- Japan

- /

- Hospitality

- /

- TSE:9853

Know This Before Buying Ginza Renoir Co., Ltd. (TYO:9853) For Its Dividend

Could Ginza Renoir Co., Ltd. (TYO:9853) be an attractive dividend share to own for the long haul? Investors are often drawn to strong companies with the idea of reinvesting the dividends. Unfortunately, it's common for investors to be enticed in by the seemingly attractive yield, and lose money when the company has to cut its dividend payments.

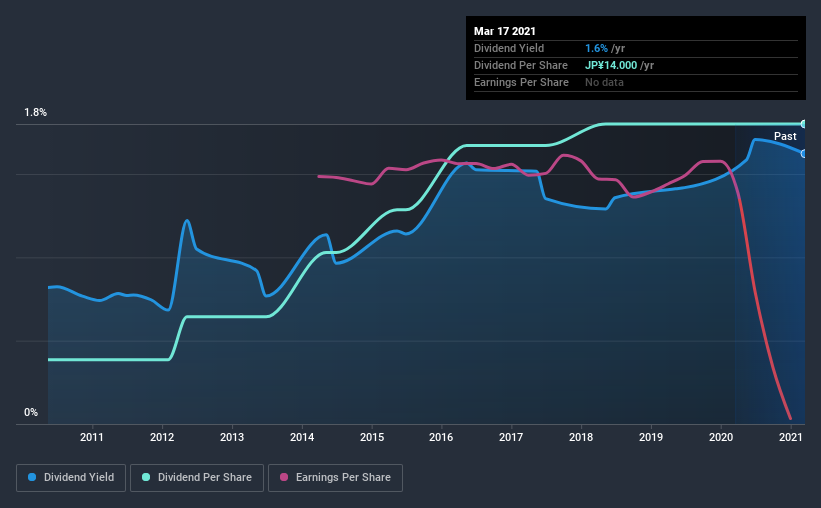

A 1.6% yield is nothing to get excited about, but investors probably think the long payment history suggests Ginza Renoir has some staying power. Some simple analysis can offer a lot of insights when buying a company for its dividend, and we'll go through this below.

Explore this interactive chart for our latest analysis on Ginza Renoir!

Payout ratios

Dividends are usually paid out of company earnings. If a company is paying more than it earns, then the dividend might become unsustainable - hardly an ideal situation. So we need to form a view on if a company's dividend is sustainable, relative to its net profit after tax. Although Ginza Renoir pays a dividend, it was loss-making during the past year. When a company is loss-making, we next need to check to see if its cash flows can support the dividend.

Last year, Ginza Renoir paid a dividend while reporting negative free cash flow. While there may be an explanation, we think this behaviour is generally not sustainable.

While the above analysis focuses on dividends relative to a company's earnings, we do note Ginza Renoir's strong net cash position, which will let it pay larger dividends for a time, should it choose.

Remember, you can always get a snapshot of Ginza Renoir's latest financial position, by checking our visualisation of its financial health.

Dividend Volatility

One of the major risks of relying on dividend income, is the potential for a company to struggle financially and cut its dividend. Not only is your income cut, but the value of your investment declines as well - nasty. Ginza Renoir has been paying dividends for a long time, but for the purpose of this analysis, we only examine the past 10 years of payments. The dividend has been stable over the past 10 years, which is great. We think this could suggest some resilience to the business and its dividends. During the past 10-year period, the first annual payment was JP¥3.0 in 2011, compared to JP¥14.0 last year. This works out to be a compound annual growth rate (CAGR) of approximately 17% a year over that time.

Dividends have been growing pretty quickly, and even more impressively, they haven't experienced any notable falls during this period.

Dividend Growth Potential

Dividend payments have been consistent over the past few years, but we should always check if earnings per share (EPS) are growing, as this will help maintain the purchasing power of the dividend. Over the past five years, it looks as though Ginza Renoir's EPS have declined at around 65% a year. A sharp decline in earnings per share is not great from from a dividend perspective, as even conservative payout ratios can come under pressure if earnings fall far enough.

Conclusion

To summarise, shareholders should always check that Ginza Renoir's dividends are affordable, that its dividend payments are relatively stable, and that it has decent prospects for growing its earnings and dividend. It's a concern to see that the company paid a dividend despite reporting a loss, and the dividend was also not well covered by free cash flow. Second, earnings per share have actually shrunk, but at least the dividends have been relatively stable. There are a few too many issues for us to get comfortable with Ginza Renoir from a dividend perspective. Businesses can change, but we would struggle to identify why an investor should rely on this stock for their income.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. To that end, Ginza Renoir has 3 warning signs (and 1 which can't be ignored) we think you should know about.

If you are a dividend investor, you might also want to look at our curated list of dividend stocks yielding above 3%.

If you’re looking to trade Ginza Renoir, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSE:9853

Excellent balance sheet and overvalued.

Market Insights

Community Narratives