- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6834

Unveiling Undiscovered Gems In January 2025

Reviewed by Simply Wall St

As global markets navigate a landscape marked by easing core inflation in the U.S. and robust bank earnings, small-cap stocks have shown resilience, with indices like the S&P MidCap 400 and Russell 2000 posting notable gains. In this environment of cautious optimism, identifying promising small-cap stocks—those often overlooked yet poised to benefit from favorable economic shifts and sectoral strengths—can be particularly rewarding for investors seeking untapped potential.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Marítima de Inversiones | NA | 82.67% | 21.14% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| SALUS Ljubljana d. d | 13.55% | 13.11% | 9.95% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Industrias del Cobre Sociedad Anónima | NA | 19.08% | 22.33% | ★★★★★★ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| Compañía Electro Metalúrgica | 71.27% | 12.50% | 19.90% | ★★★★☆☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

| BOSQAR d.d | 94.35% | 39.11% | 23.56% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Fullcast Holdings (TSE:4848)

Simply Wall St Value Rating: ★★★★★★

Overview: Fullcast Holdings Co., Ltd., along with its subsidiaries, offers human resource solutions in Japan and has a market capitalization of approximately ¥53.84 billion.

Operations: Fullcast Holdings generates revenue primarily from its Short-Term Operational Support Business, which accounts for ¥56.07 billion, followed by the Food and Beverage Business at ¥7.39 billion. The company also has revenue streams from Sales Support and Security businesses, contributing ¥3.31 billion and ¥2.39 billion respectively.

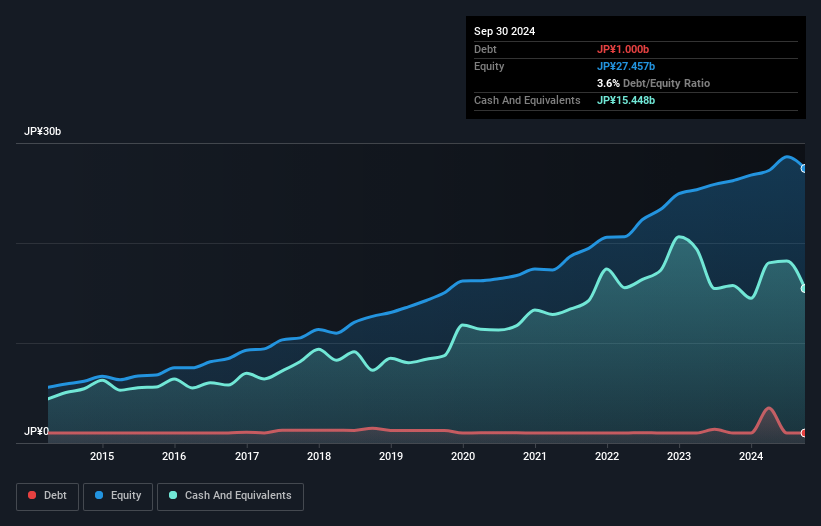

Fullcast Holdings, a smaller player in the professional services sector, is trading at 72% below its estimated fair value, suggesting potential undervaluation. The company boasts high-quality earnings and maintains a strong cash position relative to its total debt. Despite recent negative earnings growth of 10.4%, Fullcast's interest payments are well-covered by EBIT at an impressive 1817 times coverage. Over the past five years, it has successfully reduced its debt-to-equity ratio from 8.3 to 3.6, indicating improved financial health. Recent leadership changes might influence strategic direction as Takehito Hirano steps into the CEO role.

Noritake (TSE:5331)

Simply Wall St Value Rating: ★★★★★★

Overview: Noritake Co., Limited, along with its subsidiaries, offers a range of industrial, ceramic and material, engineering, and tabletop products both in Japan and globally, with a market capitalization of ¥107.18 billion.

Operations: Noritake generates revenue through its diverse product segments, including industrial, ceramic and material, engineering, and tabletop products. The company reported a market capitalization of ¥107.18 billion.

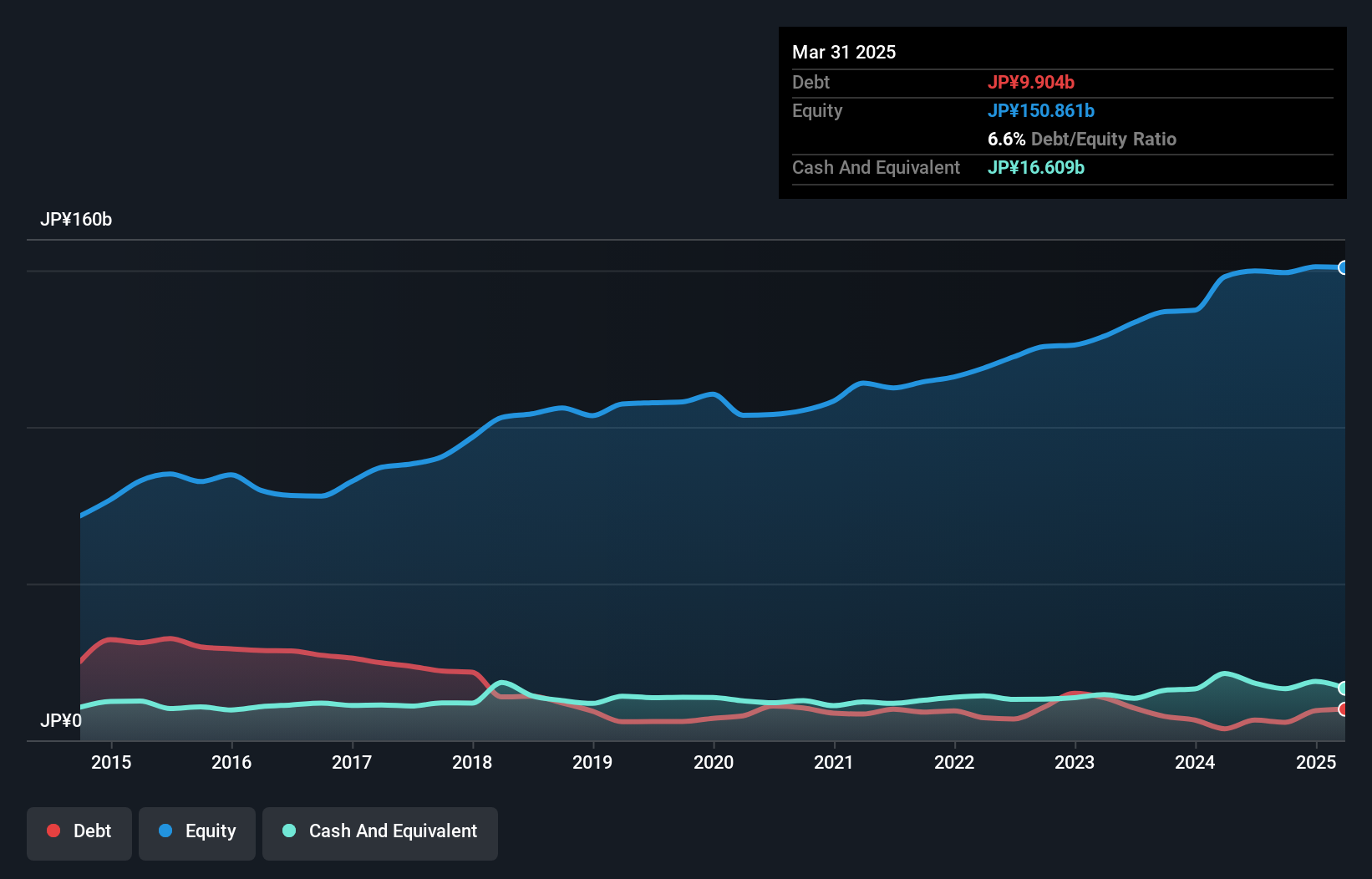

Noritake, a noteworthy player in the machinery sector, showcases a promising profile with its earnings growth of 10.3% last year, outpacing the industry's 1.6%. The company seems to be on solid financial footing as it holds more cash than its total debt and trades at approximately 57% below estimated fair value. Over five years, Noritake's debt-to-equity ratio improved from 5.6 to 3.8, reflecting prudent financial management. Recently, it completed a share buyback program repurchasing over 651,000 shares for ¥2.5 billion by January 2025, potentially enhancing shareholder value and confidence in future prospects.

- Click to explore a detailed breakdown of our findings in Noritake's health report.

Evaluate Noritake's historical performance by accessing our past performance report.

SEIKOH GIKEN (TSE:6834)

Simply Wall St Value Rating: ★★★★★★

Overview: SEIKOH GIKEN Co., Ltd. is involved in the design, manufacture, and sale of optical components, lenses, and radio over fiber products both in Japan and internationally with a market capitalization of ¥50.19 billion.

Operations: SEIKOH GIKEN generates revenue primarily from its Optical Products Related segment, contributing ¥8.23 billion, and Precision Machine Related segment, adding ¥8.78 billion.

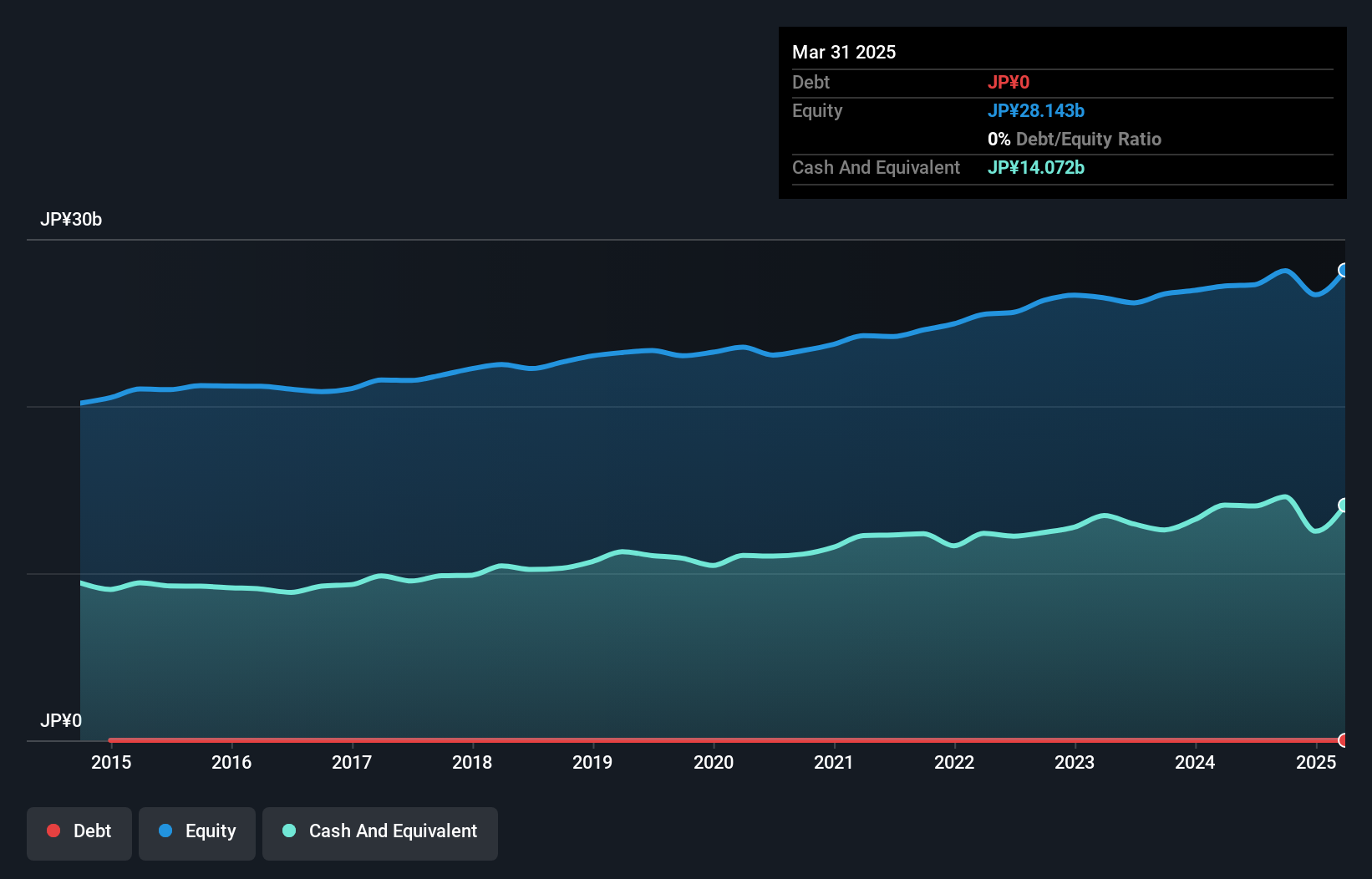

Seikoh Giken, a nimble player in the electronics sector, has seen its earnings surge by 67.8% over the past year, outpacing the industry's -0.2%. The company is debt-free and boasts high-quality earnings, which are likely contributing to its robust financial health. Trading at 32.6% below estimated fair value suggests potential upside for investors seeking undervalued opportunities. Recently, Seikoh Giken repurchased 250,000 shares for ¥1,315 million to enhance capital efficiency amid market volatility. This strategic move could signal confidence in its growth prospects and adaptability to changing business environments while maintaining profitability without debt concerns.

- Click here and access our complete health analysis report to understand the dynamics of SEIKOH GIKEN.

Review our historical performance report to gain insights into SEIKOH GIKEN's's past performance.

Next Steps

- Delve into our full catalog of 4654 Undiscovered Gems With Strong Fundamentals here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6834

SEIKOH GIKEN

Engages in design, manufacture, and sale of optical components and lens, and radio over fiber products in Japan and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives