- Japan

- /

- Hospitality

- /

- TSE:2157

Top Growth Companies With Insider Stakes February 2025

Reviewed by Simply Wall St

As global markets navigate a landscape of fluctuating interest rates and heightened competition in the AI sector, investors are closely monitoring corporate earnings and geopolitical developments. In this context, growth companies with substantial insider ownership can offer unique insights into potential resilience and alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Duc Giang Chemicals Group (HOSE:DGC) | 31.4% | 25.7% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.2% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 26.2% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Pricol (NSEI:PRICOLLTD) | 25.4% | 25.2% |

| Plenti Group (ASX:PLT) | 12.7% | 120.1% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 135% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 119.4% |

| Brightstar Resources (ASX:BTR) | 16.2% | 86% |

| Fulin Precision (SZSE:300432) | 13.6% | 71% |

Let's take a closer look at a couple of our picks from the screened companies.

Lime Technologies (OM:LIME)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Lime Technologies AB (publ) offers SaaS-based CRM solutions in the Nordic region and has a market cap of approximately SEK4.65 billion.

Operations: Revenue Segments: Selling and Implementing Software, CRM Systems: SEK656.49 million.

Insider Ownership: 10.7%

Earnings Growth Forecast: 23.5% p.a.

Lime Technologies, with high insider ownership, shows promising growth prospects. Earnings have grown 14.3% annually over the past five years and are forecast to grow 23.5% per year, outpacing the Swedish market. Despite a high debt level, Lime trades at 32.1% below its estimated fair value and is expected to achieve a significant return on equity of 34.8% in three years, suggesting potential for strong future performance amidst financial challenges.

- Get an in-depth perspective on Lime Technologies' performance by reading our analyst estimates report here.

- Insights from our recent valuation report point to the potential overvaluation of Lime Technologies shares in the market.

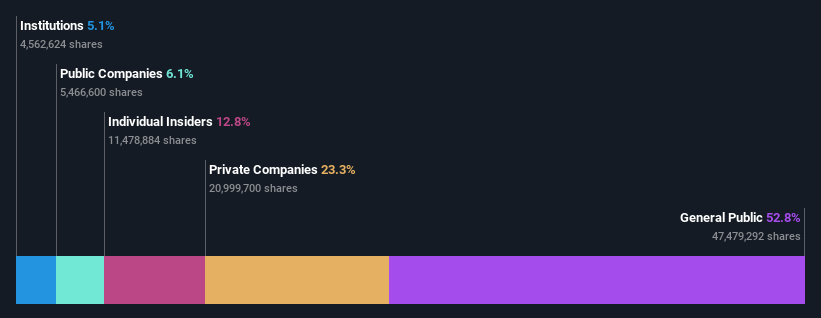

Al Masane Al Kobra Mining (SASE:1322)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Al Masane Al Kobra Mining Company operates in the Kingdom of Saudi Arabia, focusing on the production of non-ferrous metal ores and precious metals, with a market cap of SAR5.82 billion.

Operations: The company's revenue is derived from its operations at the Al Masane Mine, contributing SAR353.54 million, and the Mount Guyan Mine, adding SAR190.02 million.

Insider Ownership: 12.8%

Earnings Growth Forecast: 41.4% p.a.

Al Masane Al Kobra Mining demonstrates strong growth potential with earnings having increased by 18.5% annually over the past five years and projected to grow significantly, outpacing the Saudi Arabian market's average. Revenue is also expected to rise at a robust pace of 23% per year. Recent presentations and interviews highlight the company's future vision, though its dividend yield of 2.4% is not well covered by free cash flows, indicating potential financial constraints.

- Click to explore a detailed breakdown of our findings in Al Masane Al Kobra Mining's earnings growth report.

- According our valuation report, there's an indication that Al Masane Al Kobra Mining's share price might be on the expensive side.

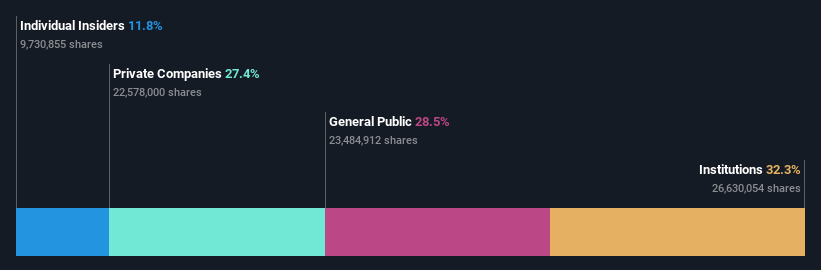

Koshidaka Holdings (TSE:2157)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Koshidaka Holdings Co., Ltd. operates a karaoke and bath house business both in Japan and internationally, with a market cap of ¥87.95 billion.

Operations: The company's revenue is primarily derived from its karaoke business, which generates ¥63.10 billion, and its real estate management segment, contributing ¥1.71 billion.

Insider Ownership: 11.8%

Earnings Growth Forecast: 16.4% p.a.

Koshidaka Holdings shows promising growth potential with earnings forecast to grow 16.4% annually, outpacing the JP market's average. Revenue is also expected to rise at 14.4% per year, exceeding market expectations. The company offers good value with a price-to-earnings ratio of 13.8x, below the industry average of 23.1x. However, its dividend track record remains unstable. Recent guidance anticipates full-year net sales of ¥71 billion and operating profit of ¥11.58 billion for fiscal year ending August 2025.

- Take a closer look at Koshidaka Holdings' potential here in our earnings growth report.

- Our comprehensive valuation report raises the possibility that Koshidaka Holdings is priced lower than what may be justified by its financials.

Summing It All Up

- Gain an insight into the universe of 1477 Fast Growing Companies With High Insider Ownership by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Koshidaka Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2157

Koshidaka Holdings

Operates a karaoke business and a bath house business in Japan and internationally.

Reasonable growth potential with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives