- Japan

- /

- Hospitality

- /

- TSE:3350

Why Metaplanet (TSE:3350) Is Down 11.6% After Suspending Acquisition Rights and Boosting Bitcoin Holdings

Reviewed by Sasha Jovanovic

- In early October 2025, Metaplanet announced the temporary suspension of its 20th to 22nd stock acquisition rights, a significant increase in Bitcoin holdings to 30,823 BTC, and the creation of a U.S. subsidiary focused on Bitcoin income activities.

- This combination of capital management moves and business expansion highlights Metaplanet’s intensified commitment to growing its digital asset operations while controlling shareholder dilution.

- We’ll explore how Metaplanet’s significant Bitcoin accumulation influences its broader investment story and future business direction.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

What Is Metaplanet's Investment Narrative?

For investors looking at Metaplanet, the core belief to hold is in the potential of Bitcoin-driven business models to dominate the digital asset economy. The latest news, suspending certain stock acquisition rights, boosting Bitcoin holdings, and launching a U.S. subsidiary, signals a tighter focus on building a large, recurring income base from crypto assets while seeking to minimize immediate shareholder dilution. These moves could amplify upcoming catalysts, like improved earnings visibility or expansion into U.S. markets, but they also tilt some short-term risks. Notably, rapid exposure to Bitcoin price movements is now even greater, and the company’s top-line surprises are leaning heavily on this singular business line. While the recent price volatility and one-off earnings are unlikely to be solved overnight, Metaplanet’s earnings revision last week suggests that management is responding quickly to shifting conditions, potentially shifting both near-term risks and upside levers as a result.

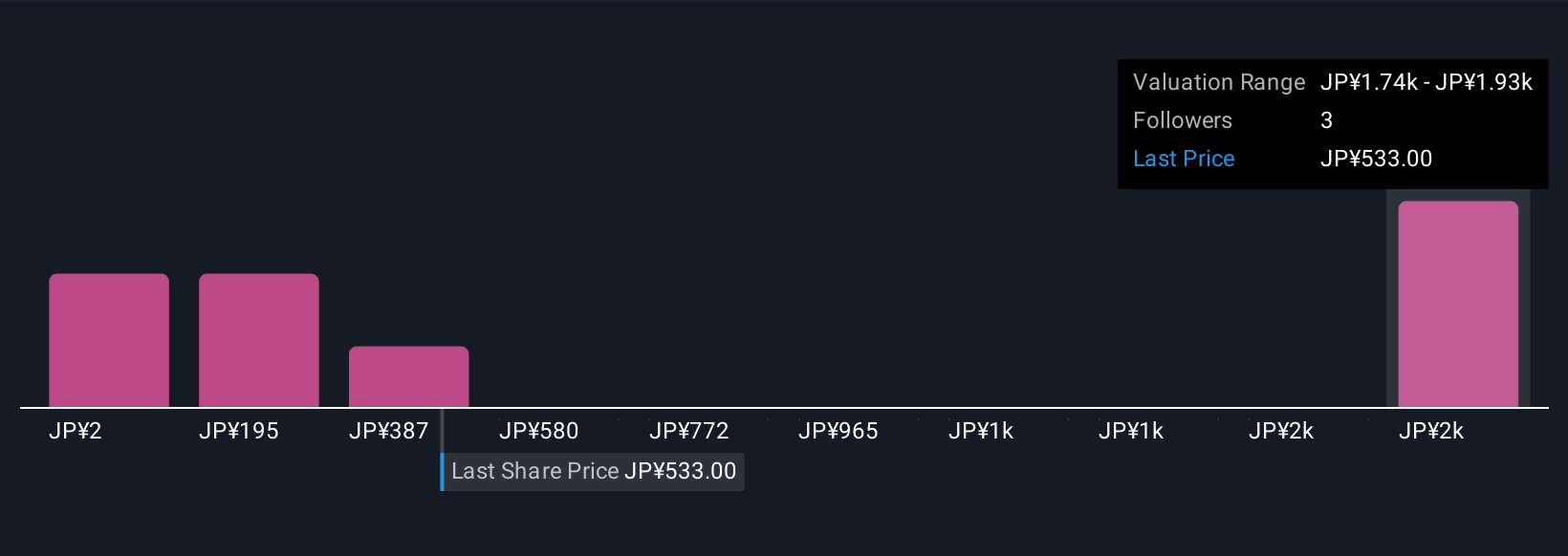

Yet, high exposure to Bitcoin creates big swings investors should be aware of. Metaplanet's share price has been on the slide but might be dropping deeper into value territory. Find out whether it's a bargain at this price.Exploring Other Perspectives

Explore 6 other fair value estimates on Metaplanet - why the stock might be worth over 3x more than the current price!

Build Your Own Metaplanet Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Metaplanet research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Metaplanet research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Metaplanet's overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3350

High growth potential with adequate balance sheet.

Market Insights

Community Narratives