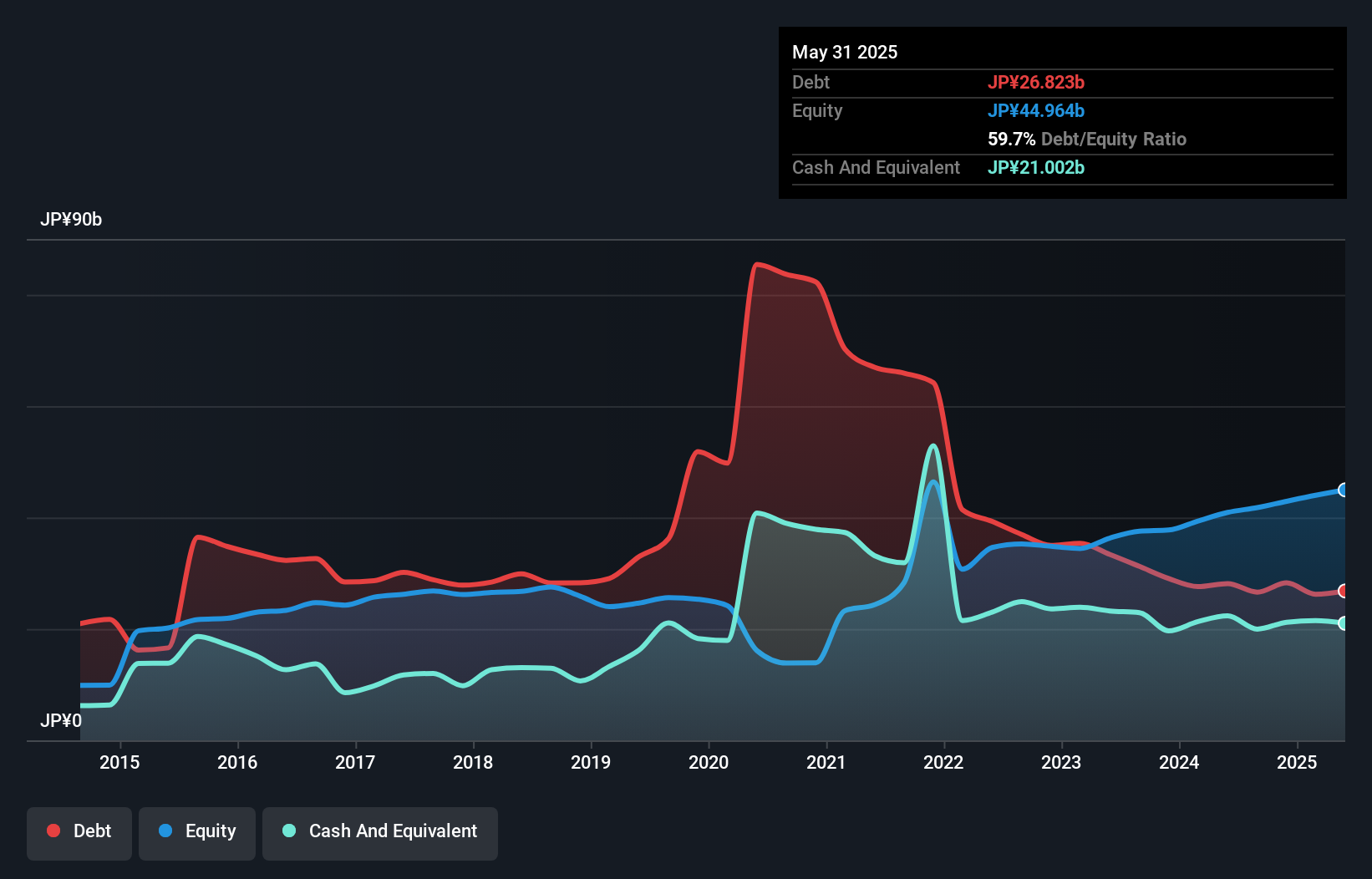

Earnings for Create Restaurants Holdings have surged by 67.9% over the past year, outpacing the hospitality industry's growth of 24.2%, showcasing its robust performance in a competitive market. The company has demonstrated financial prudence with an interest coverage ratio of 13.5x, indicating strong capability to meet debt obligations comfortably. A net debt to equity ratio at 16.5% further underscores its satisfactory financial health, suggesting effective management of leverage over time as it reduced from 204.6% five years ago to current levels. Trading at a discount of approximately 14% below estimated fair value may hint at potential upside for investors seeking opportunities in this sector.

- Click to explore a detailed breakdown of our findings in create restaurants holdings' health report.

Tsurumi ManufacturingLtd (TSE:6351)

Simply Wall St Value Rating: ★★★★★☆

Overview: Tsurumi Manufacturing Co., Ltd. is engaged in the production, purchase, import, export, sale, and leasing of submersible pumps and related equipment globally with a market cap of ¥83.36 billion.

Operations: Tsurumi Manufacturing generates revenue primarily through the production and sale of submersible pumps and related equipment. The company's financial performance is reflected in its gross profit margin, which has shown notable fluctuations over recent periods.

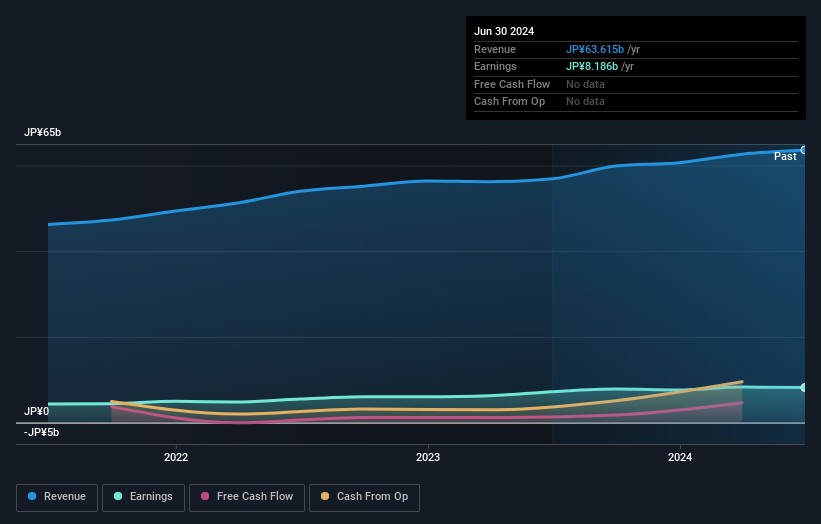

Tsurumi Manufacturing, a nimble player in the machinery sector, is currently trading at 17% below its estimated fair value. Its earnings growth of 26% over the past year outpaced the industry average of 4%, showcasing robust performance. The company has more cash than total debt, suggesting a sound financial footing despite an increase in its debt-to-equity ratio from 3.4 to 14.7 over five years. Free cash flow remains positive, and recent buybacks of ¥462.81 million worth of shares might indicate confidence in future prospects as it prepares to release Q3 results soon.

Seize The Opportunity

- Investigate our full lineup of 3212 Global Undiscovered Gems With Strong Fundamentals right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if create restaurants holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3387

create restaurants holdings

Plans, develops, and manages food courts, izakaya bars, dinner-time restaurants, and bakeries in Japan.

Solid track record with adequate balance sheet.