- Japan

- /

- Hospitality

- /

- TSE:3087

Doutor Nichires (TSE:3087) Margin Gains Underscore Value Narrative as Profitability Outpaces Market

Reviewed by Simply Wall St

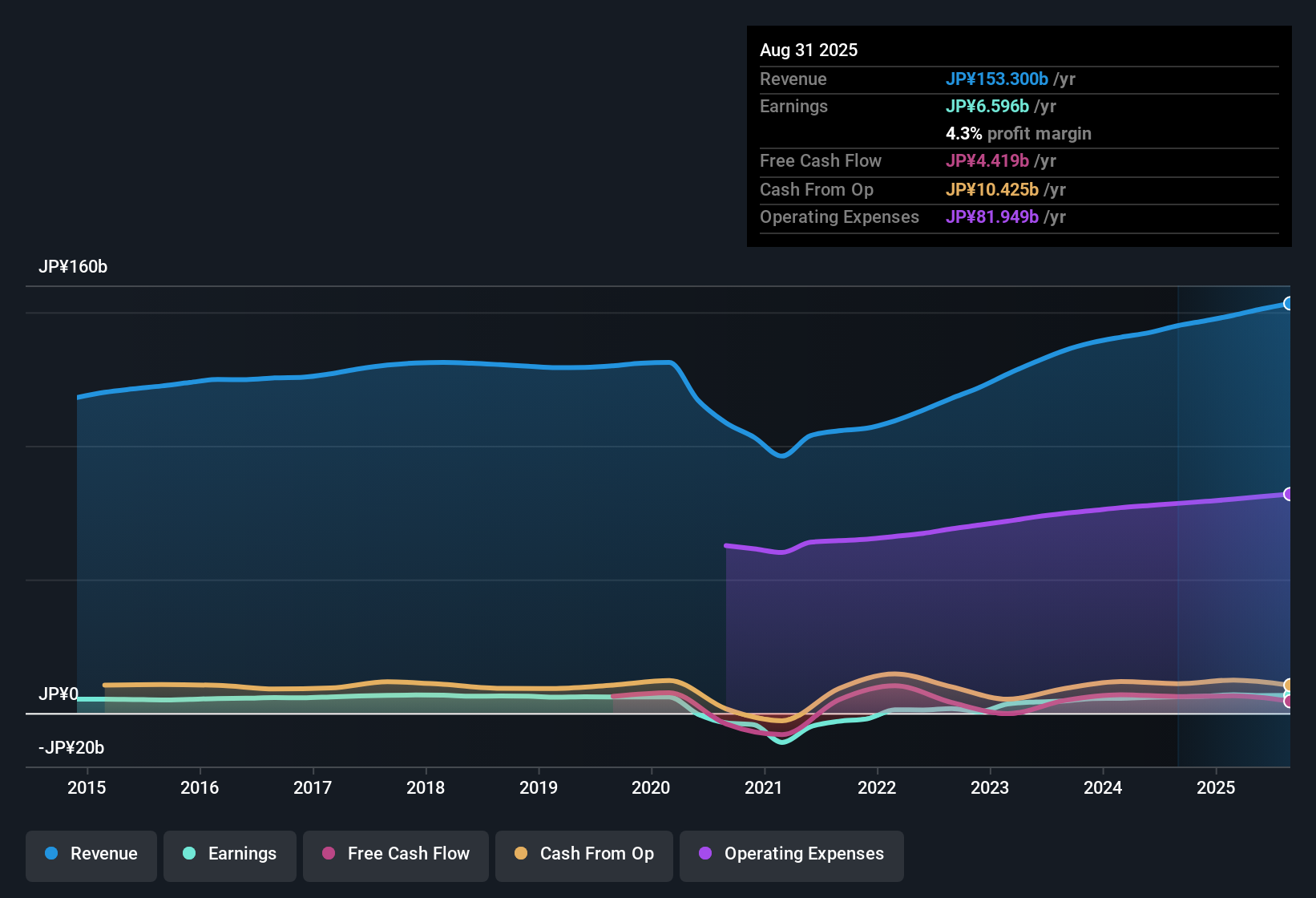

DOUTOR NICHIRES Holdings (TSE:3087) reported another period of growth, with revenue and net income forecasts pointing to gains of 5.1% and 9.8% per year, respectively. Both figures are set to beat the broader Japanese market. Net profit margin nudged up to 4.3% from last year’s 4.2%. The company has grown earnings at an impressive 63.9% average rate over five years, although the latest figure of 8.6% is a marked slowdown. Investors are likely to focus on the strong run of profitability, ongoing margin stability, and the fact that shares are trading at a Price-to-Earnings ratio of 15.7x, well below the industry and peer averages.

See our full analysis for DOUTOR NICHIRES Holdings.The next section puts these headline results side by side with the key market narratives to reveal where the earnings performance fits in, and where it might challenge expectations.

Curious how numbers become stories that shape markets? Explore Community Narratives

Long-term Margin Improvement Holds Steady

- Net profit margins edged up to 4.3% this year from 4.2%, reflecting a consistent trend of solid profitability that extends beyond headline revenue or net income results.

- Operating strength and brand resilience remain in focus, as recent market sentiment points to stability in the face of sector headwinds.

- Management's emphasis on steady operational execution and cost control is highlighted by the ability to maintain and slightly improve profit margins even with sector-wide concerns about input costs.

- Broader industry challenges, such as competitive intensity and rising expenses, are counterbalanced by the company's careful approach to menu innovation and store expansion strategies.

Earnings Growth Rate Normalizes After Surge

- Five-year average annual earnings growth stands at a remarkable 63.9%, but the most recently reported year saw this rate slow to 8.6%, marking a return to more sustainable levels after an aggressive expansion period.

- Prevailing analysis suggests the company's ability to transition from rapid catch-up growth to steadier profit delivery is a sign of resilience, not weakness.

- Forecasts for 9.8% annual earnings growth reinforce expectations for continued progress while signaling that short-term spikes have given way to normalized, predictable performance.

- Steady fundamentals and moderated growth align with a market environment that values consistent execution, particularly as the competitive landscape intensifies.

Valuation Gap Remains Attractive

- The Price-to-Earnings ratio of 15.7x remains well below both the industry average of 24x and peers at 40.5x. The current share price of 2464.00 trades at a notable discount to the DCF fair value estimate of 3315.08.

- Investment thesis centered on value is heavily supported by this clear valuation gap. Sector analysts point out that durable margins and reliable growth rates justify a potential re-rating toward fair value.

- While the rest of the industry commands higher multiples despite similar or greater competitive risks, Doutor Nichires is priced conservatively. This makes its shares appealing for investors seeking stable growth at a discount.

- The combination of solid fundamentals and discounted valuation provides a cushion for cautious buyers, further highlighted by the focus on profit and margin consistency.

With stable operations and valuation still lagging fair value, the story is about staying power and patient upside, not just chasing short-term momentum.

See our latest analysis for DOUTOR NICHIRES Holdings.Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on DOUTOR NICHIRES Holdings's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite robust profitability, Doutor Nichires’ rapid earnings expansion has slowed noticeably. This suggests that future growth may be steadier rather than dynamic.

If you want investments that keep delivering consistent results, turn to stable growth stocks screener (2090 results) for a lineup of companies with reliable and sustained growth trajectories.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3087

DOUTOR NICHIRES Holdings

Engages in the operation and management of cafes and restaurants in Japan.

Undervalued with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives