- Japan

- /

- Hospitality

- /

- TSE:2753

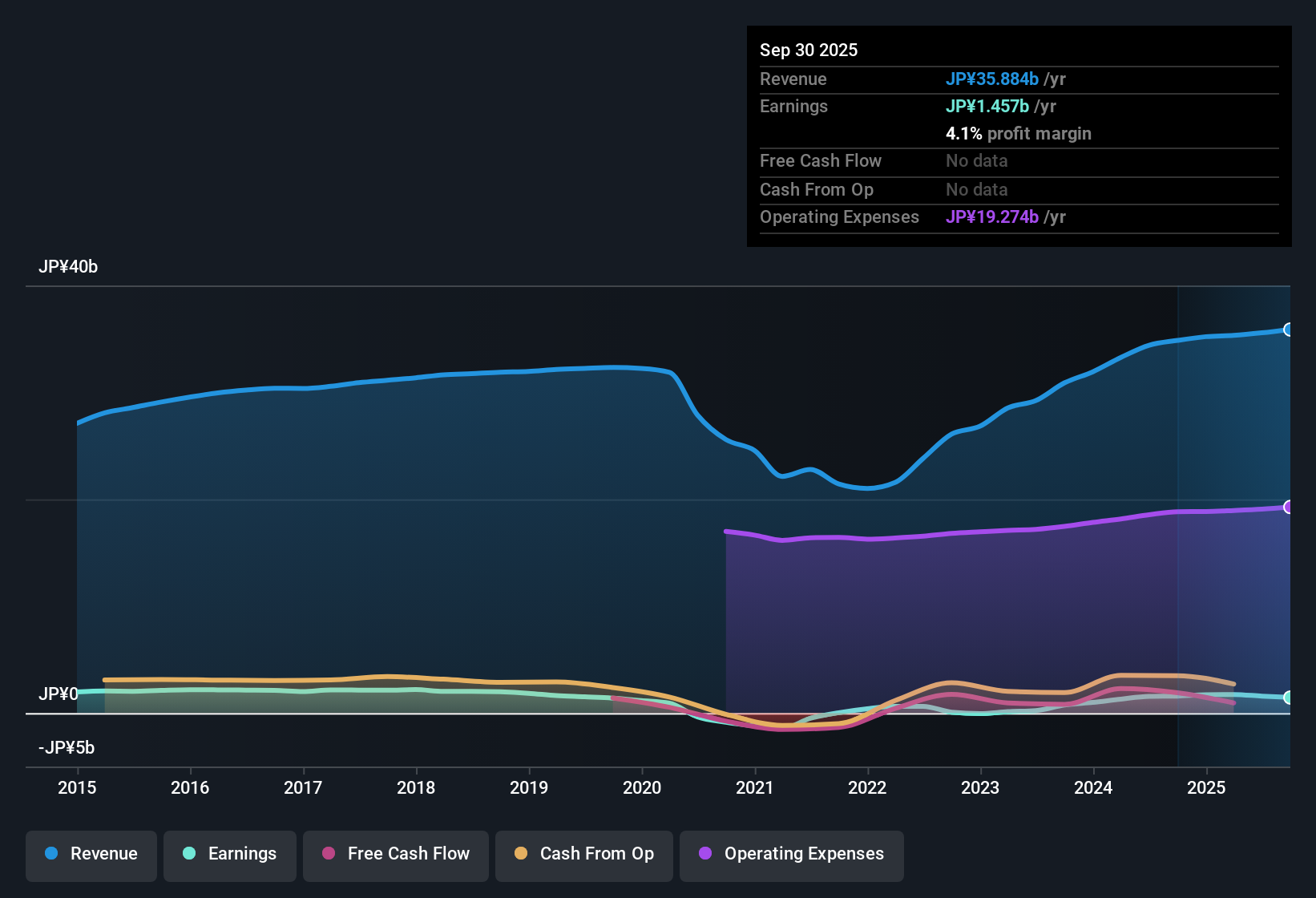

Amiyaki Tei (TSE:2753) Net Margin Slips to 4.1%, Challenging Bullish Growth Narrative

Reviewed by Simply Wall St

Amiyaki Tei (TSE:2753) is projecting revenue to grow at an impressive 10.8% per year, well above the broader Japanese market’s 4.4%. While EPS is forecasted to rise at 14.8% per year, which still outpaces the average, the company is coming off a year where its net profit margin slipped slightly to 4.1% from 4.6% and it faced a recent period of negative earnings growth. Despite these margin headwinds, investors may be encouraged by the record of strong five-year earnings growth and continued forecasts for above-market performance.

See our full analysis for Amiyaki Tei.Next up, we will see how these headline results compare with the market narratives dominating the conversation, and whether the numbers back up the prevailing story or cut against it.

Curious how numbers become stories that shape markets? Explore Community Narratives

Five-Year Profitability Surge Now Levels Off

- Amiyaki Tei’s annual earnings growth has averaged an impressive 63.3% over the last five years, but that rapid climb has slowed, with no current sign of accelerating profit growth in the most recent filings.

- While earlier performance heavily supported the bullish case for continued outperformance versus peers, the current net profit margin has slipped to 4.1% from last year’s 4.6%. This signals that the exceptional expansion phase may have transitioned into steadier, more predictable growth.

- This cooling margin trend stands in contrast to bullish hopes for a fresh wave of upside and shows how fast historical compounding can taper off.

- With sector peers generally showing lower earnings growth but more stable profit margins, bulls will want to see evidence that Amiyaki Tei can recover margin progress after recent softness.

Premium Price Tag Versus Peers but Below Industry Highs

- The company trades at a price-to-earnings ratio of 20.2x, which is above the peer group average of 16.8x but still lower than the hospitality industry’s 24.2x multiple.

- Prevailing market analysis notes that this mid-range valuation reflects the company’s promise as a growth story while also hinting at market hesitance to assign top-tier multiples while net profit margins have softened in the latest period.

- What’s surprising is that despite forecasts for revenue and earnings to outpace the market, investors are cautious and have kept the valuation below the broader industry average even as it sits above peers.

- This gap with industry highs suggests potential upside if margins and profit trajectory improve, but it also underscores risks if recent margin pressure becomes a longer-term trend.

Share Price Outpaces DCF Fair Value

- Amiyaki Tei’s current share price of ¥1,432 stands 14% above the DCF fair value of ¥1,252.03, signaling investors are already pricing in positive growth expectations.

- Prevailing market analysis highlights that this sizable premium points to optimism about future sales and profitability but also creates a risk if growth targets are not met, as the valuation cushion relative to intrinsic value is thinner than for more conservatively priced stocks.

- DCF-based investors may see less room for error from here, especially with margins under recent pressure.

- Growth forecasts remain a strong draw, but the share price premium could amplify any market reaction if those forecasts are missed.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Amiyaki Tei's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

While Amiyaki Tei boasts robust historical growth, recent margin pressure and a share price premium suggest its performance may be less predictable in the future.

If you want steadier returns and lower volatility, use our stable growth stocks screener to discover companies delivering more consistent profit and margin expansion across market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2753

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives