- Japan

- /

- Food and Staples Retail

- /

- TSE:141A

January 2025's Top Growth Stocks Backed By Insiders

Reviewed by Simply Wall St

As global markets continue to navigate the early days of President Trump's administration, U.S. stocks have surged toward record highs, buoyed by optimism surrounding potential trade deals and a burgeoning interest in artificial intelligence investments. Growth stocks, in particular, have outperformed their value counterparts for the first time this year, reflecting investor confidence in sectors poised for expansion amid these economic developments. In such an environment, companies with high insider ownership often stand out as they suggest strong internal confidence and alignment with shareholder interests—key attributes when evaluating growth opportunities.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Duc Giang Chemicals Group (HOSE:DGC) | 31.4% | 25.7% |

| Seojin SystemLtd (KOSDAQ:A178320) | 32.1% | 39.9% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.2% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 26.2% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Laopu Gold (SEHK:6181) | 36.4% | 36.6% |

| Pharma Mar (BME:PHM) | 11.9% | 55.1% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.1% |

| Plenti Group (ASX:PLT) | 12.7% | 120.1% |

| HANA Micron (KOSDAQ:A067310) | 18.2% | 119.4% |

Here's a peek at a few of the choices from the screener.

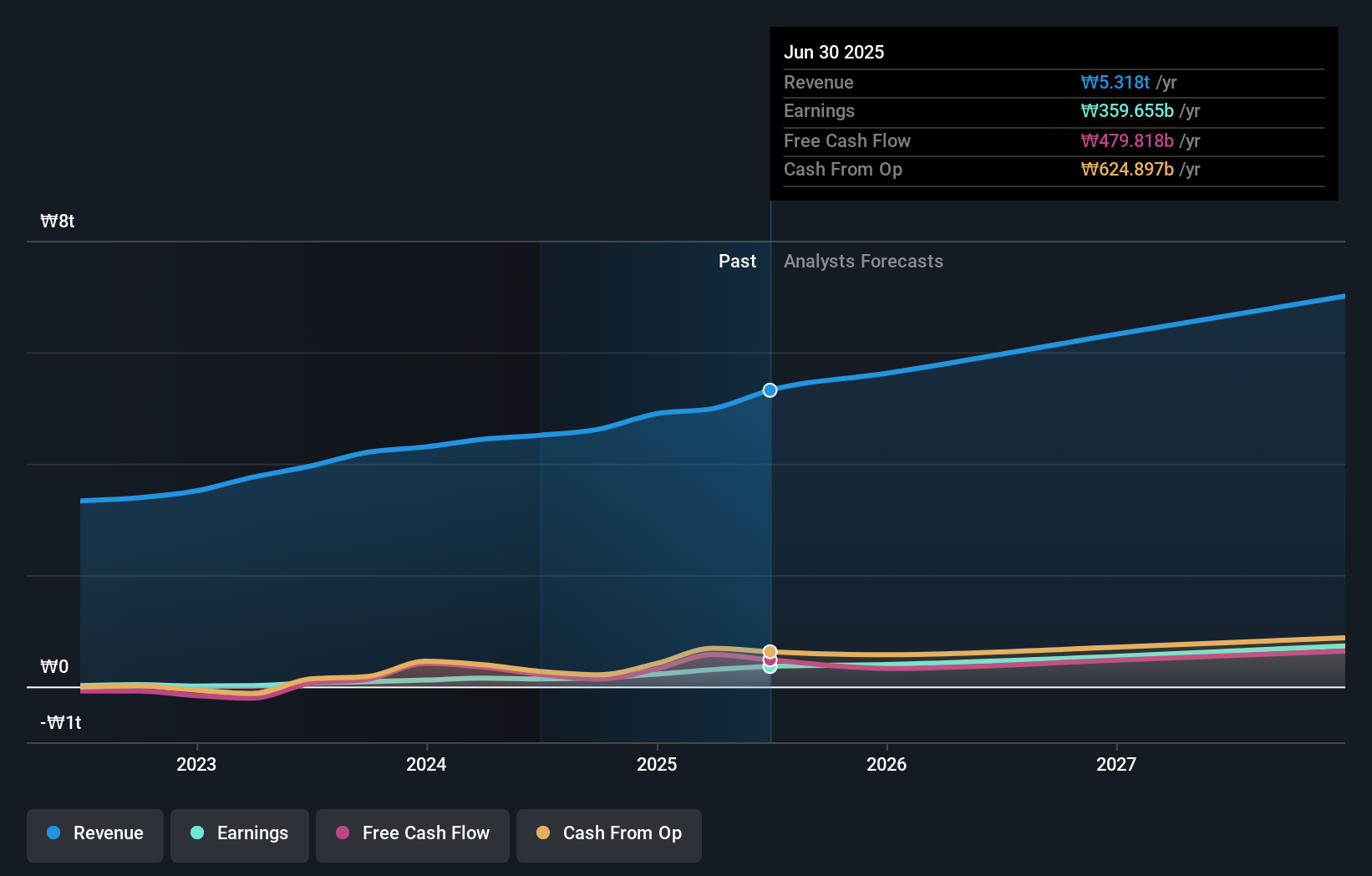

Hyosung Heavy Industries (KOSE:A298040)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hyosung Heavy Industries Corporation manufactures and sells heavy electrical equipment in South Korea and internationally, with a market cap of ₩4.73 trillion.

Operations: Hyosung Heavy Industries generates revenue primarily from its Heavy Industry segment, contributing ₩3.47 trillion, and its Construction segment, adding ₩1.76 trillion.

Insider Ownership: 16.4%

Hyosung Heavy Industries demonstrates significant growth potential, with earnings forecasted to grow at 39.6% annually, outpacing the Korean market. Despite trading at 47.3% below its estimated fair value, debt coverage remains a concern due to insufficient operating cash flow. The company's recent inclusion in the KOSPI 200 Index highlights its growing prominence. Although insider trading activity has been minimal over the past three months, robust profit growth of 78.1% last year underscores its upward trajectory.

- Get an in-depth perspective on Hyosung Heavy Industries' performance by reading our analyst estimates report here.

- Our comprehensive valuation report raises the possibility that Hyosung Heavy Industries is priced lower than what may be justified by its financials.

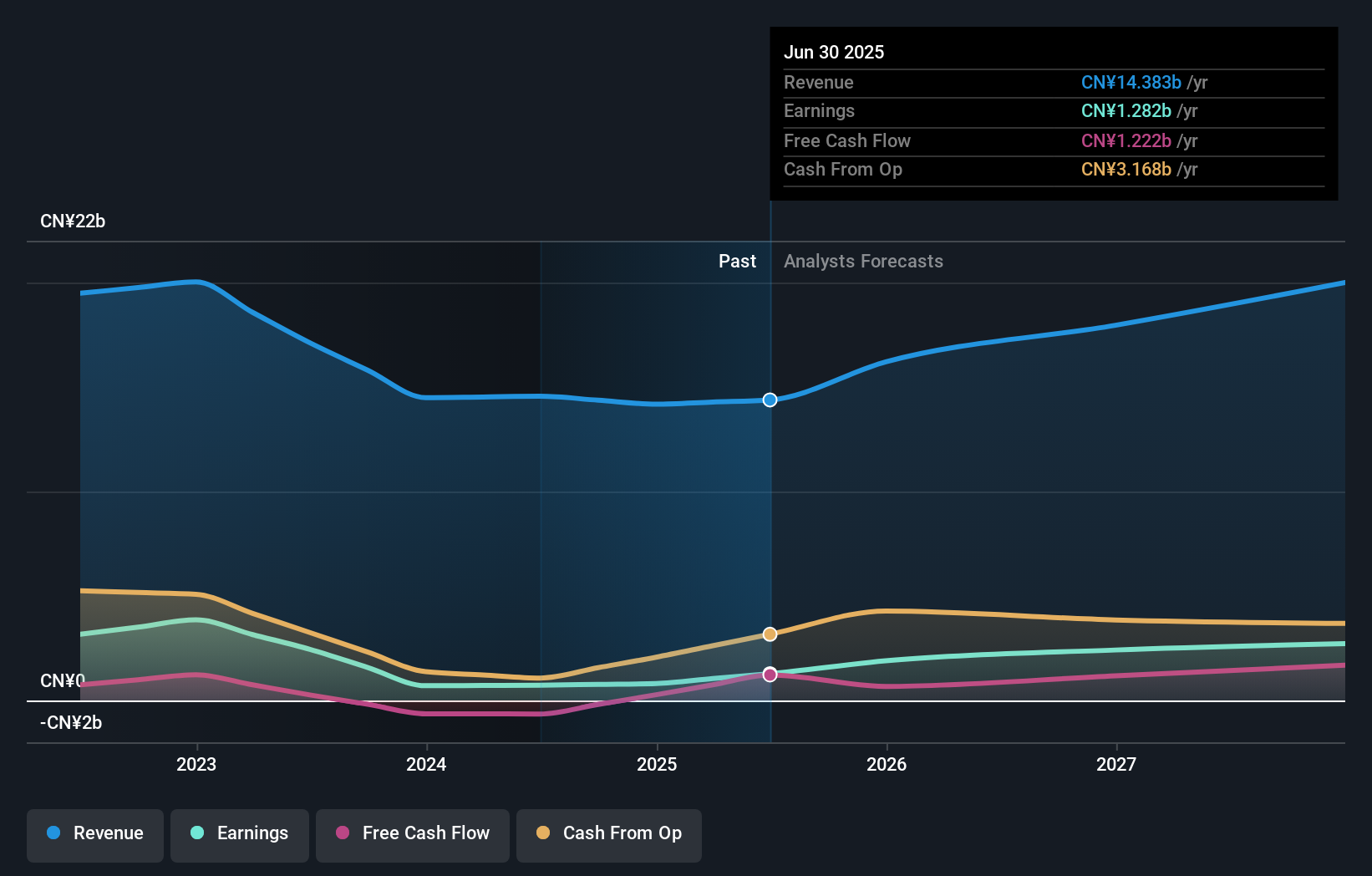

Dongyue Group (SEHK:189)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Dongyue Group Limited is an investment holding company that manufactures, distributes, and sells a range of chemical products including polymers, organic silicone, and refrigerants both in the People's Republic of China and internationally with a market cap of HK$14.35 billion.

Operations: The company's revenue segments include CN¥4.31 billion from polymers, CN¥5.53 billion from refrigerants, CN¥5.12 billion from organic silicon, and CN¥1.12 billion from dichloromethane PVC and liquid alkali.

Insider Ownership: 15.4%

Dongyue Group is poised for robust growth, with earnings projected to increase significantly at 41% annually, surpassing the Hong Kong market. Revenue growth of 8.8% per year also exceeds market expectations but remains below high-growth thresholds. Despite a low forecasted return on equity of 11.7%, insider trading activity has been minimal recently, suggesting stability in management's outlook. However, profit margins have declined to 5% from last year's 14.3%, indicating potential profitability challenges ahead.

- Dive into the specifics of Dongyue Group here with our thorough growth forecast report.

- The analysis detailed in our Dongyue Group valuation report hints at an inflated share price compared to its estimated value.

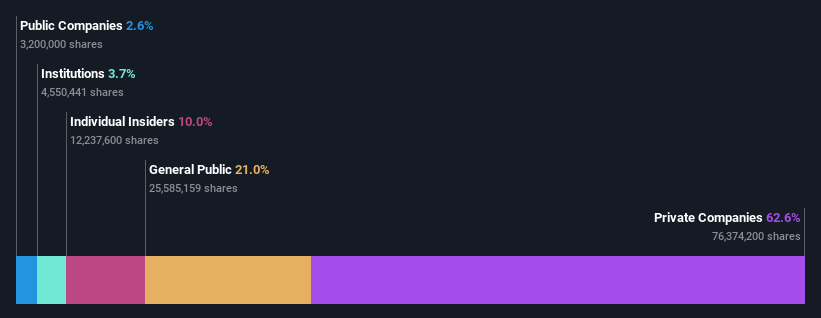

Trial Holdings (TSE:141A)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Trial Holdings Inc. is a diversified company engaged in retail, logistics, financial/payment services, and retail tech businesses with a market cap of ¥329.01 billion.

Operations: The company's revenue segments include retail, logistics, financial/payment services, and retail tech businesses.

Insider Ownership: 10%

Trial Holdings demonstrates promising growth prospects, with earnings expected to rise significantly at 21.3% annually, outpacing the JP market. Revenue is forecasted to grow at 11.6% per year, also above market rates. Recent sales reports indicate strong performance, with December's all-store sales up very large year-over-year. Despite trading below fair value estimates and no recent insider trading activity, a low future return on equity of 12.6% may pose a concern for investors seeking high returns.

- Click to explore a detailed breakdown of our findings in Trial Holdings' earnings growth report.

- Our valuation report here indicates Trial Holdings may be undervalued.

Seize The Opportunity

- Dive into all 1475 of the Fast Growing Companies With High Insider Ownership we have identified here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade Trial Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Trial Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:141A

Trial Holdings

Operates in the retail, logistics, financial / payment services, and retail tech businesses.

Adequate balance sheet with moderate growth potential.

Market Insights

Community Narratives