- Japan

- /

- Food and Staples Retail

- /

- TSE:7481

Oie Sangyo Co., Ltd.'s (TSE:7481) Price Is Right But Growth Is Lacking After Shares Rocket 27%

Oie Sangyo Co., Ltd. (TSE:7481) shares have had a really impressive month, gaining 27% after a shaky period beforehand. Looking back a bit further, it's encouraging to see the stock is up 77% in the last year.

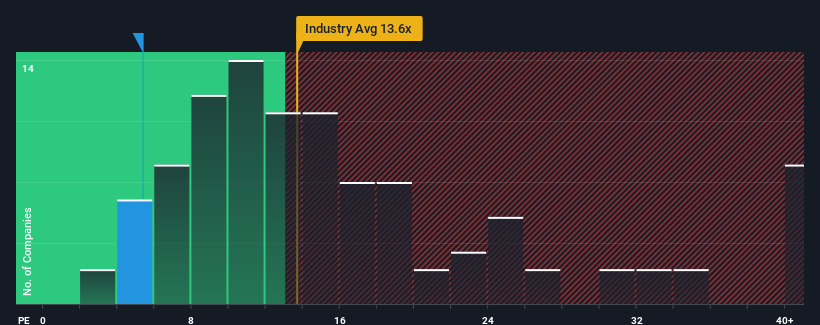

Even after such a large jump in price, Oie Sangyo's price-to-earnings (or "P/E") ratio of 5.4x might still make it look like a strong buy right now compared to the market in Japan, where around half of the companies have P/E ratios above 15x and even P/E's above 22x are quite common. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

Oie Sangyo certainly has been doing a great job lately as it's been growing earnings at a really rapid pace. One possibility is that the P/E is low because investors think this strong earnings growth might actually underperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for Oie Sangyo

Does Growth Match The Low P/E?

The only time you'd be truly comfortable seeing a P/E as depressed as Oie Sangyo's is when the company's growth is on track to lag the market decidedly.

Retrospectively, the last year delivered an exceptional 91% gain to the company's bottom line. Although, its longer-term performance hasn't been as strong with three-year EPS growth being relatively non-existent overall. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

This is in contrast to the rest of the market, which is expected to grow by 9.7% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this information, we can see why Oie Sangyo is trading at a P/E lower than the market. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the bourse.

The Key Takeaway

Shares in Oie Sangyo are going to need a lot more upward momentum to get the company's P/E out of its slump. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Oie Sangyo maintains its low P/E on the weakness of its recent three-year growth being lower than the wider market forecast, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. If recent medium-term earnings trends continue, it's hard to see the share price rising strongly in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Oie Sangyo, and understanding should be part of your investment process.

If you're unsure about the strength of Oie Sangyo's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:7481

Excellent balance sheet, good value and pays a dividend.

Market Insights

Community Narratives