- Taiwan

- /

- Construction

- /

- TWSE:6691

Exploring Guizhou Chanhen Chemical And Two Other Promising Small Caps Globally

Reviewed by Simply Wall St

As global markets navigate a landscape marked by mixed performances and cautious optimism around trade negotiations, small-cap stocks have shown resilience with indices like the S&P MidCap 400 and Russell 2000 posting gains. Amid this backdrop of economic uncertainty and potential tariff de-escalation, investors are increasingly looking toward small-cap companies that demonstrate robust fundamentals and strategic positioning as potential opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| S.A.S. Dragon Holdings | 77.35% | 3.64% | 7.13% | ★★★★★★ |

| Daphne International Holdings | NA | -40.78% | 85.98% | ★★★★★★ |

| Baazeem Trading | 6.93% | -1.88% | -2.38% | ★★★★★★ |

| Yibin City Commercial Bank | 136.61% | 11.29% | 20.39% | ★★★★★★ |

| Chongqing Machinery & Electric | 25.60% | 7.97% | 18.73% | ★★★★★☆ |

| Lee's Pharmaceutical Holdings | 13.81% | -0.34% | -27.47% | ★★★★★☆ |

| Billion Industrial Holdings | 7.13% | 18.54% | -14.41% | ★★★★★☆ |

| Pizu Group Holdings | 48.10% | -4.86% | -19.23% | ★★★★☆☆ |

| Time Interconnect Technology | 78.17% | 24.96% | 19.51% | ★★★★☆☆ |

| National Corporation for Tourism and Hotels | 19.25% | 0.67% | 4.89% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Guizhou Chanhen Chemical (SZSE:002895)

Simply Wall St Value Rating: ★★★★★☆

Overview: Guizhou Chanhen Chemical Corporation is involved in the mining and beneficiation of phosphate and processing phosphorus in China, with a market cap of CN¥12.77 billion.

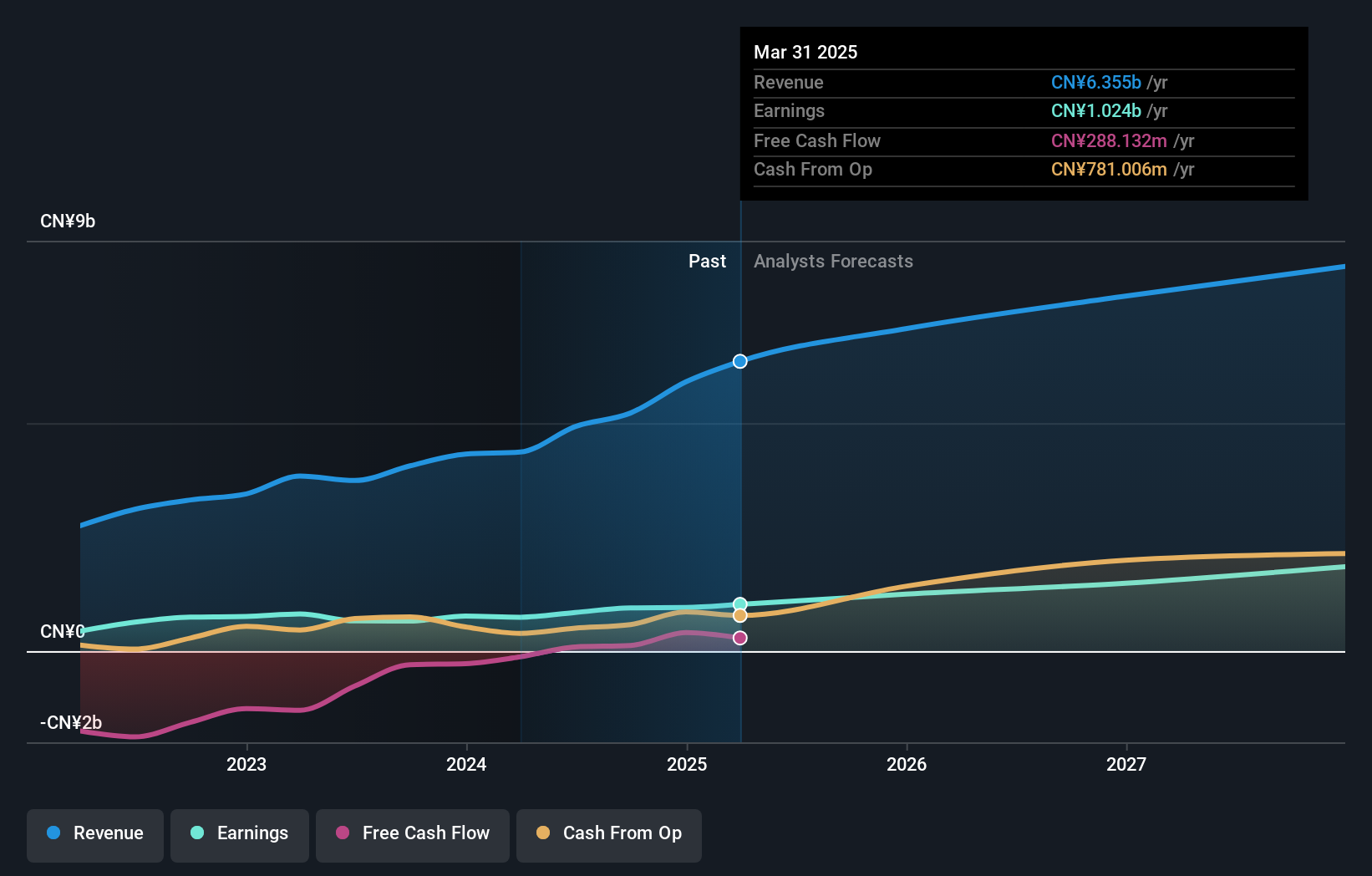

Operations: Guizhou Chanhen Chemical generates revenue primarily from phosphate mining and phosphorus processing activities. The company's financial performance is influenced by its cost structure, which includes expenses related to mining operations and processing activities. Gross profit margin trends provide insight into the efficiency of its production processes over time.

Guizhou Chanhen Chemical, a nimble player in the chemicals sector, has been making waves with its robust earnings growth of 37.9% over the past year, outpacing the industry average of 2.7%. Its net debt to equity ratio stands at a satisfactory 28.8%, indicating prudent financial management. Trading at about 8.9% below its estimated fair value, it presents an attractive proposition for investors seeking value. The company recently approved a cash dividend of CNY 12 per ten shares and repurchased shares worth CNY 2.54 million, reflecting confidence in its financial health and future prospects.

- Delve into the full analysis health report here for a deeper understanding of Guizhou Chanhen Chemical.

Learn about Guizhou Chanhen Chemical's historical performance.

H2O Retailing (TSE:8242)

Simply Wall St Value Rating: ★★★★☆☆

Overview: H2O Retailing Corporation is a Japanese company that manages department stores, supermarkets, and shopping centers, with a market capitalization of ¥244.80 billion.

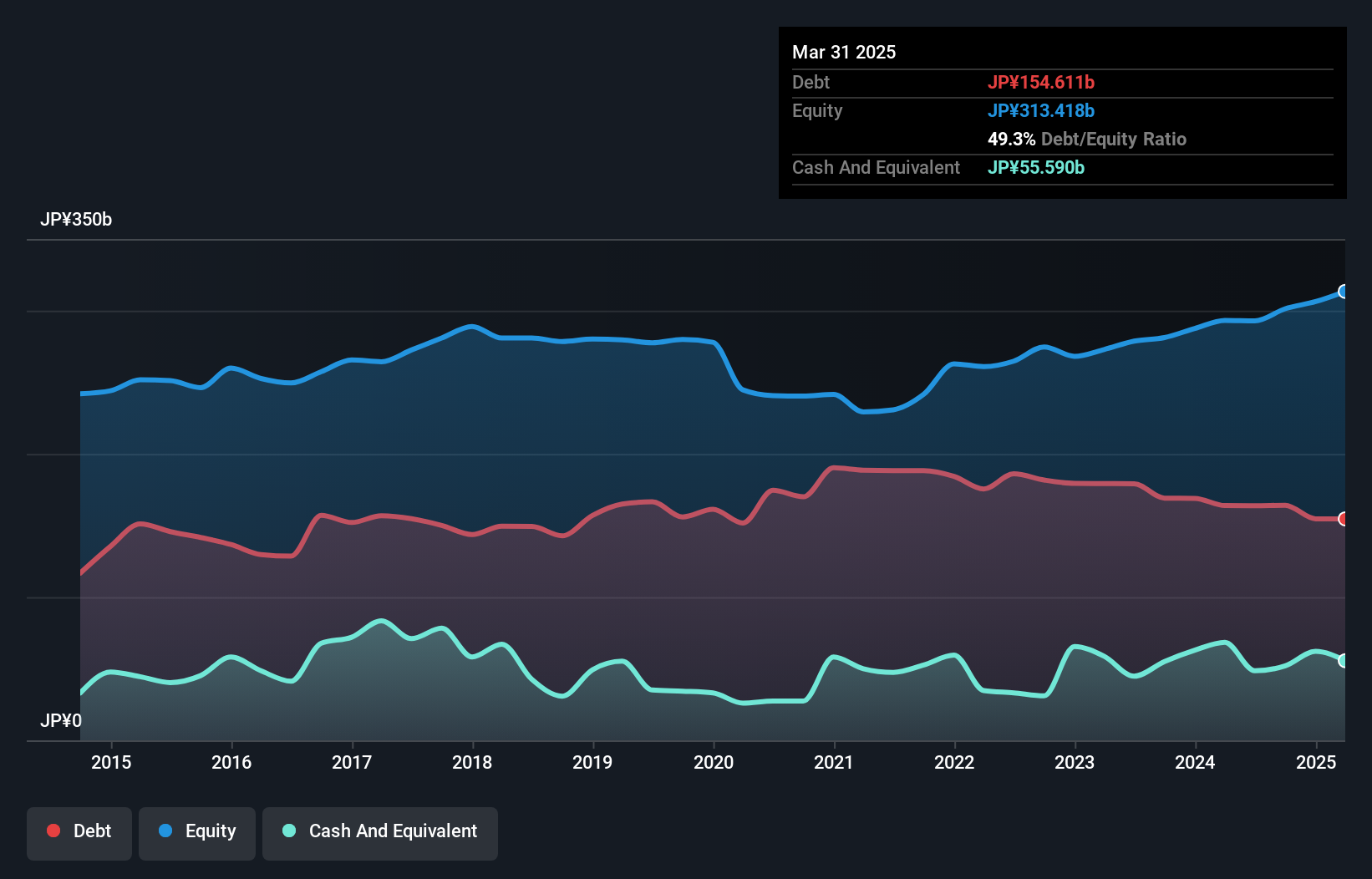

Operations: H2O Retailing generates revenue primarily from its operations in department stores, supermarkets, and shopping centers. The company's financial performance is influenced by its ability to manage costs effectively across these segments. Notably, the net profit margin has shown variability over recent periods, reflecting changes in operational efficiency and market conditions.

H2O Retailing has shown impressive earnings growth of 59.1% over the past year, outpacing the Consumer Retailing industry at 7.4%. The company's debt to equity ratio improved from 62% to 49.3% over five years, with a satisfactory net debt to equity ratio of 31.6%. A recent ¥16.3 billion one-off gain affected its financial results, highlighting potential volatility in earnings quality. On May 13, H2O announced a share repurchase program for up to ¥15 billion and plans dividends of ¥22 per share for fiscal year ending March 2026, reflecting commitment to shareholder returns amidst strategic initiatives under its management plan.

- Click here and access our complete health analysis report to understand the dynamics of H2O Retailing.

Review our historical performance report to gain insights into H2O Retailing's's past performance.

Yankey Engineering (TWSE:6691)

Simply Wall St Value Rating: ★★★★★★

Overview: Yankey Engineering Co., Ltd. provides engineering services across Taiwan, China, and Thailand with a market capitalization of NT$44.75 billion.

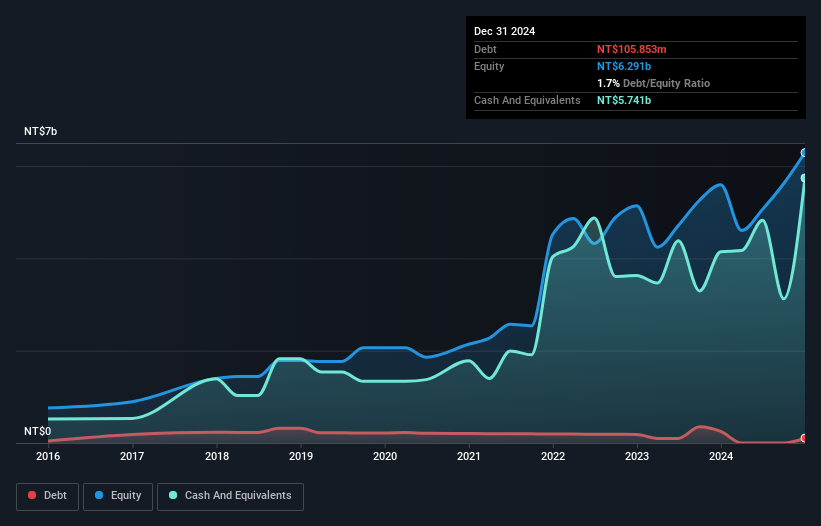

Operations: Yankey Engineering generates revenue primarily from its engineering services in Taiwan, China, and Thailand. The company has a market capitalization of NT$44.75 billion.

Yankey Engineering has been making waves with its impressive financial performance. Over the past year, earnings surged by 30%, outpacing the broader Construction industry’s growth of just 1%. The company is debt-free, a significant improvement from five years ago when its debt-to-equity ratio was 11%. Trading at nearly 80% below estimated fair value, Yankey seems undervalued. Recent Q1 results showed sales reaching TWD 3.95 billion and net income climbing to TWD 597 million from TWD 361 million last year. With high-quality earnings and positive free cash flow, Yankey appears well-positioned for continued success in its sector.

Turning Ideas Into Actions

- Discover the full array of 3208 Global Undiscovered Gems With Strong Fundamentals right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:6691

Yankey Engineering

Offers engineering services in Taiwan, China, and Thailand.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives