3 Asian Stocks Estimated To Be Up To 42.1% Below Intrinsic Value

Reviewed by Simply Wall St

Amidst ongoing trade tensions and economic policy shifts, Asian markets have shown resilience with indices like Japan's Nikkei 225 and China's CSI 300 posting gains. In this environment, identifying stocks that are undervalued compared to their intrinsic value can be a strategic approach for investors seeking opportunities amidst market fluctuations.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Xi'an NovaStar Tech (SZSE:301589) | CN¥149.07 | CN¥296.52 | 49.7% |

| Micro-Star International (TWSE:2377) | NT$136.00 | NT$265.69 | 48.8% |

| Tonghua Dongbao Pharmaceutical (SHSE:600867) | CN¥7.27 | CN¥14.11 | 48.5% |

| LITALICO (TSE:7366) | ¥1166.00 | ¥2305.35 | 49.4% |

| World Fitness Services (TWSE:2762) | NT$79.80 | NT$156.42 | 49% |

| CS BEARING (KOSDAQ:A297090) | ₩5350.00 | ₩10442.66 | 48.8% |

| Zhejiang Century Huatong GroupLtd (SZSE:002602) | CN¥6.87 | CN¥13.33 | 48.5% |

| Swire Properties (SEHK:1972) | HK$16.08 | HK$31.96 | 49.7% |

| Innovent Biologics (SEHK:1801) | HK$47.25 | HK$93.85 | 49.7% |

| SAMG Entertainment (KOSDAQ:A419530) | ₩36600.00 | ₩72265.47 | 49.4% |

Underneath we present a selection of stocks filtered out by our screen.

Akeso (SEHK:9926)

Overview: Akeso, Inc. is a biopharmaceutical company that focuses on the research, development, manufacturing, and commercialization of antibody drugs with a market cap of HK$74.45 billion.

Operations: The company's revenue is primarily generated from its research, development, production, and sale of biopharmaceutical products, amounting to CN¥2.12 billion.

Estimated Discount To Fair Value: 32.3%

Akeso is trading at HK$82.95, significantly below its estimated fair value of HK$122.47, suggesting undervaluation based on discounted cash flow analysis. Despite recent earnings showing a net loss of CNY 514.52 million for 2024, the company is expected to become profitable within three years with revenue growth projected at 28.9% annually, far outpacing the Hong Kong market average. However, Akeso's share price has been highly volatile recently which could pose risks for investors seeking stability.

- Our comprehensive growth report raises the possibility that Akeso is poised for substantial financial growth.

- Delve into the full analysis health report here for a deeper understanding of Akeso.

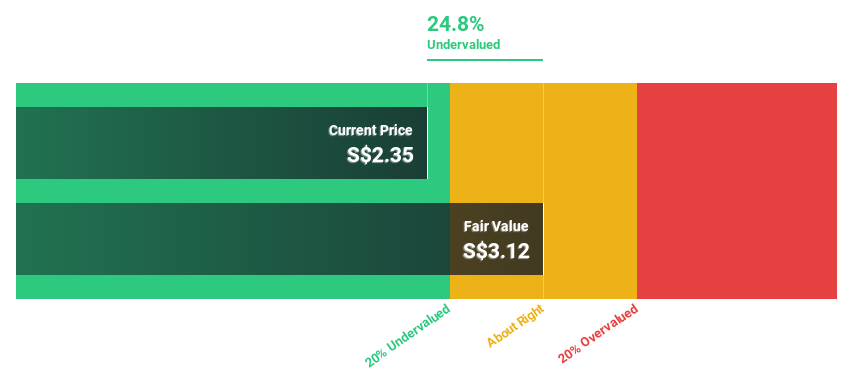

Yangzijiang Shipbuilding (Holdings) (SGX:BS6)

Overview: Yangzijiang Shipbuilding (Holdings) Ltd. is an investment holding company involved in shipbuilding activities across Greater China and various international markets, with a market cap of SGD8.11 billion.

Operations: The company generates revenue primarily from its shipbuilding operations, which account for CN¥25.22 billion, followed by its shipping segment contributing CN¥1.24 billion.

Estimated Discount To Fair Value: 29.0%

Yangzijiang Shipbuilding (Holdings) trades at S$2.06, below its estimated fair value of S$2.90, highlighting potential undervaluation based on cash flows. The company reported robust earnings growth of 61.7% last year and forecasts suggest continued revenue growth at 14.9% annually, outpacing the Singapore market average. Recent actions include a share buyback program and a proposed final dividend of SGD 0.12 per share, reflecting strong cash flow management and shareholder returns focus.

- Insights from our recent growth report point to a promising forecast for Yangzijiang Shipbuilding (Holdings)'s business outlook.

- Navigate through the intricacies of Yangzijiang Shipbuilding (Holdings) with our comprehensive financial health report here.

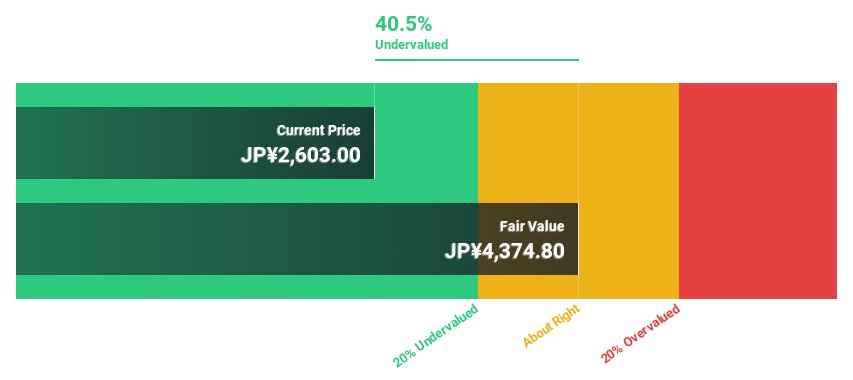

NIHON CHOUZAILtd (TSE:3341)

Overview: NIHON CHOUZAI Co., Ltd. operates a chain of health insurance dispensing pharmacies in Japan, with a market cap of ¥75.11 billion.

Operations: The company's revenue is primarily derived from its Dispensing Pharmacy Business at ¥317.50 billion, followed by the Pharmaceutical Manufacturing Sales Business at ¥40.19 billion, and the Medical Worker Dispatch/Introduction Business at ¥11.29 billion.

Estimated Discount To Fair Value: 42.1%

NIHON CHOUZAI Ltd. trades at ¥2,514, significantly below its estimated fair value of ¥4,342.14, suggesting undervaluation based on cash flows despite recent challenges. The company faces a volatile share price and reported an impairment loss of ¥2.08 billion in its Dispensing Pharmacy Business due to a changing business environment. However, earnings are forecast to grow 35.73% annually with expectations of becoming profitable within three years, surpassing average market growth rates in Japan.

- Our growth report here indicates NIHON CHOUZAILtd may be poised for an improving outlook.

- Take a closer look at NIHON CHOUZAILtd's balance sheet health here in our report.

Summing It All Up

- Gain an insight into the universe of 274 Undervalued Asian Stocks Based On Cash Flows by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Akeso, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:9926

Akeso

A biopharmaceutical company, researches, develops, manufactures, and commercializes antibody drugs.

Exceptional growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives