Yamaha (TSE:7951): Exploring the Valuation Story Behind Recent Market Movement

Reviewed by Simply Wall St

Yamaha (TSE:7951) has recently caught the eye of investors as its stock chart takes a fresh turn, even though there hasn't been a headline-making event behind the move. The stock’s energy in the market might feel a bit mysterious, but moments like this are exactly when valuation-driven minds perk up. Is there an overlooked opportunity forming, or is something underlying quietly shifting?

Looking at the past year, Yamaha’s share price has slipped 12%, with modest gains in the past month hinting at renewed activity after a prolonged downtrend. The company did post healthy annual growth in both revenue and net income, though those financial improvements haven't translated into steady momentum for the share price just yet. Short-term rallies are beginning to surface, but the bigger picture still shows a company whose long-term performance has trailed the market, despite steady operational results.

This brings us to the critical question for any investor: is Yamaha’s valuation finally offering a margin of safety, or does the market already see through to what’s ahead and is pricing in future growth?

Most Popular Narrative: 9.9% Undervalued

The leading narrative currently sees Yamaha as undervalued by just under 10%, reflecting optimism that recent strategic moves could drive stronger growth and profitability in the years ahead.

Expansion in digital music technology and emerging markets supports higher-margin revenue streams, future growth, and increased brand value.

Focus on innovation, automation, and sustainability enhances operational efficiency and builds resilience against market fluctuations.

Curious how digital transformation and bold investments are shaping valuation forecasts for Yamaha? The most influential narrative is built around a handful of essential assumptions that could totally reshape future earnings and profit margins. Which underlying numbers and strategic pivots power this upbeat outlook? Explore the full narrative to uncover the financial story that analysts believe could explain why Yamaha might be trading below its fair value.

Result: Fair Value of ¥1132.5 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent currency volatility and weakening demand for audio equipment in key markets could undermine Yamaha’s growth outlook and put pressure on future profitability.

Find out about the key risks to this Yamaha narrative.Another View: High Price Tag on Current Profits

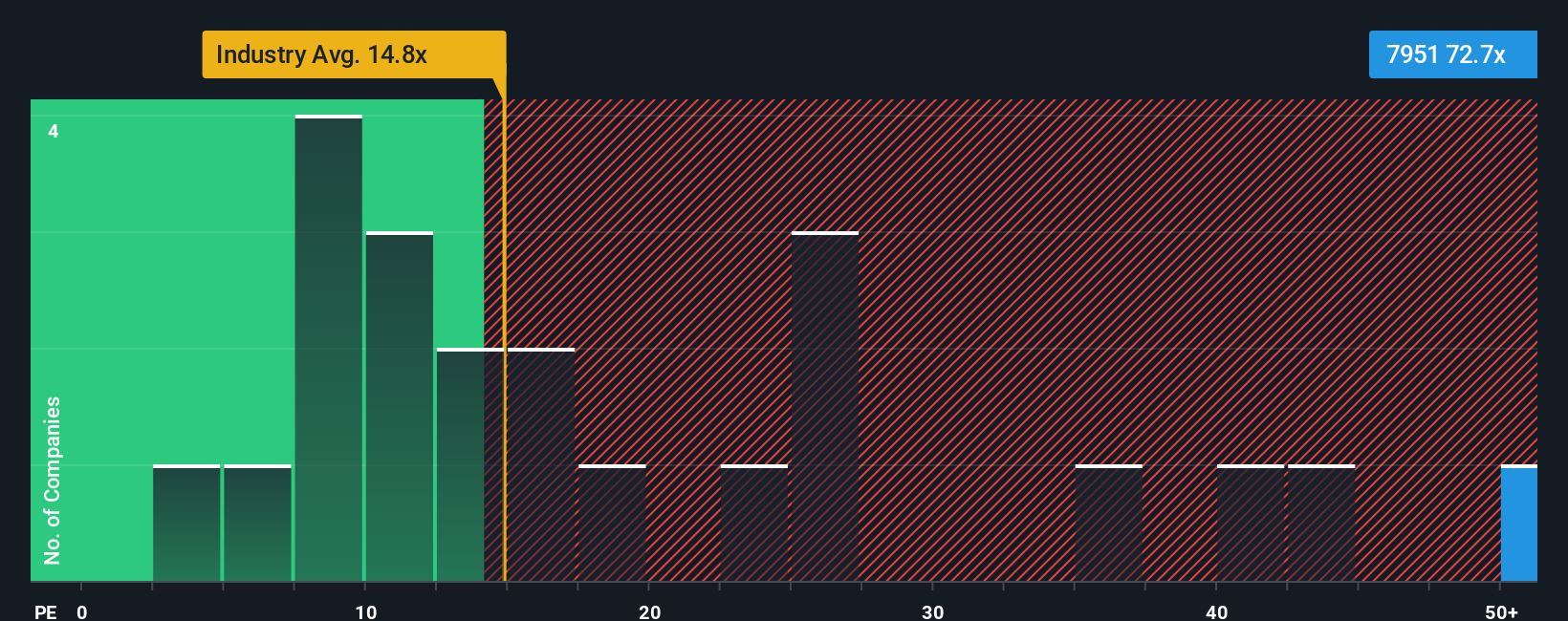

While the fair value estimate looks appealing, a different angle raises eyebrows. Yamaha’s shares are trading at a much higher multiple compared to the industry average. This suggests investors are paying up for its earnings potential. Does the current premium reflect confidence, or risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Yamaha Narrative

If you see Yamaha’s story differently or want to dive deeper into the numbers, you can craft your own perspective in just a few minutes: Do it your way.

A great starting point for your Yamaha research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Make your next smart move and seize fresh opportunities in the market using tailored screeners designed to spotlight promising stocks with strong potential. Whether you're seeking value, innovation, or income, there is a screening tool with your name on it.

- Uncover hidden gems offering robust cash flow by starting with undervalued stocks based on cash flows. This can reveal overlooked companies that could be trading at a discount.

- Capture the next wave of technology by tapping into AI penny stocks and see which forward-thinking businesses are harnessing the power of artificial intelligence.

- Accelerate your passive income strategy when you scan for opportunities in dividend stocks with yields > 3%, featuring stocks with high, reliable dividend yields.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About TSE:7951

Yamaha

Engages in the musical instruments, audio equipment, and other businesses in Japan and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives