- Taiwan

- /

- Semiconductors

- /

- TWSE:6962

Mizuno And 2 Other Undiscovered Gems In Asia With Strong Potential

Reviewed by Simply Wall St

Amid a backdrop of mixed global market performances and hopes for tariff de-escalation, small- and mid-cap indexes have shown resilience, marking gains for the fifth consecutive week. In this dynamic environment, identifying stocks with strong potential involves looking beyond immediate market fluctuations to find companies that exhibit robust fundamentals and strategic positioning.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Toukei Computer | NA | 5.68% | 13.35% | ★★★★★★ |

| Shangri-La Hotel | NA | 15.26% | 23.20% | ★★★★★★ |

| Luyin Investment GroupLtd | 40.20% | 6.14% | 18.68% | ★★★★★★ |

| Guangzhou Devotion Thermal Technology | 6.73% | -5.25% | 19.74% | ★★★★★★ |

| Suzhou Longjie Special Fiber | 1.49% | 12.26% | -16.14% | ★★★★★☆ |

| Nikko | 44.54% | 5.86% | -5.45% | ★★★★★☆ |

| Uju Holding | 33.18% | 8.01% | -15.93% | ★★★★★☆ |

| Jiangxi Jiangnan New Material Technology | 65.40% | 18.89% | 17.99% | ★★★★★☆ |

| Mr Max Holdings | 48.68% | 1.03% | 0.97% | ★★★★☆☆ |

| iMarketKorea | 30.43% | 4.91% | 1.88% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

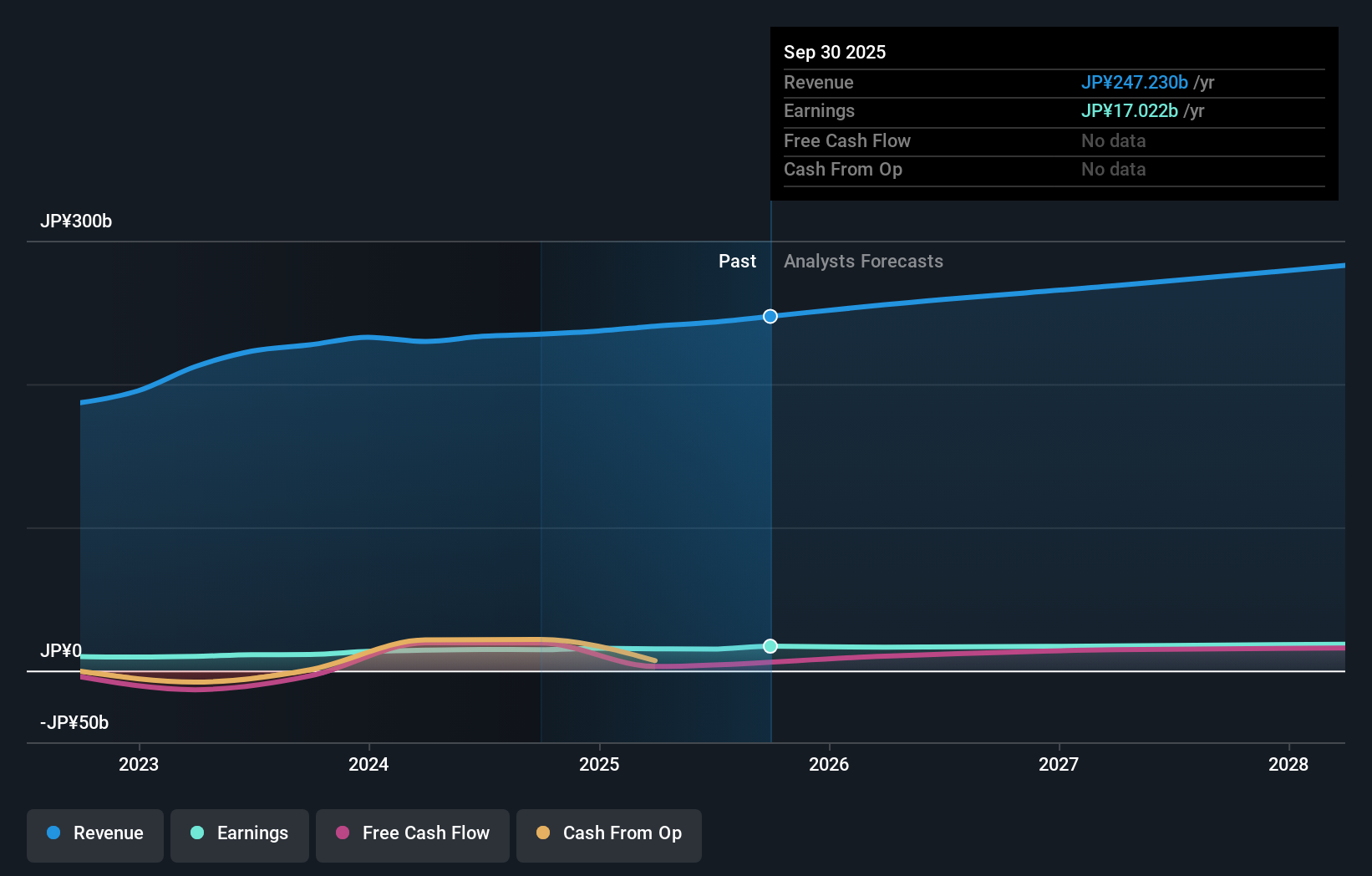

Mizuno (TSE:8022)

Simply Wall St Value Rating: ★★★★★★

Overview: Mizuno Corporation is a global manufacturer and seller of sports products, operating across Japan, Asia, Europe, the Americas, and Oceania with a market cap of ¥214.64 billion.

Operations: The company's primary revenue stream is from Japan, contributing ¥151.18 billion, followed by Asia and Oceania at ¥35.94 billion, and the Americas at ¥35.71 billion. Europe adds another ¥25.22 billion to the revenue mix.

Mizuno, a notable player in the sports equipment industry, has shown impressive performance with earnings growth of 16% over the past year, outpacing the Leisure industry's -3%. The company trades at 37.8% below its estimated fair value and boasts a strong financial position with more cash than total debt. Mizuno's recent dividend announcement of JPY 90 per share for fiscal year ended March 2025 reflects its profitability, though future guidance suggests a decrease to JPY 25 per share after a stock split. Earnings are forecasted to grow by approximately 8.42% annually, indicating potential value for investors.

- Click to explore a detailed breakdown of our findings in Mizuno's health report.

Assess Mizuno's past performance with our detailed historical performance reports.

Machvision (TWSE:3563)

Simply Wall St Value Rating: ★★★★★★

Overview: Machvision Inc. specializes in developing and selling machine vision systems for the semiconductor and printed circuit board (PCB) industries in Taiwan, with a market capitalization of NT$29.19 billion.

Operations: Machvision generates revenue primarily from its Optical Inspection Machinery Equipment and related products, amounting to NT$2.06 billion.

Machvision, a nimble player in the tech scene, has seen its earnings grow by 99.8% over the past year, outpacing the broader semiconductor industry growth of 16.7%. Despite a drop in net income to TWD 320.81 million from TWD 425.95 million last year, it remains debt-free with high-quality earnings and positive free cash flow. The company reported sales of TWD 1,531.83 million for the full year ending December 2024 compared to TWD 1,760.59 million previously, reflecting some challenges but also highlighting its resilience in maintaining profitability without leveraging debt.

- Delve into the full analysis health report here for a deeper understanding of Machvision.

Examine Machvision's past performance report to understand how it has performed in the past.

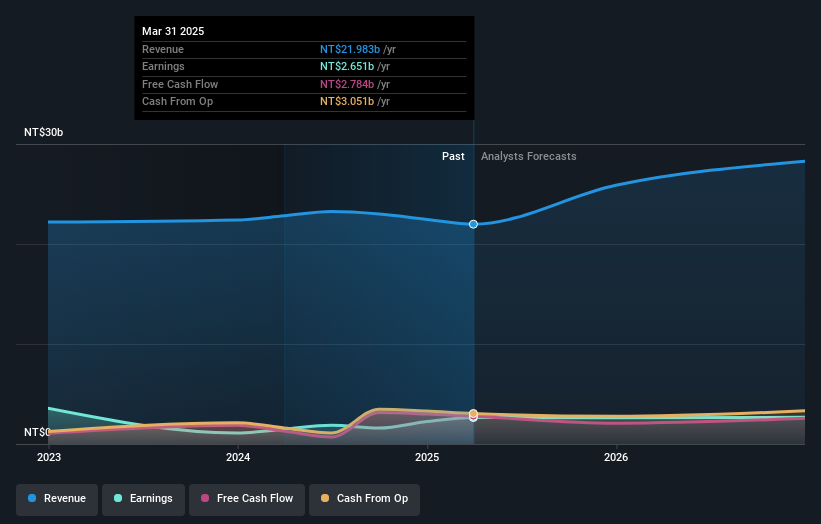

ITH (TWSE:6962)

Simply Wall St Value Rating: ★★★★★★

Overview: ITH Corporation offers panel display and touch integrated single chip solutions in Taiwan and internationally, with a market cap of NT$27.33 billion.

Operations: ITH Corporation generates revenue primarily from its panel display and touch integrated single chip solutions. The company's market cap stands at NT$27.33 billion.

ITH Corporation, a nimble player in the semiconductor industry, has shown impressive earnings growth of 78.3% over the past year, far outpacing the sector's average of 16.7%. This debt-free company reported net income of TWD 926 million for Q1 2025, up from TWD 525 million a year earlier, with basic earnings per share rising to TWD 1.97 from TWD 1.33. Despite volatile share prices recently, ITH trades at a significant discount to its estimated fair value by about 36%, suggesting potential upside for investors who can weather short-term fluctuations.

- Take a closer look at ITH's potential here in our health report.

Gain insights into ITH's historical performance by reviewing our past performance report.

Where To Now?

- Take a closer look at our Asian Undiscovered Gems With Strong Fundamentals list of 2653 companies by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade ITH, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:6962

ITH

Provides panel display and touch integrated single chip in Taiwan and internationally.

Flawless balance sheet and good value.

Market Insights

Community Narratives