- Hong Kong

- /

- Healthcare Services

- /

- SEHK:1931

Uncovering December 2024's Hidden Gems With Strong Potential

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by interest rate adjustments and mixed economic signals, small-cap stocks have faced particular challenges, with the Russell 2000 Index underperforming against larger indices like the S&P 500. Amidst these fluctuations, investors are increasingly seeking opportunities in overlooked sectors where growth potential remains strong despite broader market volatility. In this environment, identifying stocks with solid fundamentals and resilience to economic shifts can be key to uncovering hidden gems that offer promising prospects for future growth.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Citra Tubindo | NA | 11.06% | 31.01% | ★★★★★★ |

| Prima Andalan Mandiri | 0.94% | 20.24% | 15.28% | ★★★★★★ |

| Cardig Aero Services | NA | 6.60% | 69.79% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| CTCI Advanced Systems | 30.56% | 24.10% | 29.97% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Chongqing Machinery & Electric | 27.77% | 8.82% | 11.12% | ★★★★☆☆ |

| Bank MNC Internasional | 18.72% | 4.80% | 43.63% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Korea Ratings (KOSDAQ:A034950)

Simply Wall St Value Rating: ★★★★★★

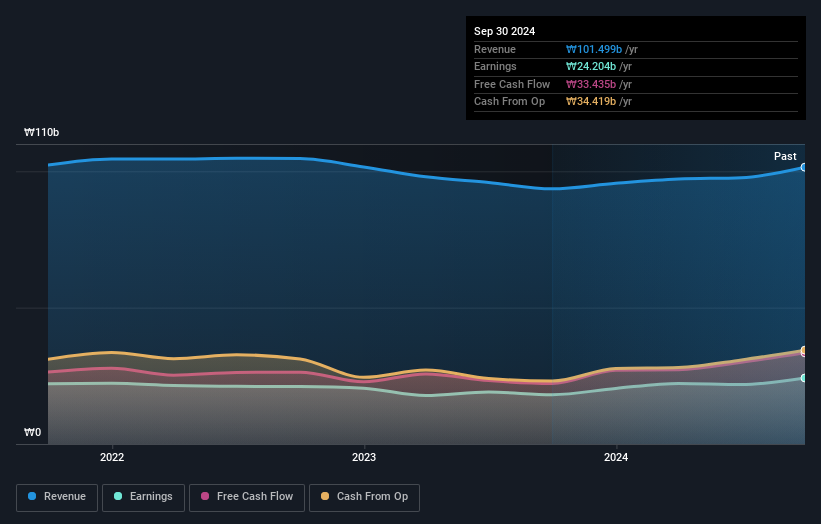

Overview: Korea Ratings Co., Ltd. operates in South Korea offering credit rating and business valuation services, with a market cap of ₩395.23 billion.

Operations: Korea Ratings Co., Ltd. generates revenue primarily from its Korean Corporate Evaluation segment, which contributes ₩58.31 billion, and the Incredible segment, adding ₩43.23 billion. The company experiences a minor consolidated adjustment of -₩46.87 million in its financials.

Korea Ratings, a lesser-known player in the financial sector, presents a compelling profile with its debt-free status over the past five years. The company has demonstrated high-quality earnings and boasts a notable 33.9% earnings growth over the last year, outpacing the industry average of -3.7%. Trading at 3.9% below its estimated fair value suggests potential undervaluation. With consistent positive free cash flow and no debt concerns impacting interest coverage, Korea Ratings seems well-positioned within its niche market for continued stability and potential growth opportunities moving forward.

- Click to explore a detailed breakdown of our findings in Korea Ratings' health report.

Explore historical data to track Korea Ratings' performance over time in our Past section.

IVD Medical Holding (SEHK:1931)

Simply Wall St Value Rating: ★★★★★☆

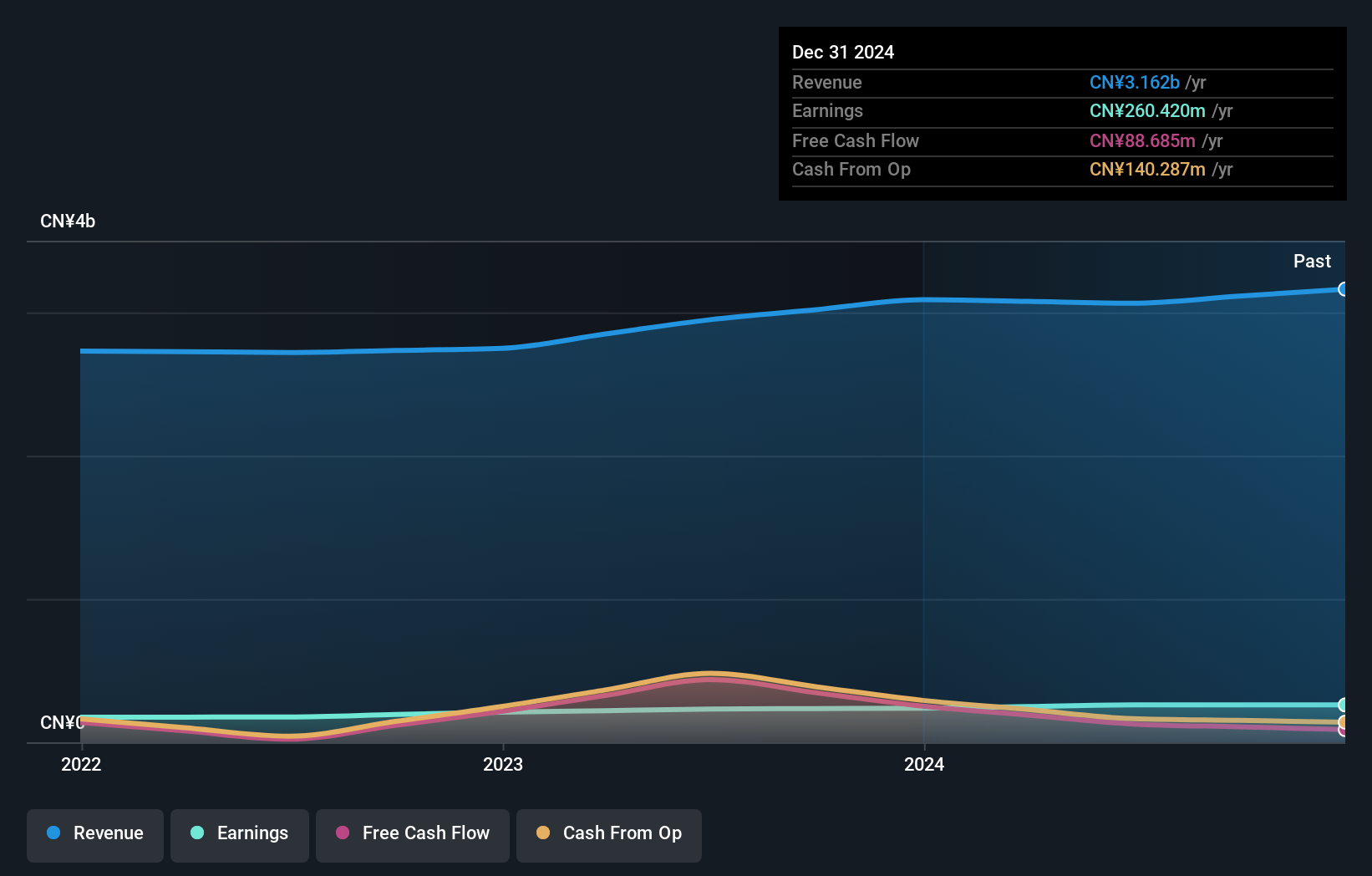

Overview: IVD Medical Holding Limited is an investment holding company that distributes in vitro diagnostic (IVD) products in Mainland China and internationally, with a market capitalization of approximately HK$2.60 billion.

Operations: IVD Medical Holding generates revenue primarily from its distribution business, which accounts for CN¥2.86 billion, and also earns from after-sales services at CN¥196.47 million. The self-branded products segment contributes a smaller portion with CN¥9.05 million in revenue.

IVD Medical Holding, a smaller player in the healthcare sector, shows promising financial health with cash reserves surpassing its total debt. The company's earnings have grown by 12% over the past year, outpacing the broader healthcare industry's -17%, signaling robust performance. Despite an increased debt-to-equity ratio from 5% to 23% over five years, interest payments are comfortably covered by EBIT at a multiple of 21. Recent changes in auditors might raise eyebrows but don't overshadow its strong fundamentals and attractive valuation with a price-to-earnings ratio of 9x against Hong Kong's market average of 10x.

- Dive into the specifics of IVD Medical Holding here with our thorough health report.

Gain insights into IVD Medical Holding's past trends and performance with our Past report.

ITOCHU-SHOKUHIN (TSE:2692)

Simply Wall St Value Rating: ★★★★★★

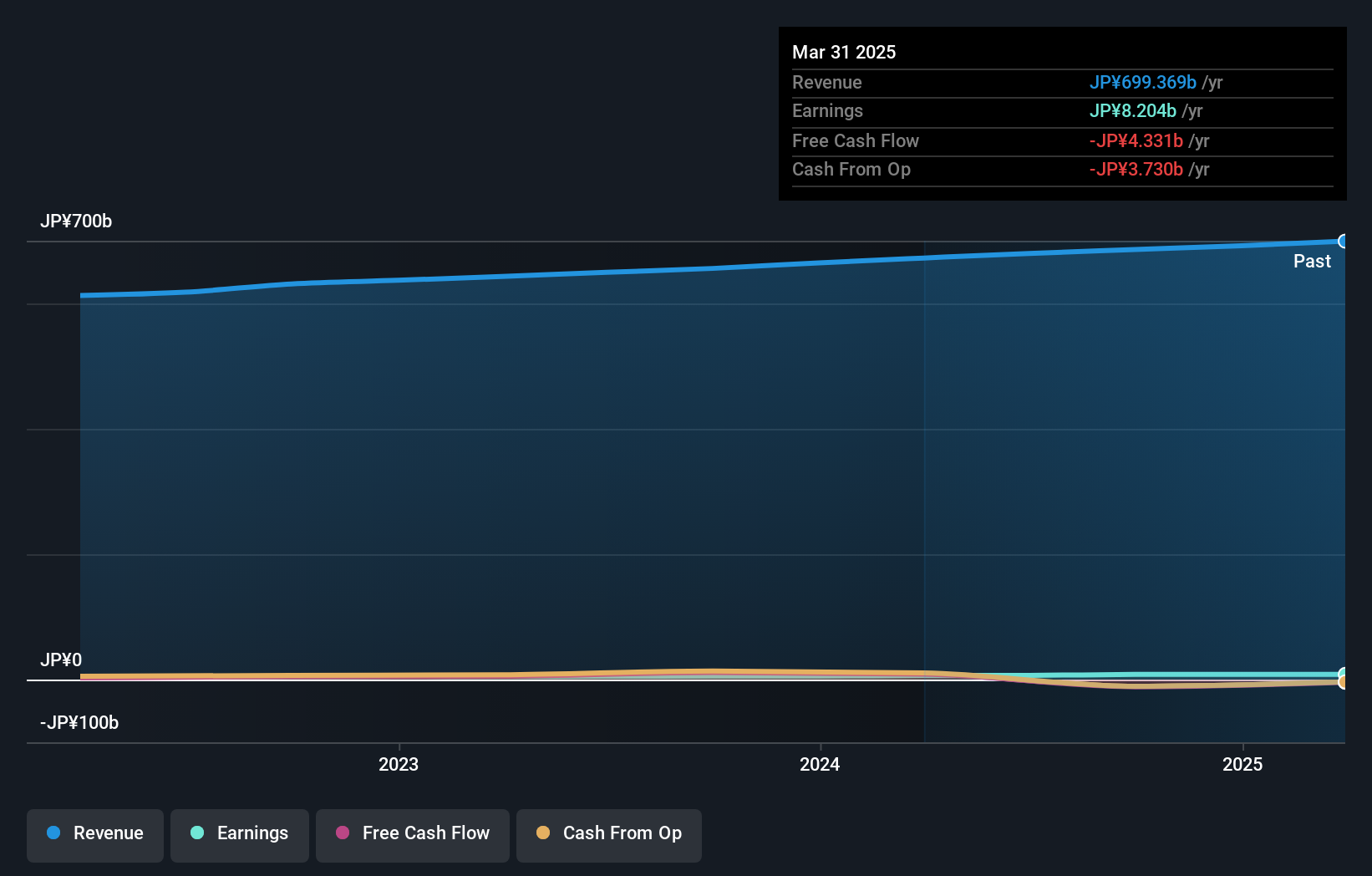

Overview: ITOCHU-SHOKUHIN Co., Ltd. is involved in the wholesale distribution of food products and alcoholic beverages across Japan, with a market capitalization of ¥88.30 billion.

Operations: The primary revenue stream for ITOCHU-SHOKUHIN comes from its food wholesale business, generating ¥685.96 billion. The company's financial performance is influenced by the dynamics of this segment, which plays a crucial role in its overall revenue model.

ITOCHU-SHOKUHIN, a smaller player in the market, has shown impressive earnings growth of 49.4% over the past year, outpacing the Consumer Retailing industry’s 10.5%. With a price-to-earnings ratio of 10.7x, it appears undervalued compared to Japan's market average of 13.4x. The company's financial health is robust; it has eliminated debt entirely over five years from a previous debt-to-equity ratio of 1.7%. Despite not being free cash flow positive recently, its high level of non-cash earnings suggests strong underlying profitability and potential for future performance improvements within its sector.

Key Takeaways

- Delve into our full catalog of 600 Undiscovered Gems With Strong Fundamentals here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1931

IVD Medical Holding

An investment holding company, distributes In vitro diagnostic (IVD) products in Mainland China and internationally.

Solid track record with excellent balance sheet.