- Hong Kong

- /

- Hospitality

- /

- SEHK:999

Discovering Undiscovered Gems in January 2025

Reviewed by Simply Wall St

As global markets continue to navigate the evolving landscape shaped by recent political developments and economic indicators, major indices like the S&P 500 have reached new heights, buoyed by optimism surrounding potential trade deals and advancements in artificial intelligence. Despite large-cap stocks outpacing their smaller counterparts, small-cap companies remain a fertile ground for discovering promising investments that can benefit from shifts in manufacturing activity and consumer trends. In this environment, identifying stocks with strong fundamentals and unique growth prospects is crucial for uncovering those hidden gems that may thrive amidst broader market dynamics.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Natural Food International Holding | NA | 2.49% | 20.35% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Kenturn Nano. Tec | 45.38% | 9.73% | 28.94% | ★★★★★☆ |

| ONEJOON | 9.85% | 24.95% | 4.85% | ★★★★★☆ |

| Giant Heavy Machinery Service | 17.81% | 21.88% | 48.77% | ★★★★★☆ |

| PAN Group | 143.29% | 15.75% | 23.10% | ★★★★☆☆ |

| Petrolimex Insurance | 32.25% | 4.46% | 7.91% | ★★★★☆☆ |

| Bhakti Multi Artha | 45.21% | 32.37% | -16.43% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Xiaocaiyuan International Holding (SEHK:999)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Xiaocaiyuan International Holding Ltd. is an investment holding company that operates in the restaurant business in the People’s Republic of China, with a market capitalization of approximately HK$10.85 billion.

Operations: Xiaocaiyuan generates revenue primarily through its restaurant operations, contributing CN¥3.05 billion, and its delivery business, adding CN¥1.49 billion.

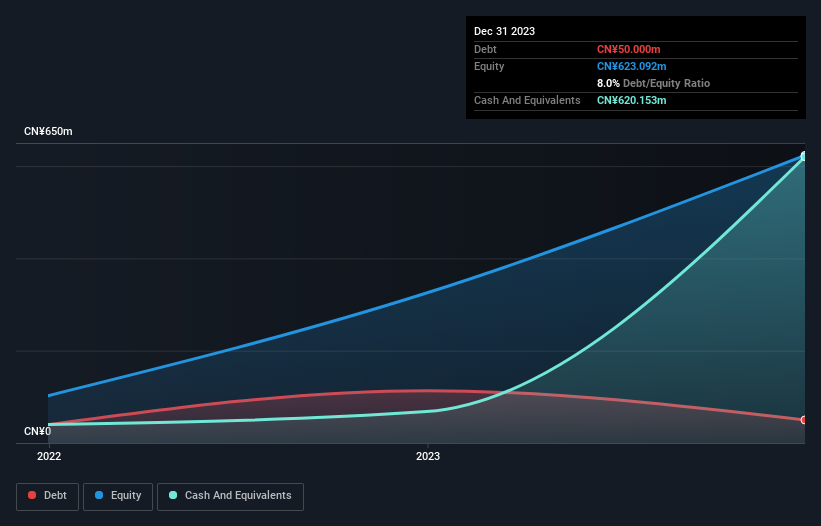

Xiaocaiyuan International Holding recently completed an IPO raising HKD 860.04 million, offering shares at HKD 8.5 each with a slight discount. The company has shown remarkable earnings growth of 124% over the past year, outpacing the Hospitality industry's average of 13%. Trading at about 68% below its estimated fair value, it appears undervalued. Despite high-quality past earnings and interest payments well covered by EBIT at a ratio of 31x, its shares remain highly illiquid. With more cash than debt on hand, Xiaocaiyuan seems positioned for potential growth as revenue is forecasted to increase by nearly 19% annually.

- Click here and access our complete health analysis report to understand the dynamics of Xiaocaiyuan International Holding.

Learn about Xiaocaiyuan International Holding's historical performance.

G-7 Holdings (TSE:7508)

Simply Wall St Value Rating: ★★★★★☆

Overview: G-7 Holdings Inc. operates through its subsidiaries in the food retail industry both in Japan and internationally, with a market capitalization of approximately ¥61.69 billion.

Operations: G-7 Holdings generates revenue primarily from its Business Supermarket Business and Automotive related business, with the former contributing ¥114.44 billion and the latter ¥44.62 billion. The Meat Business adds another ¥21.03 billion to its revenue streams.

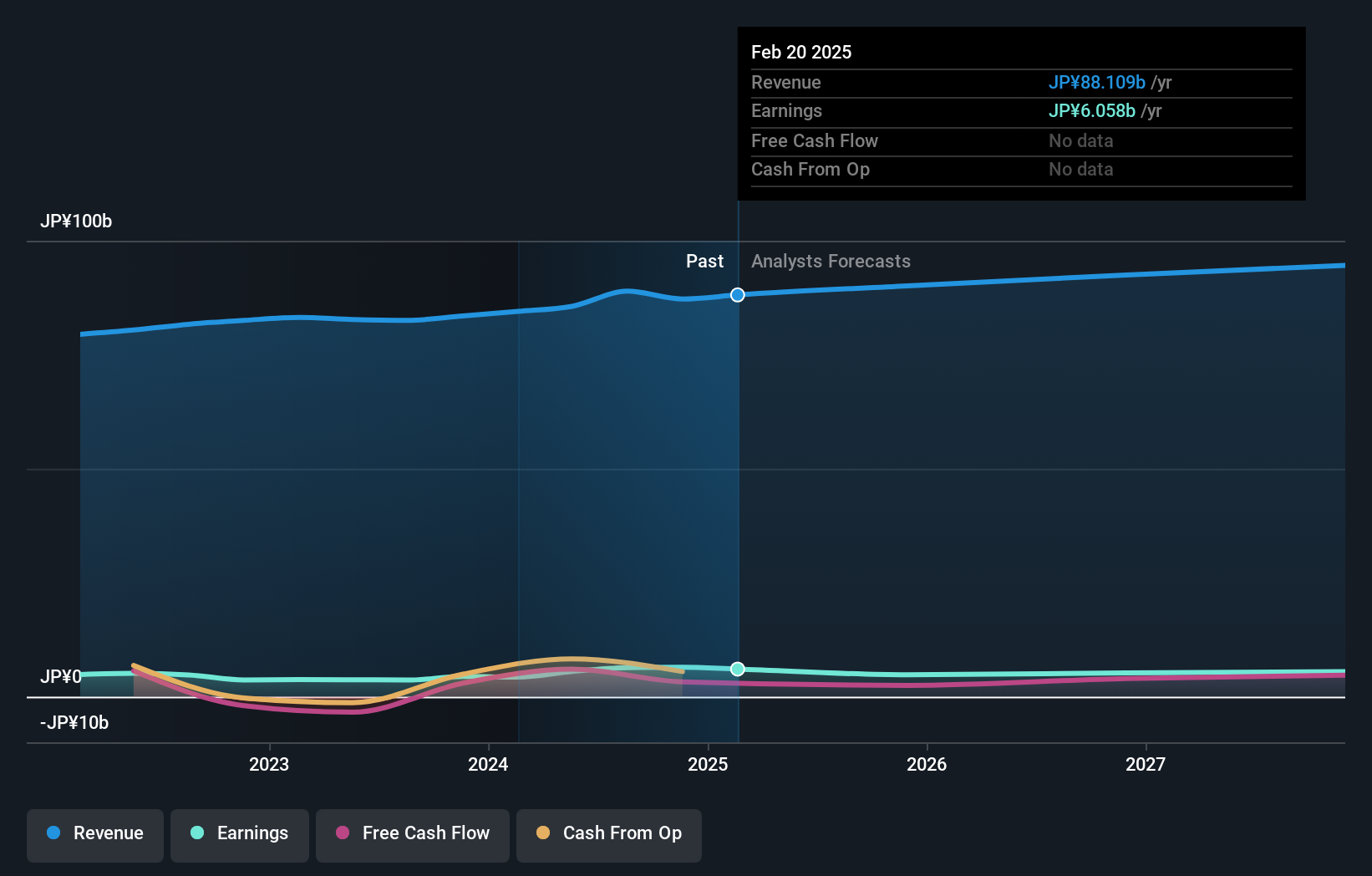

G-7 Holdings, a compact player in the market, is catching attention with its robust financial health. The company boasts high-quality earnings and trades at about 8.7% below fair value estimates. Over the past year, earnings surged by 27.9%, outpacing the Consumer Retailing industry’s 11.5% growth rate, which highlights its competitive edge. Interest payments are comfortably covered by EBIT at a ratio of 183x, suggesting strong operational efficiency despite an increase in debt to equity from 39% to 46% over five years. Recently affirming a dividend of JPY 20 per share for Q2 FY2025 further underscores its commitment to shareholder returns.

- Click to explore a detailed breakdown of our findings in G-7 Holdings' health report.

Review our historical performance report to gain insights into G-7 Holdings''s past performance.

Zojirushi (TSE:7965)

Simply Wall St Value Rating: ★★★★★★

Overview: Zojirushi Corporation is a company that produces and sells household products both in Japan and globally, with a market capitalization of ¥109.75 billion.

Operations: Zojirushi Corporation generates revenue primarily from manufacturing and selling household goods, amounting to ¥87.22 billion.

Zojirushi, a notable player in the consumer durables sector, has shown impressive earnings growth of 45.5% over the past year, significantly outpacing the industry's modest 0.6%. This growth was partly influenced by a substantial one-off gain of ¥1.9 billion in its recent financials. The company boasts more cash than total debt and positive free cash flow, reflecting strong financial health. Despite recent share price volatility, Zojirushi's debt-to-equity ratio has improved from 2.1 to 1.7 over five years, indicating prudent financial management. Looking ahead, earnings are expected to grow at a steady pace of 1.12% annually.

- Navigate through the intricacies of Zojirushi with our comprehensive health report here.

Assess Zojirushi's past performance with our detailed historical performance reports.

Where To Now?

- Gain an insight into the universe of 4664 Undiscovered Gems With Strong Fundamentals by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:999

Xiaocaiyuan International Holding

An investment holding company, engages in the restaurant business in the People’s Republic of China.

Proven track record with adequate balance sheet.

Market Insights

Community Narratives