- Japan

- /

- Auto Components

- /

- TSE:5185

Top Dividend Stocks For Steady Income November 2024

Reviewed by Simply Wall St

As global markets react to the recent "red sweep" in the U.S. elections, with major indices like the S&P 500 and Nasdaq Composite reaching record highs, investors are closely monitoring potential shifts in fiscal policy and their implications on growth and inflation. Amidst this backdrop of economic optimism tempered by uncertainty, dividend stocks offer a compelling opportunity for generating steady income, particularly as lower corporate taxes may enhance earnings potential for companies with strong cash flow.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 3.02% | ★★★★★★ |

| Globeride (TSE:7990) | 4.06% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.19% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.51% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.35% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.67% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.49% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.82% | ★★★★★★ |

| Kwong Lung Enterprise (TPEX:8916) | 6.32% | ★★★★★★ |

| Innotech (TSE:9880) | 5.04% | ★★★★★★ |

Click here to see the full list of 1930 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

FukokuLtd (TSE:5185)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Fukoku Co., Ltd. manufactures and markets rubber products both in Japan and internationally, with a market capitalization of ¥29.43 billion.

Operations: Fukoku Co., Ltd.'s revenue is derived from its production and sales of rubber products across domestic and international markets.

Dividend Yield: 4.1%

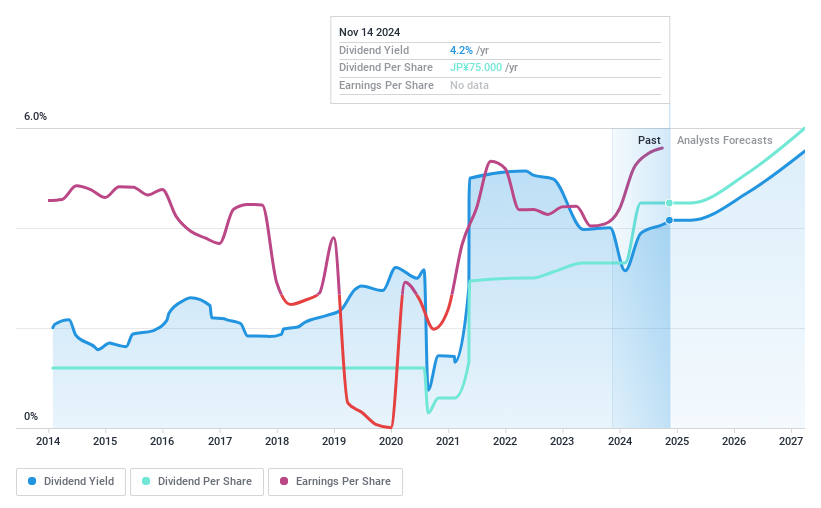

Fukoku Ltd. demonstrates a strong dividend profile with a low payout ratio of 14.8%, ensuring dividends are well-covered by earnings and cash flows, which have a cash payout ratio of 27.7%. The recent board meeting confirmed an increased interim dividend of ¥37.50 per share, up from ¥27.50 last year, reflecting stable and growing payouts over the past decade. Its dividend yield of 4.11% ranks in the top quartile among Japanese stocks, enhancing its appeal to income-focused investors.

- Navigate through the intricacies of FukokuLtd with our comprehensive dividend report here.

- Our expertly prepared valuation report FukokuLtd implies its share price may be lower than expected.

Takuma (TSE:6013)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Takuma Co., Ltd. specializes in the design, construction, and supervision of boilers, plant machinery, pollution prevention and environmental equipment plants, as well as heating, cooling, and sanitation facilities in Japan with a market cap of ¥131.43 billion.

Operations: Takuma Co., Ltd. generates revenue through its operations in designing, constructing, and overseeing boilers, plant machinery, pollution control and environmental equipment plants, along with heating, cooling, and sanitation systems within Japan.

Dividend Yield: 3.4%

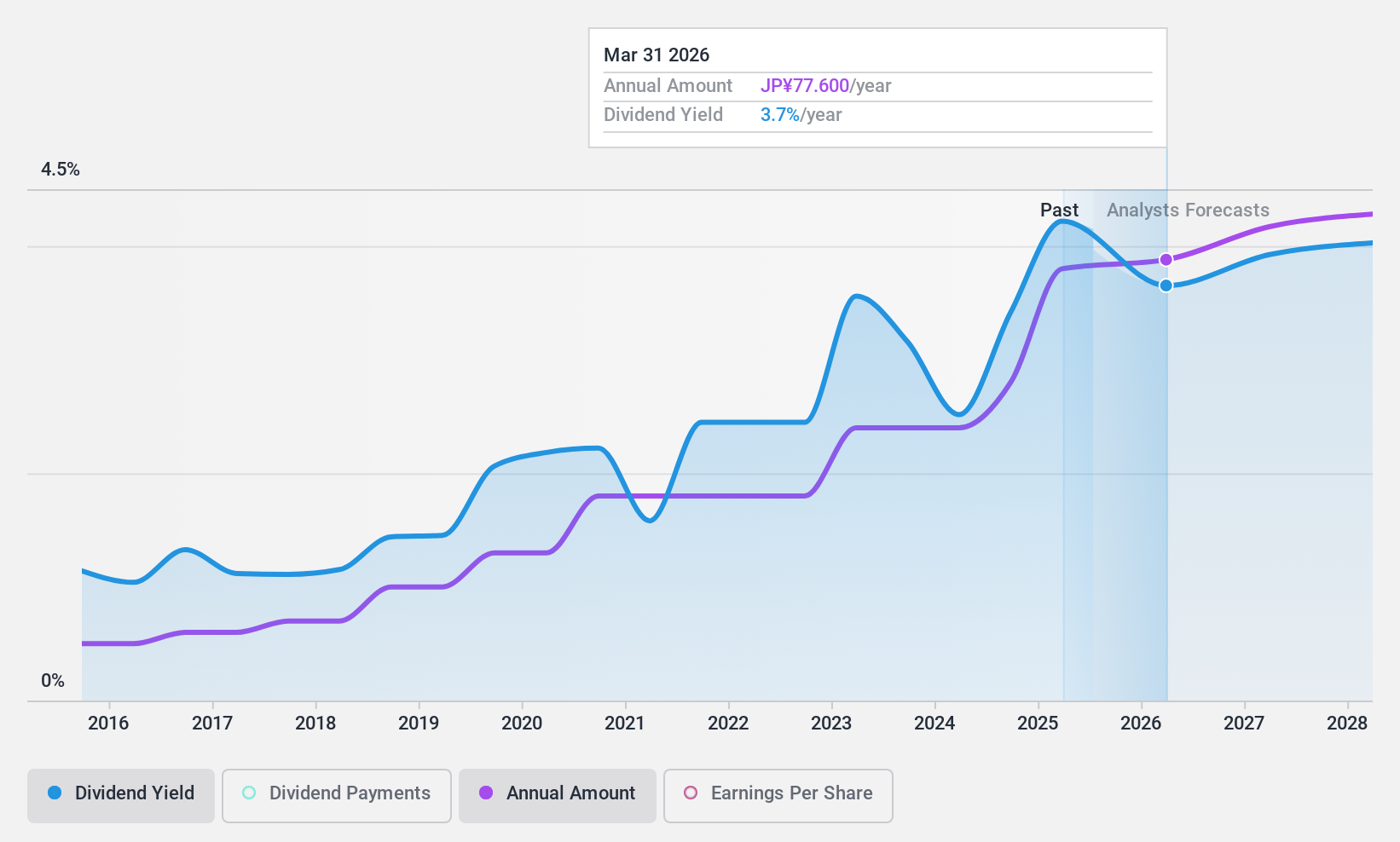

Takuma's dividend yield of 3.36% is below the top 25% in Japan, and its dividends aren't covered by free cash flows despite a low payout ratio of 17.5%. However, dividends have been stable and growing over the past decade. Recent earnings grew significantly by 50.9%, but future growth is modest at 1.47% annually. The company is trading at a discount to its estimated fair value and recently completed a share buyback worth ¥2.27 billion (US$).

- Take a closer look at Takuma's potential here in our dividend report.

- Our valuation report here indicates Takuma may be undervalued.

TamronLtd (TSE:7740)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Tamron Co., Ltd., along with its subsidiaries, manufactures and sells optical equipment in Japan, with a market cap of ¥178.68 billion.

Operations: Tamron Co., Ltd.'s revenue segments include the manufacturing and sale of optical equipment in Japan.

Dividend Yield: 3.7%

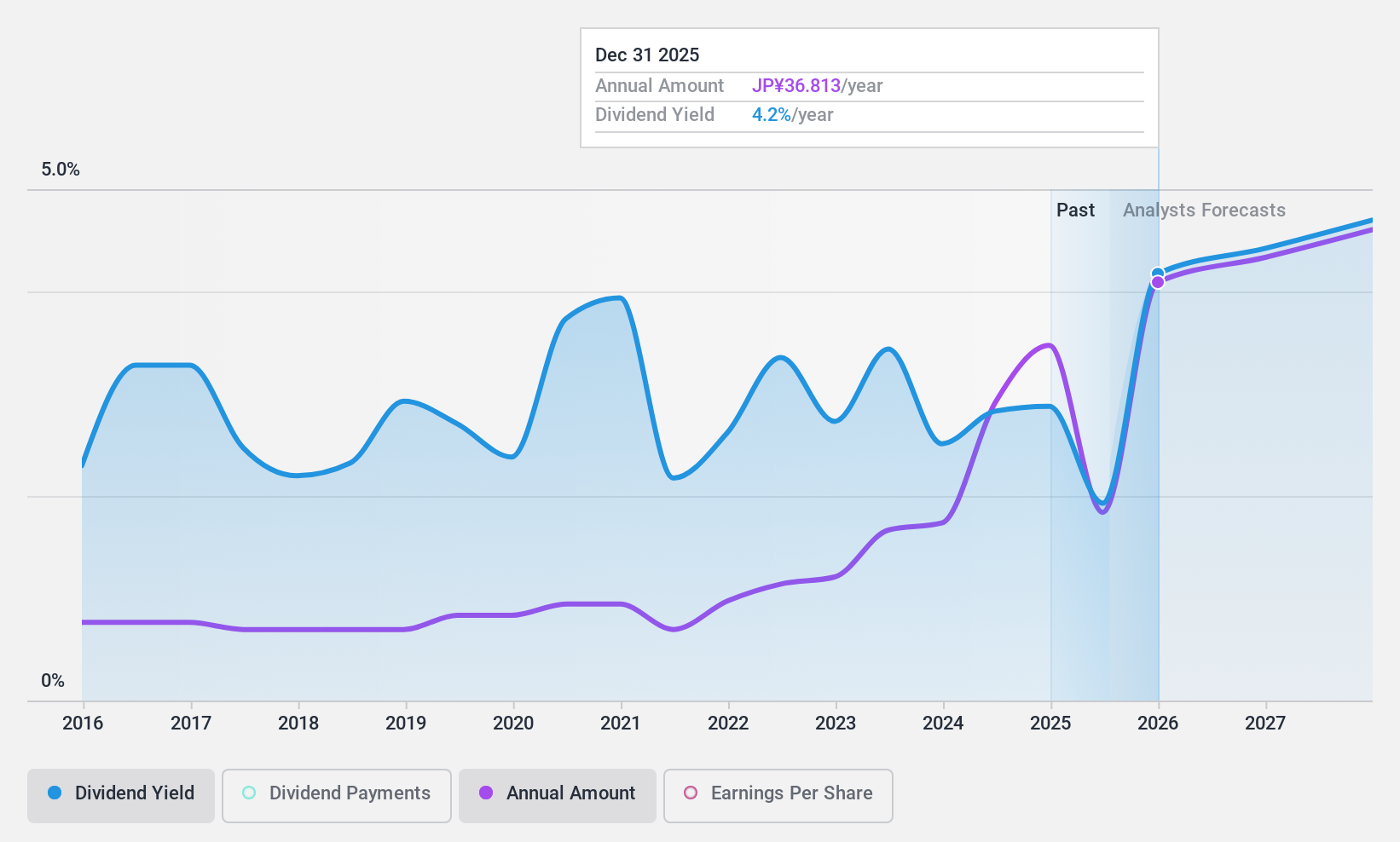

Tamron Ltd.'s dividend yield of 3.69% is slightly below the top 25% in Japan. While dividends are well-covered by earnings with a low payout ratio of 23.4%, they have been unreliable and volatile over the past decade, experiencing significant annual drops. Despite recent earnings growth of 59.1%, share price volatility remains high, which may concern investors seeking stability. The company trades at a discount to its estimated fair value, suggesting potential undervaluation opportunities.

- Delve into the full analysis dividend report here for a deeper understanding of TamronLtd.

- The analysis detailed in our TamronLtd valuation report hints at an deflated share price compared to its estimated value.

Where To Now?

- Dive into all 1930 of the Top Dividend Stocks we have identified here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5185

FukokuLtd

Produces and sells rubber products in Japan and internationally.

Flawless balance sheet 6 star dividend payer.