- Japan

- /

- Hospitality

- /

- TSE:2882

EAT&HOLDINGS (TSE:2882) Margin Miss on ¥201M One-Off Loss Challenges Growth Narrative

Reviewed by Simply Wall St

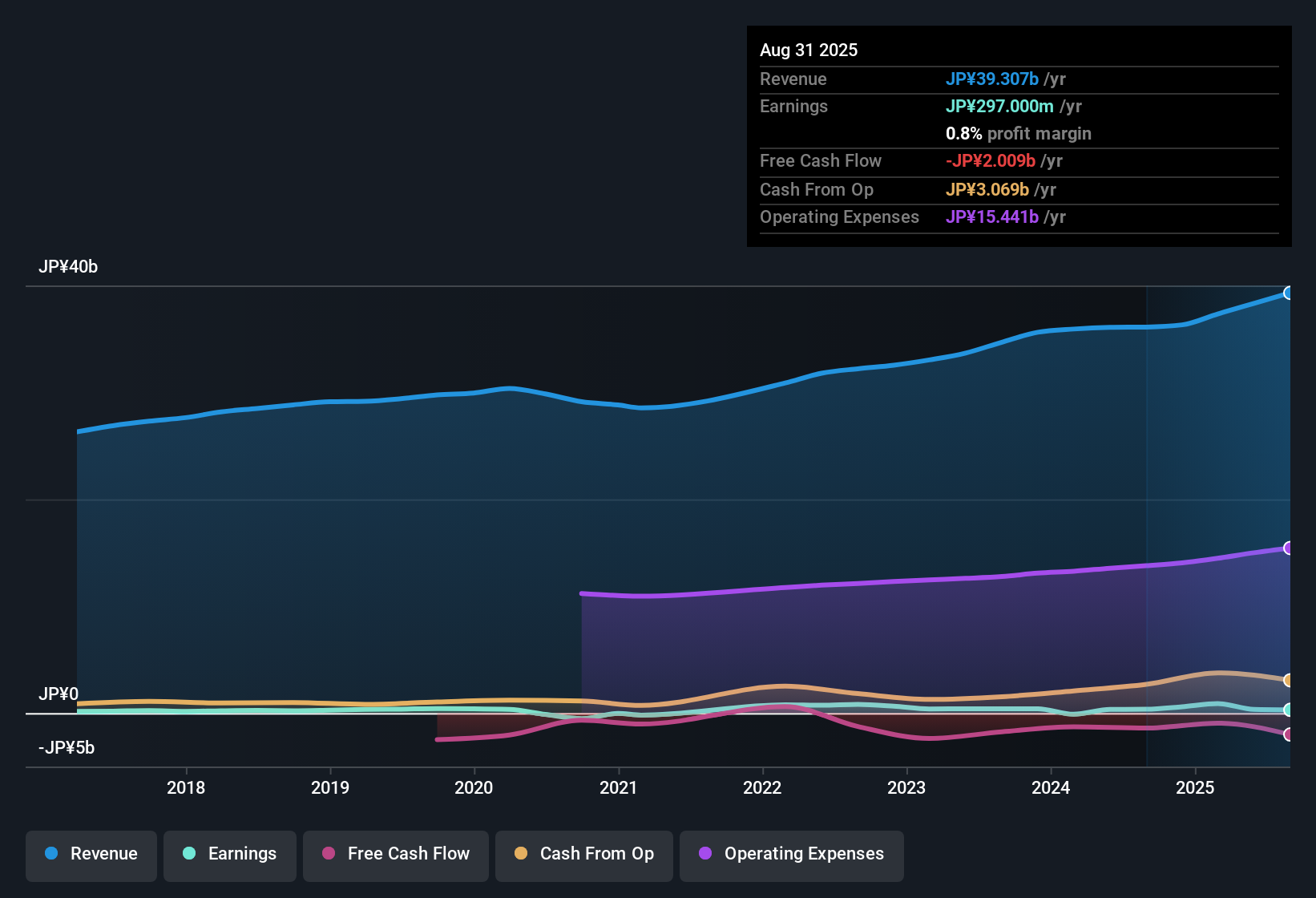

EAT&HOLDINGSLtd (TSE:2882) delivered a net profit margin of 0.8%, down from 1% last year, as recent earnings were weighed by a one-off loss of ¥201.0 million over the past twelve months. Despite these challenges, analysts expect earnings to climb rapidly, with forecasts calling for 43.62% annual growth over the next three years, outpacing both industry and market averages.

See our full analysis for EAT&HOLDINGSLtd.Now let’s see how these headline numbers stack up against the narratives investors and analysts focus on. Some expectations might hold up, while others could be put to the test.

Curious how numbers become stories that shape markets? Explore Community Narratives

One-Off Loss Drives Margin Dip

- The company’s net profit margin fell to 0.8% after absorbing a one-off loss of ¥201.0 million, a specific event not expected to recur according to the EDGAR filing summary.

- Management’s view is that, despite this non-recurring charge temporarily hitting margins, EAT&HOLDINGSLtd’s forward trajectory for annual earnings growth remains robust, supported by

- a five-year track record of averaging 22% earnings growth per year. This history lends strong support to optimistic projections for the next three years.

- clear guidance that the recent margin setback is not expected to affect forecasted earnings outperformance compared to the industry and market.

Profitability Streak Holds Despite Setbacks

- Over the past five years, EAT&HOLDINGSLtd delivered an average of 22% annual earnings growth, transitioning to profitability even as the latest period was hit by temporary setbacks.

- The prevailing market view suggests the company’s resilience stems from sustained profit growth. However,

- minor risks remain as earnings quality has come under scrutiny due to the impact of non-recurring losses, signaling that investors should be attentive to the sources of reported profit.

- EAT&HOLDINGSLtd is not in a strong financial position according to risk statement analysis, so while growth rates are attractive, the underlying financial base warrants careful monitoring.

Valuation Premium vs. Peers Raises Debate

- Shares currently trade at a Price-to-Earnings ratio of 76.5x, more than triple the sector average of 24.2x and well above industry peers at 22.5x. The share price of ¥2,001 is slightly above the estimated DCF fair value of ¥198.30.

- The prevailing perspective is that market optimism for future earnings is fueling this hefty premium. At the same time,

- valuation-conscious investors see the combination of above-average multiples and minor earnings quality risks as a yellow flag, especially since profitability is not yet backed by a solid financial position.

- debate persists as to whether rapid anticipated growth can sufficiently justify such a significant valuation gap over similar companies.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on EAT&HOLDINGSLtd's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

EAT&HOLDINGSLtd’s lofty valuation and fragile financial position contrast with its ambitious growth forecasts, raising questions about earnings quality and stability.

If you want to target companies with healthier balance sheets and reliable financial footing, use our solid balance sheet and fundamentals stocks screener to zero in on businesses built for strength and resilience when it counts most.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EAT&HOLDINGSLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2882

Moderate growth potential with mediocre balance sheet.

Market Insights

Community Narratives