- Japan

- /

- Hospitality

- /

- TSE:2340

How Much Did Gokurakuyu Holdings'(TYO:2340) Shareholders Earn From Share Price Movements Over The Last Three Years?

If you are building a properly diversified stock portfolio, the chances are some of your picks will perform badly. But long term Gokurakuyu Holdings Co., Ltd. (TYO:2340) shareholders have had a particularly rough ride in the last three year. Sadly for them, the share price is down 56% in that time. And the ride hasn't got any smoother in recent times over the last year, with the price 39% lower in that time. The falls have accelerated recently, with the share price down 20% in the last three months.

Check out our latest analysis for Gokurakuyu Holdings

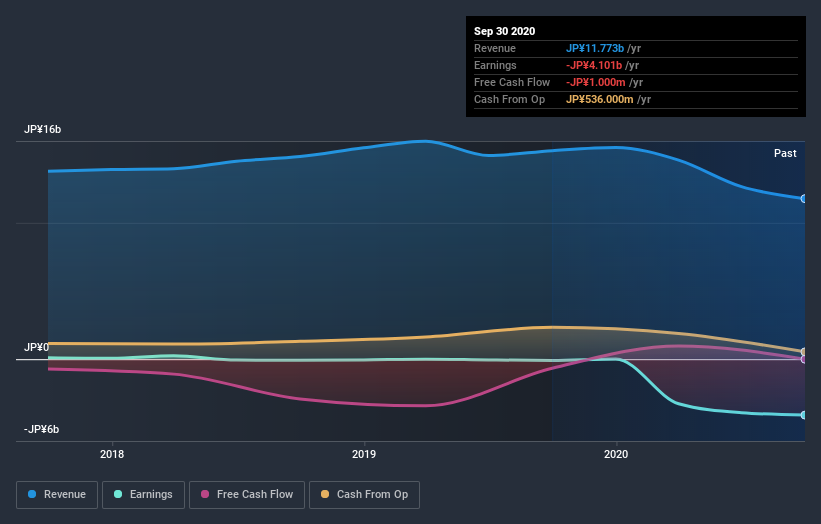

Given that Gokurakuyu Holdings didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally expect to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over the last three years, Gokurakuyu Holdings' revenue dropped 1.9% per year. That is not a good result. The share price decline of 16% compound, over three years, is understandable given the company doesn't have profits to boast of, and revenue is moving in the wrong direction. Of course, it's the future that will determine whether today's price is a good one. We don't generally like to own companies that lose money and can't grow revenues. But any company is worth looking at when it makes a maiden profit.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

This free interactive report on Gokurakuyu Holdings' balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Investors in Gokurakuyu Holdings had a tough year, with a total loss of 39%, against a market gain of about 5.7%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 8% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Gokurakuyu Holdings has 4 warning signs (and 1 which is a bit concerning) we think you should know about.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on JP exchanges.

If you’re looking to trade Gokurakuyu Holdings, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TSE:2340

Gokurakuyu Holdings

Operates, manages, and franchises spas facilities under the Gokurakuyu and RAKU SPA names in Japan and internationally.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.