- Japan

- /

- Food and Staples Retail

- /

- TSE:3549

Kusuri No Aoki Holdings (TSE:3549): Evaluating Valuation Following Standout September Sales Results

Reviewed by Kshitija Bhandaru

Kusuri No Aoki Holdings (TSE:3549) caught attention after releasing preliminary sales results for September 2025. All stores sales were up 113 percent, while existing stores rose 103 percent. This update offers new insight into recent consumer trends.

See our latest analysis for Kusuri No Aoki Holdings.

The sales momentum seems to have sparked renewed optimism among investors, with Kusuri No Aoki Holdings’ share price gaining 4.54% over the past week and holding onto a 19.3% year-to-date return. Notably, its one-year total shareholder return stands at an impressive 10.7%, while the three-year figure has risen over 55%, highlighting steady gains for long-term holders even amid recent pullbacks. With the latest surge in sales, it appears that market confidence is building again around the group’s growth potential.

If this uptick has you looking for what’s next in the market, it could be the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

The question now is whether Kusuri No Aoki Holdings is offering investors an attractive entry point at current levels, or if the recent rally means the market has already factored in its future growth potential.

Price-to-Earnings of 21x: Is it justified?

At a last close price of ¥3,729, Kusuri No Aoki Holdings is currently priced at a notable premium compared to both industry peers and its own historical averages. This premium merits a closer look at what is driving such valuation.

The price-to-earnings (P/E) ratio measures how much investors are willing to pay today for a company's earnings. For Kusuri No Aoki Holdings, the current ratio stands at 21x. This provides a lens into what the market expects for future growth and profitability in the consumer retailing sector.

Despite solid top-line gains and faster-than-industry earnings growth, a P/E ratio of 21x means investors are paying more for the company's earnings than for typical peers. The Japanese Consumer Retailing industry average sits at 13.6x and the peer average at 15.4x. Even when compared to an estimated fair P/E ratio of 18.9x, Kusuri No Aoki Holdings trades at a premium. This signals that the market is either betting on sustained superior performance or potentially overestimating future prospects.

Explore the SWS fair ratio for Kusuri No Aoki Holdings

Result: Price-to-Earnings of 21x (OVERVALUED)

However, sustained growth is not guaranteed. Competitive pressures or shifts in consumer spending could quickly dampen the current positive momentum.

Find out about the key risks to this Kusuri No Aoki Holdings narrative.

Another View: Discounted Cash Flow Analysis

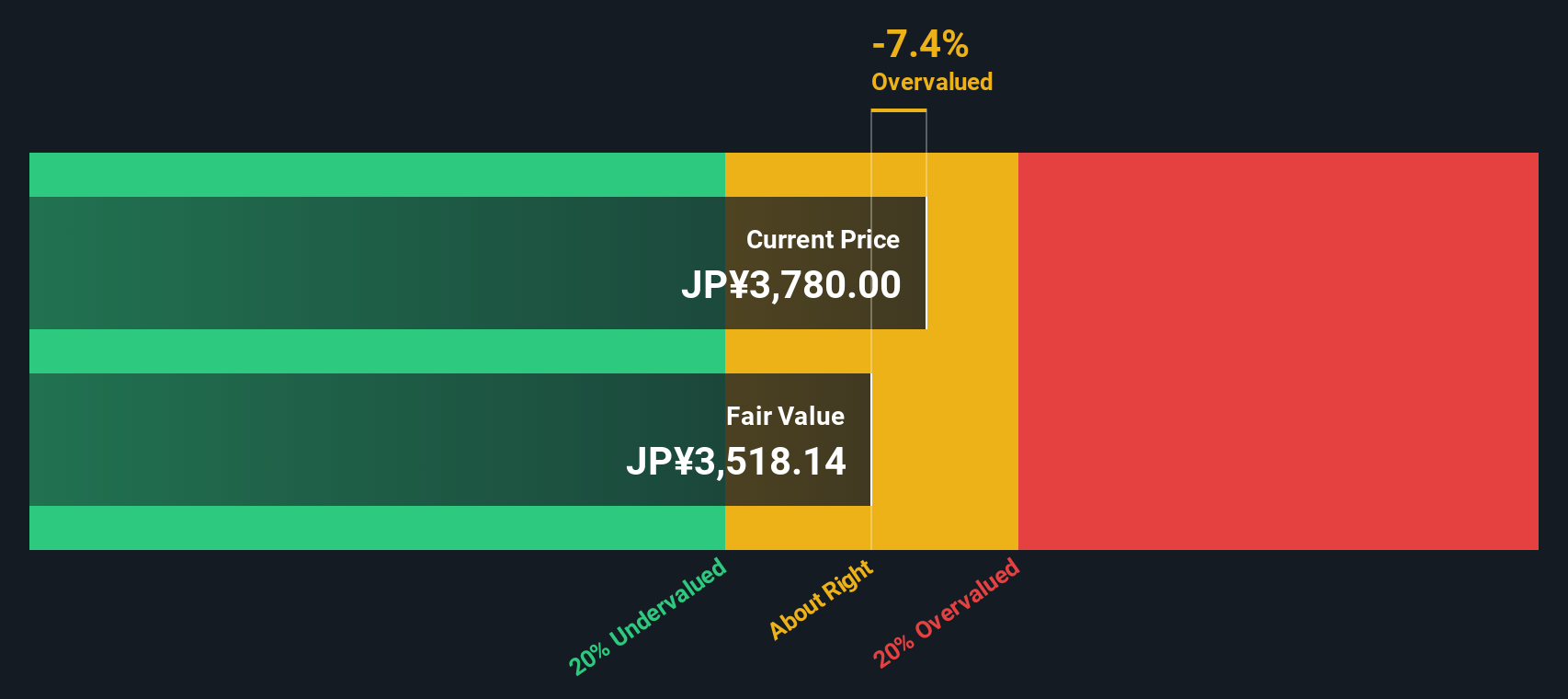

While the price-to-earnings ratio shows Kusuri No Aoki Holdings trading at a premium, our SWS DCF model paints a slightly different picture. According to this method, the current share price of ¥3,729 is above the estimated fair value of ¥3,464.52, suggesting the shares may still be overvalued from a cash flow perspective.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Kusuri No Aoki Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Kusuri No Aoki Holdings Narrative

If you want to dive deeper or take a different approach to the analysis, you can easily craft your own narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Kusuri No Aoki Holdings.

Looking for more investment ideas?

Smart investing means always keeping an eye out for your next great opportunity. Level up your portfolio by checking out these hand-picked market angles. Miss them, and you could overlook tomorrow’s winners.

- Boost your portfolio’s potential by tapping into these 898 undervalued stocks based on cash flows that have strong cash flow signals and could be priced below their true worth.

- Tap into the future of healthcare advancements by exploring these 33 healthcare AI stocks at the cutting edge of medical innovation and artificial intelligence.

- Accelerate your search for portfolio game-changers with these 79 cryptocurrency and blockchain stocks positioned at the forefront of digital finance and blockchain disruption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kusuri No Aoki Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3549

Kusuri No Aoki Holdings

Engages in the retail of pharmaceuticals, cosmetics, and daily goods in Japan.

Solid track record with adequate balance sheet.

Market Insights

Community Narratives