- Japan

- /

- Food and Staples Retail

- /

- TSE:3034

Insider-Owned Growth Leaders On The Japanese Exchange For July 2024

Reviewed by Simply Wall St

As global markets navigate through fluctuating economic indicators and monetary policy adjustments, Japan's stock market has shown resilience despite recent currency interventions aimed at stabilizing the yen. This backdrop creates a compelling context for examining growth-oriented companies in Japan, particularly those with high insider ownership which can signal strong confidence in the company’s future from those who know it best.

Top 10 Growth Companies With High Insider Ownership In Japan

| Name | Insider Ownership | Earnings Growth |

| Hottolink (TSE:3680) | 27% | 59.7% |

| Kasumigaseki CapitalLtd (TSE:3498) | 34.8% | 42.9% |

| Medley (TSE:4480) | 34% | 28.7% |

| Micronics Japan (TSE:6871) | 15.3% | 39.8% |

| Kanamic NetworkLTD (TSE:3939) | 25% | 28.9% |

| SHIFT (TSE:3697) | 35.4% | 32.5% |

| ExaWizards (TSE:4259) | 21.9% | 91.1% |

| Money Forward (TSE:3994) | 21.4% | 66.9% |

| Astroscale Holdings (TSE:186A) | 20.9% | 90% |

| Soiken Holdings (TSE:2385) | 19.8% | 118.4% |

Let's review some notable picks from our screened stocks.

Qol Holdings (TSE:3034)

Simply Wall St Growth Rating: ★★★★☆☆

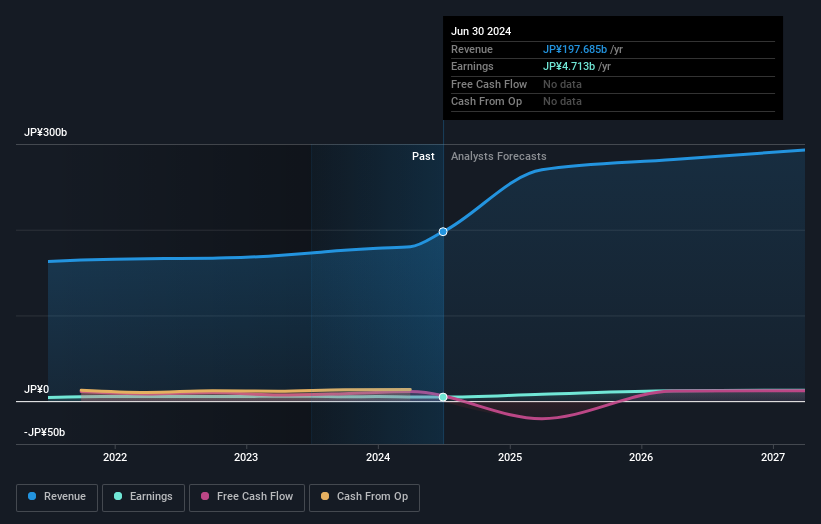

Overview: Qol Holdings Co., Ltd. operates a network of dispensing pharmacies and provides business process outsourcing services in Japan, with a market capitalization of approximately ¥57.10 billion.

Operations: The company operates primarily in two segments: dispensing pharmacies and business process outsourcing services.

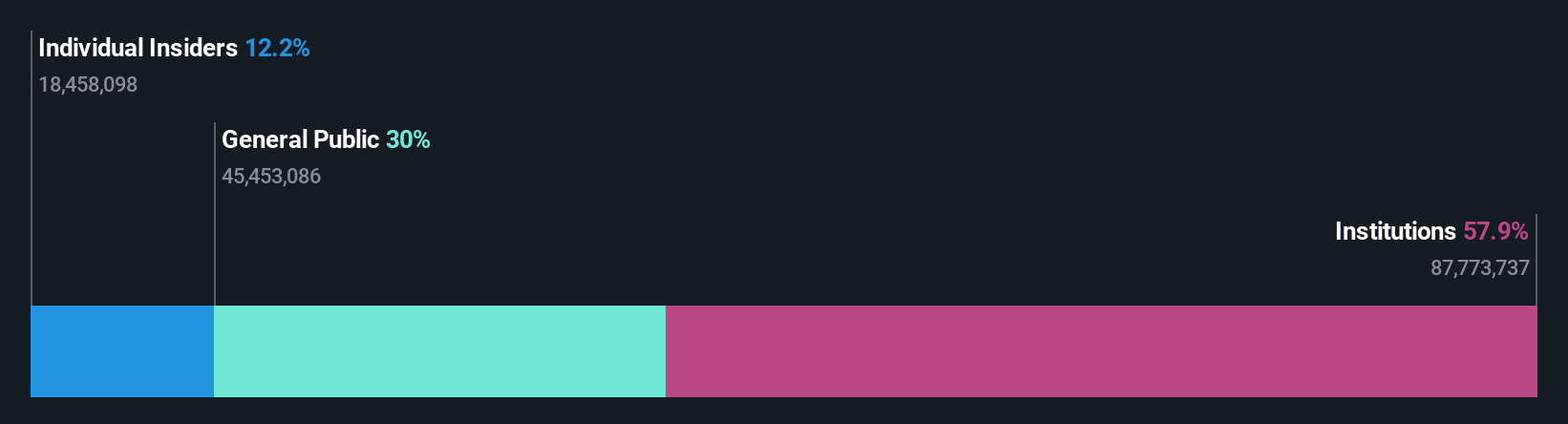

Insider Ownership: 14.5%

Earnings Growth Forecast: 29.4% p.a.

Qol Holdings is positioned intriguingly in Japan's growth sector, with high insider ownership enhancing its appeal. The company's revenue is expected to increase by 13.7% annually, outpacing the Japanese market average of 4.3%. While its earnings growth projection stands at a robust 29.36% per year, it still trades at a significant discount—75.3% below estimated fair value—suggesting potential undervaluation. However, challenges include a highly volatile share price and a forecasted low return on equity of 17%.

- Click here to discover the nuances of Qol Holdings with our detailed analytical future growth report.

- According our valuation report, there's an indication that Qol Holdings' share price might be on the cheaper side.

World (TSE:3612)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: World Co., Ltd. is a company engaged in the planning, manufacturing, retailing, selling, and importing/exporting of apparel and fashion products both in Japan and internationally, with a market capitalization of approximately ¥77.18 billion.

Operations: The company generates its revenue primarily from the planning, manufacturing, and distribution of apparel and fashion items globally.

Insider Ownership: 14.7%

Earnings Growth Forecast: 23.6% p.a.

World Co., Ltd. in Japan, despite a high level of debt and an unstable dividend track record, shows promising growth prospects. Its earnings have increased by 37.3% over the past year and are expected to grow at 23.62% annually, outstripping the Japanese market forecast of 9%. Additionally, it’s trading at a significant discount—76.6% below its estimated fair value—potentially indicating undervaluation. However, its return on equity is projected to remain low at 14.5% in three years’ time.

- Unlock comprehensive insights into our analysis of World stock in this growth report.

- Our valuation report unveils the possibility World's shares may be trading at a discount.

BayCurrent Consulting (TSE:6532)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: BayCurrent Consulting, Inc. offers consulting services in Japan and has a market capitalization of approximately ¥706.57 billion.

Operations: The firm specializes in consulting services across Japan.

Insider Ownership: 13.9%

Earnings Growth Forecast: 18.7% p.a.

BayCurrent Consulting, with recent share buybacks totaling ¥3.6 billion, demonstrates a commitment to shareholder value. The company's earnings have grown by 17.4% over the past year and are expected to rise annually by 18.7%, surpassing Japan's market forecast of 9%. Despite trading at a substantial discount of 38.6% below its estimated fair value and experiencing high share price volatility, BayCurrent maintains robust revenue growth projections of 18.2% per year, which also exceeds the market average.

- Get an in-depth perspective on BayCurrent Consulting's performance by reading our analyst estimates report here.

- Our expertly prepared valuation report BayCurrent Consulting implies its share price may be lower than expected.

Make It Happen

- Explore the 96 names from our Fast Growing Japanese Companies With High Insider Ownership screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Qol Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3034

Qol Holdings

Engages in management of dispensing pharmacies and business process outsourcing contracting businesses in Japan.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives