- Japan

- /

- Hospitality

- /

- TSE:3350

Will Metaplanet's (TSE:3350) Preferred Share Move Reinforce Its Bitcoin Strategy or Increase Risks?

Reviewed by Sasha Jovanovic

- Metaplanet's board recently held meetings to approve a capital raising initiative using preferred shares as part of a strategy to increase its Bitcoin holdings without diluting common shareholders.

- This move underscores Metaplanet’s intention to use innovative financing as it expands Bitcoin-backed financial products amid ongoing debate over the fair value of Bitcoin treasury companies.

- We'll explore how Metaplanet's use of preferred shares to build its Bitcoin reserves is shaping its broader investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Metaplanet's Investment Narrative?

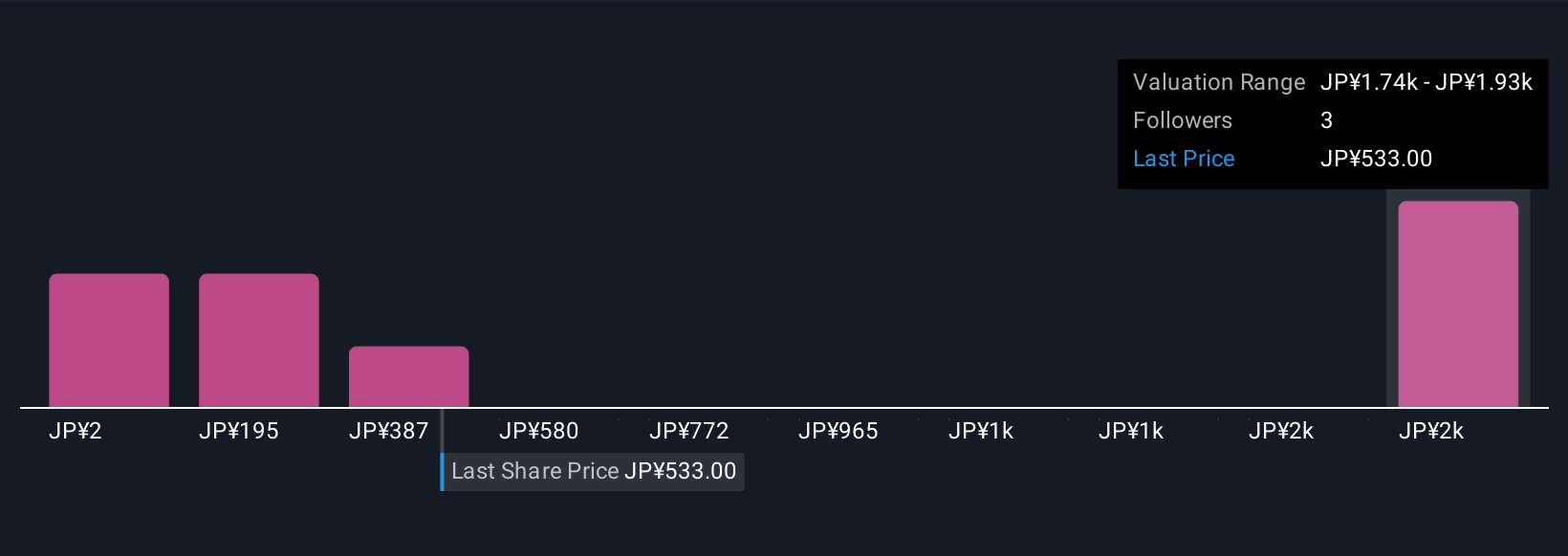

For investors interested in Metaplanet, the big-picture conviction often centers on the belief that Bitcoin will play an increasingly important role in both corporate finance and the broader economy. Recent board meetings and the move toward raising capital via preferred shares show management is prioritizing growth in Bitcoin holdings without further diluting common shareholders, a material strategic shift in response to concerns about share dilution and capital efficiency. This could affect near-term catalysts, including how quickly Metaplanet can expand its Bitcoin-backed product offerings or capture new financing opportunities in Japan, particularly after significant upward revisions to revenue and earnings expectations. However, with such innovation comes uncertainty: the stock’s extreme price swings, questions about fair value versus Bitcoin assets, and a management team still building its track record are now even more relevant risks than before.

But with all the excitement, not every investor will be comfortable with the heightened volatility or the company's rapid pace of change. Metaplanet's share price has been on the slide but might be dropping deeper into value territory. Find out whether it's a bargain at this price.Exploring Other Perspectives

Explore 6 other fair value estimates on Metaplanet - why the stock might be worth less than half the current price!

Build Your Own Metaplanet Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Metaplanet research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Metaplanet research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Metaplanet's overall financial health at a glance.

Contemplating Other Strategies?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3350

Metaplanet

Engages in hotel management operation and development in Japan.

Flawless balance sheet with high growth potential.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)