- Japan

- /

- Hospitality

- /

- TSE:2694

Yakiniku Sakai Holdings' (TSE:2694) Conservative Accounting Might Explain Soft Earnings

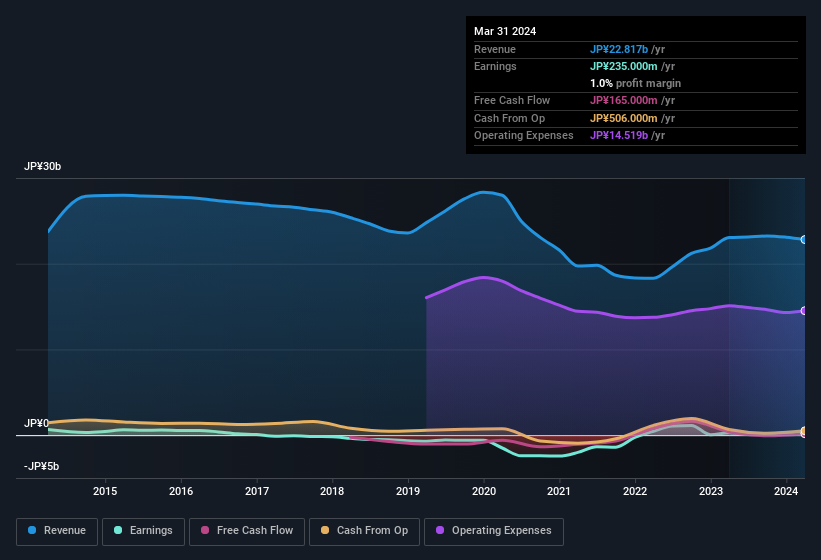

Soft earnings didn't appear to concern Yakiniku Sakai Holdings Inc.'s (TSE:2694) shareholders over the last week. We did some digging, and we believe the earnings are stronger than they seem.

Check out our latest analysis for Yakiniku Sakai Holdings

The Impact Of Unusual Items On Profit

For anyone who wants to understand Yakiniku Sakai Holdings' profit beyond the statutory numbers, it's important to note that during the last twelve months statutory profit was reduced by JP¥490m due to unusual items. While deductions due to unusual items are disappointing in the first instance, there is a silver lining. We looked at thousands of listed companies and found that unusual items are very often one-off in nature. And, after all, that's exactly what the accounting terminology implies. Yakiniku Sakai Holdings took a rather significant hit from unusual items in the year to March 2024. As a result, we can surmise that the unusual items made its statutory profit significantly weaker than it would otherwise be.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Yakiniku Sakai Holdings.

An Unusual Tax Situation

Just as we noted the unusual items, we must inform you that Yakiniku Sakai Holdings received a tax benefit which contributed JP¥119m to the bottom line. It's always a bit noteworthy when a company is paid by the tax man, rather than paying the tax man. Of course, prima facie it's great to receive a tax benefit. However, our data indicates that tax benefits can temporarily boost statutory profit in the year it is booked, but subsequently profit may fall back. Assuming the tax benefit is not repeated every year, we could see its profitability drop noticeably, all else being equal. So while we think it's great to receive a tax benefit, it does tend to imply an increased risk that the statutory profit overstates the sustainable earnings power of the business.

Our Take On Yakiniku Sakai Holdings' Profit Performance

In the last year Yakiniku Sakai Holdings received a tax benefit, which boosted its profit in a way that might not be much more sustainable than turning prime farmland into gas fields. But on the other hand, it also saw an unusual item depress its profit. Considering all the aforementioned, we'd venture that Yakiniku Sakai Holdings' profit result is a pretty good guide to its true profitability, albeit a bit on the conservative side. If you want to do dive deeper into Yakiniku Sakai Holdings, you'd also look into what risks it is currently facing. While conducting our analysis, we found that Yakiniku Sakai Holdings has 1 warning sign and it would be unwise to ignore this.

In this article we've looked at a number of factors that can impair the utility of profit numbers, as a guide to a business. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:2694

Excellent balance sheet with proven track record.