- Japan

- /

- Food and Staples Retail

- /

- TSE:9948

ARCS (TSE:9948) Margin Gain Reinforces Stable Earnings Narrative Despite Muted Growth Outlook

Reviewed by Simply Wall St

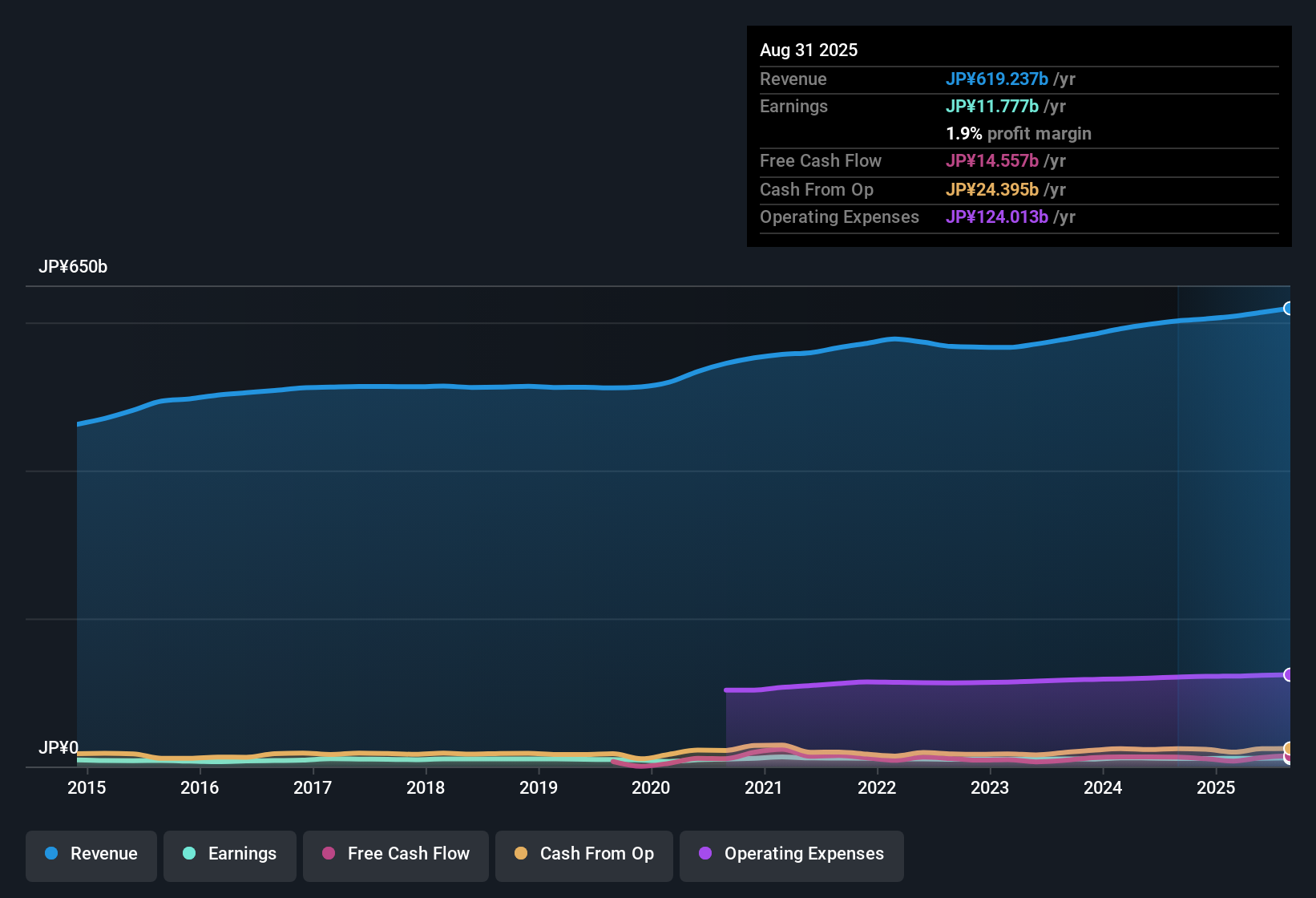

ARCS (TSE:9948) reported a current net profit margin of 1.9%, edging up from 1.8% a year ago, as earnings grew 7.4% over the past year. This is well ahead of its 0.2% 5-year average annual growth. Forward guidance calls for EPS to grow at 1.6% per year, trailing the 8.1% annual growth expected from the broader Japanese market. Revenue is projected to increase 2.8% annually, remaining below the market’s 4.4% average. With steadily improving profitability, a below-fair-value share price, and a favorable risk-reward profile, the latest results reinforce ARCS’s reputation for quality earnings and earnings stability even as its growth lags behind sector leaders.

See our full analysis for ARCS.Next, we’ll see how these fresh numbers match up with the prevailing narratives in the Simply Wall St community. There are places where expectations align, and others where the data may push the story in a new direction.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margin Uptick Outpaces Long-Run Trend

- Net profit margins increased to 1.9% from 1.8% last year, putting ARCS well above its 0.2% 5-year average annual earnings growth.

- The latest numbers support the idea that profitability is holding up even in a slow-growth sector, with steady margin improvement giving ARCS a stable foundation.

- Despite the modest headline increase, this outperformance versus the long-run growth trend highlights the company's ability to defend margins. This is a key talking point for investors betting on its quality characteristics.

- Stability is a main appeal: ARCS's rising margins, while not dramatic, point to deliberate management and cost control, which have been core arguments for its reputation as an "earnings quality" pick.

Trading at a Deep Discount to DCF Fair Value

- ARCS shares trade at ¥3,185, sitting well below the DCF fair value estimate of ¥4,830.95. This is a discount of roughly 34%.

- Valuation appears attractive given ARCS's premium to the sector average price/earnings ratio (14.6x vs 13.1x), but investors eyeing the broader peer group may see this discount to DCF as signaling underappreciated upside.

- Past and expected profit growth, along with a favorable risk-reward profile, add weight to arguments that share price pessimism may be excessive versus ARCS's fundamental quality.

- On the flip side, trading below DCF fair value with limited sector growth may also suggest the discount is a market response to muted forward guidance, not just a mispricing opportunity.

Dividend and Growth Factors Shape Risk/Reward

- Four reward factors stand out: a stable dividend, appealing valuation, and both historical as well as expected profit and revenue growth, with no significant listed risks.

- Prevailing analysis highlights that while ARCS's growth outlook (revenues up 2.8% and EPS up 1.6% per year) trails the broader market, its risk/reward profile holds strong because it combines steady dividends and profitability with undervaluation.

- The absence of major flagged risks supports the case for ARCS as a conservative, reliability-first choice, attractive to investors who value consistency over rapid expansion.

- For those prioritizing growth, the lack of robust revenue acceleration compared to sector leaders remains a key tradeoff to weigh.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on ARCS's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

While ARCS offers earnings stability and valuation upside, its limited revenue and EPS growth lag behind the broader Japanese market and sector leaders.

If you want investments with stronger ongoing expansion, use stable growth stocks screener (2096 results) to quickly focus on companies consistently delivering reliable growth year after year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9948

Solid track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives