Investors Holding Back On NARUMIYA INTERNATIONAL Co., Ltd. (TSE:9275)

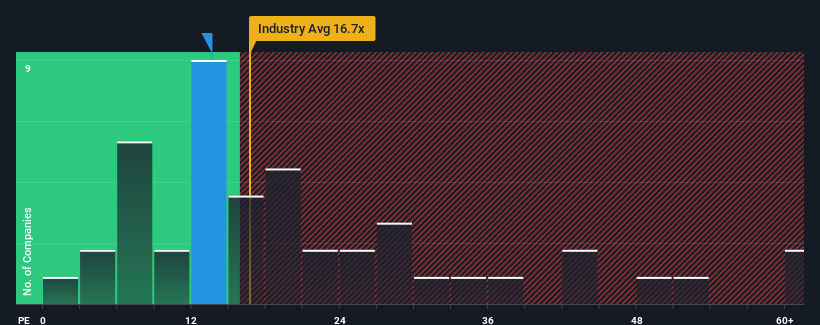

It's not a stretch to say that NARUMIYA INTERNATIONAL Co., Ltd.'s (TSE:9275) price-to-earnings (or "P/E") ratio of 13.6x right now seems quite "middle-of-the-road" compared to the market in Japan, where the median P/E ratio is around 15x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

For example, consider that NARUMIYA INTERNATIONAL's financial performance has been poor lately as its earnings have been in decline. It might be that many expect the company to put the disappointing earnings performance behind them over the coming period, which has kept the P/E from falling. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

View our latest analysis for NARUMIYA INTERNATIONAL

What Are Growth Metrics Telling Us About The P/E?

The only time you'd be comfortable seeing a P/E like NARUMIYA INTERNATIONAL's is when the company's growth is tracking the market closely.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 3.5%. Even so, admirably EPS has lifted 226% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 11% shows it's noticeably more attractive on an annualised basis.

In light of this, it's curious that NARUMIYA INTERNATIONAL's P/E sits in line with the majority of other companies. It may be that most investors are not convinced the company can maintain its recent growth rates.

What We Can Learn From NARUMIYA INTERNATIONAL's P/E?

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of NARUMIYA INTERNATIONAL revealed its three-year earnings trends aren't contributing to its P/E as much as we would have predicted, given they look better than current market expectations. There could be some unobserved threats to earnings preventing the P/E ratio from matching this positive performance. At least the risk of a price drop looks to be subdued if recent medium-term earnings trends continue, but investors seem to think future earnings could see some volatility.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with NARUMIYA INTERNATIONAL, and understanding these should be part of your investment process.

You might be able to find a better investment than NARUMIYA INTERNATIONAL. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if NARUMIYA INTERNATIONAL might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:9275

NARUMIYA INTERNATIONAL

Manufactures, processes, and sells clothing and related products.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives