- Japan

- /

- Food and Staples Retail

- /

- TSE:9869

Kato Sangyo (TSE:9869): Assessing Valuation Following Completion of Share Buyback Program

Reviewed by Kshitija Bhandaru

Kato Sangyo (TSE:9869) has wrapped up its latest share buyback program, repurchasing a total of 356,600 shares, or 1.15% of its outstanding stock, between July and September 2025. The completion of this buyback offers a fresh angle for investors to assess the company's capital allocation decisions.

See our latest analysis for Kato Sangyo.

Kato Sangyo’s buyback comes amid solid momentum for shareholders, with a 32.74% year-to-date share price return and a 46.81% total shareholder return over the past year. The stock’s steady climb reflects growing confidence and renewed interest from investors, supported by buyback-driven sentiment.

If Kato Sangyo’s strong run has you exploring what else could be outperforming, now’s the moment to discover fast growing stocks with high insider ownership

After such a robust rally and a completed buyback, investors may be wondering if Kato Sangyo still has room to run, or if the market has already priced in all its future growth potential.

Price-to-Earnings of 13x: Is it justified?

Kato Sangyo is trading at a price-to-earnings ratio of 13x, which puts the last close of ¥5,980 well below the peer group average. This suggests that investors are paying less for each unit of earnings relative to similar companies in the sector.

The price-to-earnings (P/E) ratio measures how much investors are willing to pay for a company's earnings. In the consumer retailing space, the P/E ratio helps quickly gauge whether a stock may be under- or over-valued compared to industry peers.

Notably, Kato Sangyo's P/E of 13x is attractively valued against the industry average of 15.2x and also below the broader Japanese market average of 14.2x. This signals that the market could be overlooking the company’s earnings potential, especially given its consistent profit growth and history of quality earnings.

Compared to the wider Consumer Retailing industry in Japan, where the average P/E sits at 13.1x, Kato Sangyo remains modestly valued. With a lower multiple and recent outperformance versus both the industry and market, the current price appears reasonable for long-term investors.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 13x (UNDERVALUED)

However, investors should remain alert to potential earnings volatility or industry shifts, as these factors could quickly change the stock’s current favorable outlook.

Find out about the key risks to this Kato Sangyo narrative.

Another View: What Does the SWS DCF Model Say?

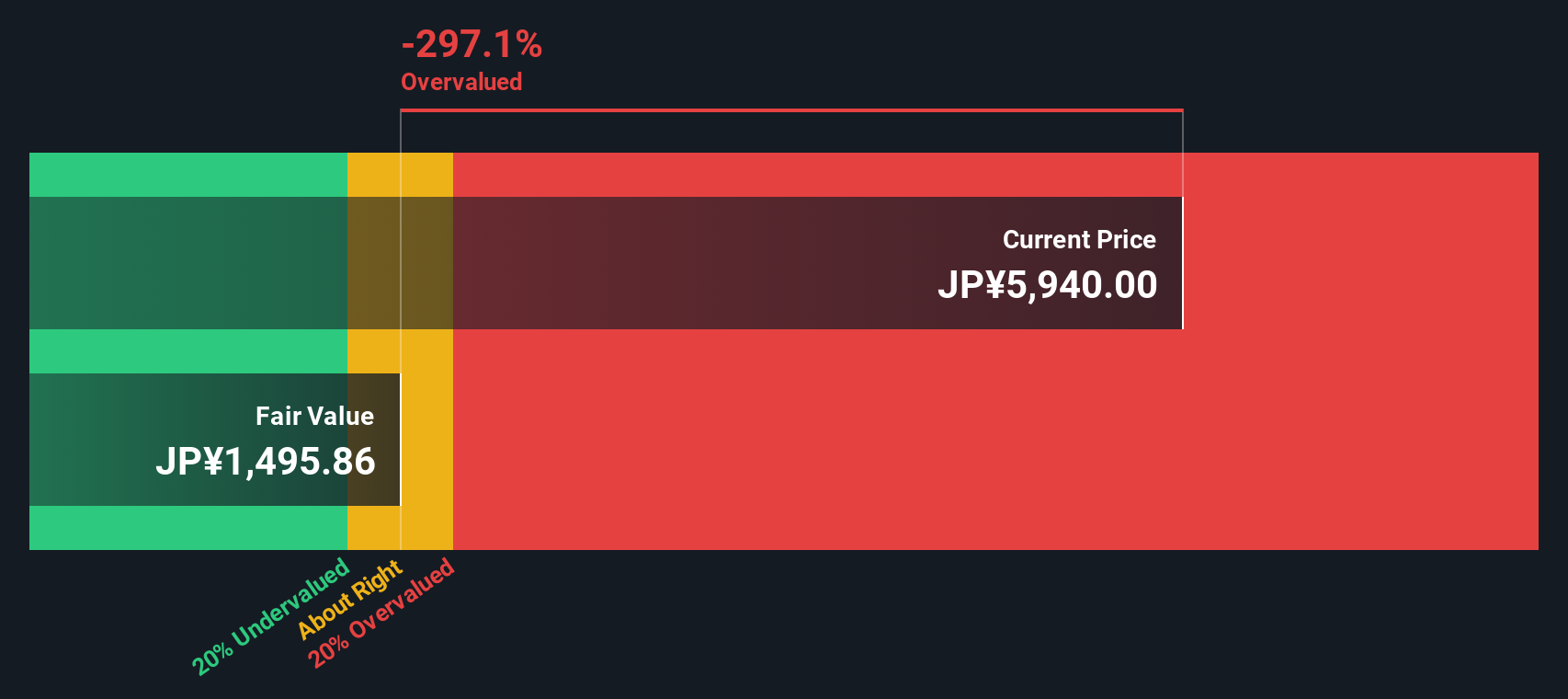

While the P/E ratio paints Kato Sangyo as undervalued compared to its peers, our DCF model offers a very different perspective. According to the SWS DCF model, the current price of ¥5,980 is significantly above the estimated fair value of ¥1,493.78, suggesting shares may actually be overvalued at this level. This raises the question: are investors relying too much on peer comparisons, or is the market right to price in potential not captured by cash flow analysis?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Kato Sangyo for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Kato Sangyo Narrative

If you have a different perspective or want to dive deeper into the numbers, you're invited to shape your own take. Get started in just a few minutes. Do it your way

A great starting point for your Kato Sangyo research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors never settle for just one opportunity. Make your research count by checking other strategies tailored to your risk appetite and goals with these top picks below.

- Uncover up-and-coming potential with these 3556 penny stocks with strong financials, which combine strong financials and growth stories you won’t want to overlook.

- Capture the momentum of next-level technology by targeting these 24 AI penny stocks, which are positioned for rapid expansion in the artificial intelligence space.

- Secure substantial yields with these 18 dividend stocks with yields > 3% and ensure your portfolio benefits from steady, reliable income streams in any market.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kato Sangyo might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9869

Kato Sangyo

Engages in the general food wholesaling business in Japan and internationally.

Excellent balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives