- Japan

- /

- Professional Services

- /

- TSE:9233

Top 3 Dividend Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

As global markets react to the recent U.S. election results and economic policy changes, major indices like the S&P 500 have reached record highs, driven by investor optimism over potential growth and tax reforms. Amidst these dynamic market conditions, dividend stocks stand out as a reliable option for investors seeking steady income streams and potential portfolio enhancement.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.18% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.25% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.69% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.54% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.40% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.45% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.89% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.53% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.86% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.86% | ★★★★★★ |

Click here to see the full list of 1951 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Evergent Investments (BVB:EVER)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Evergent Investments SA is a publicly owned investment manager with a market capitalization of RON1.31 billion.

Operations: Evergent Investments SA generates revenue primarily from Financial Investment Services (RON304.43 million), with additional contributions from the Manufacture of Agricultural Machinery and Equipment (RON25.18 million), and Cultivation of Fruit-Bearing Trees such as Blueberries (RON7.63 million), along with Real Estate Development in Apartments (RON0.31 million).

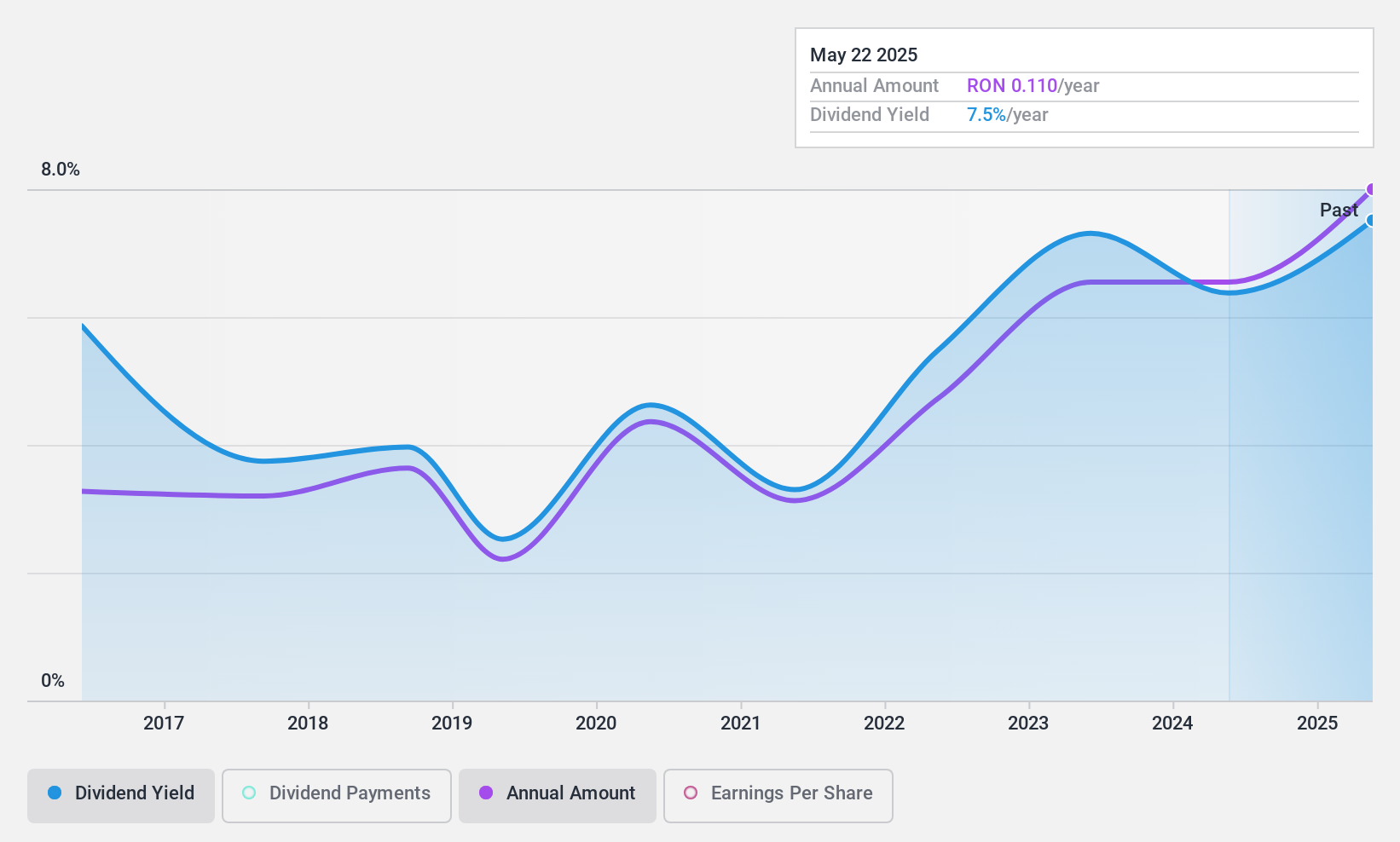

Dividend Yield: 6.2%

Evergent Investments shows a mixed profile for dividend stocks. Its earnings have grown 8.8% annually over the past five years, and dividends are well covered by earnings and cash flows with payout ratios of 28.6% and 34.7%, respectively. However, its dividend yield of 6.23% is lower than the top market tier, and payments have been volatile over the past decade despite some growth in payouts. Recent half-year results show significant income growth to RON 113.65 million from RON 22.52 million last year.

- Click to explore a detailed breakdown of our findings in Evergent Investments' dividend report.

- The valuation report we've compiled suggests that Evergent Investments' current price could be inflated.

Électricite de Strasbourg Société Anonyme (ENXTPA:ELEC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Électricite de Strasbourg Société Anonyme supplies electricity and natural gas to individuals, businesses, and local authorities in France, with a market capitalization of €806.56 million.

Operations: Électricite de Strasbourg Société Anonyme generates revenue primarily through its Electricity Distributor segment, which accounts for €302.94 million, and the Production and Distribution of Electricity and Gas segment, contributing €1.24 billion.

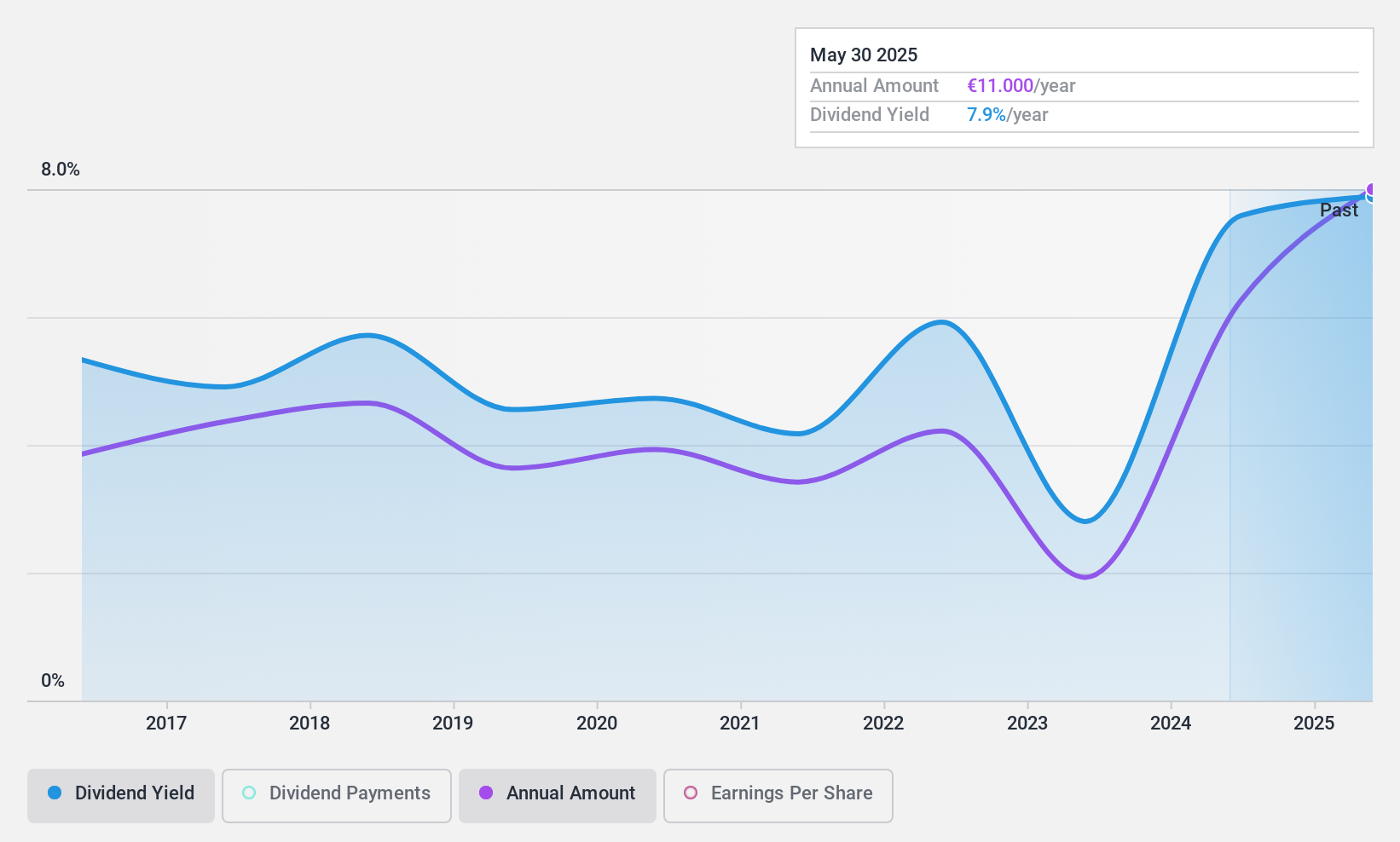

Dividend Yield: 7.6%

Électricite de Strasbourg Société Anonyme offers a compelling dividend profile with a yield of 7.64%, placing it in the top 25% of French dividend payers. Dividends are well-covered by earnings and cash flows, with payout ratios of 43.8% and 38.6%, respectively, suggesting sustainability. However, the dividend track record has been unstable over the past decade despite recent earnings growth of €96 million last year. The stock trades significantly below its estimated fair value, indicating potential undervaluation opportunities for investors seeking income and value.

- Take a closer look at Électricite de Strasbourg Société Anonyme's potential here in our dividend report.

- Our expertly prepared valuation report Électricite de Strasbourg Société Anonyme implies its share price may be lower than expected.

Asia Air Survey (TSE:9233)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Asia Air Survey Co., Ltd. offers aerial surveying services and products both in Japan and internationally, with a market cap of ¥20.36 billion.

Operations: Asia Air Survey Co., Ltd. generates revenue through its aerial surveying services and products offered domestically and internationally.

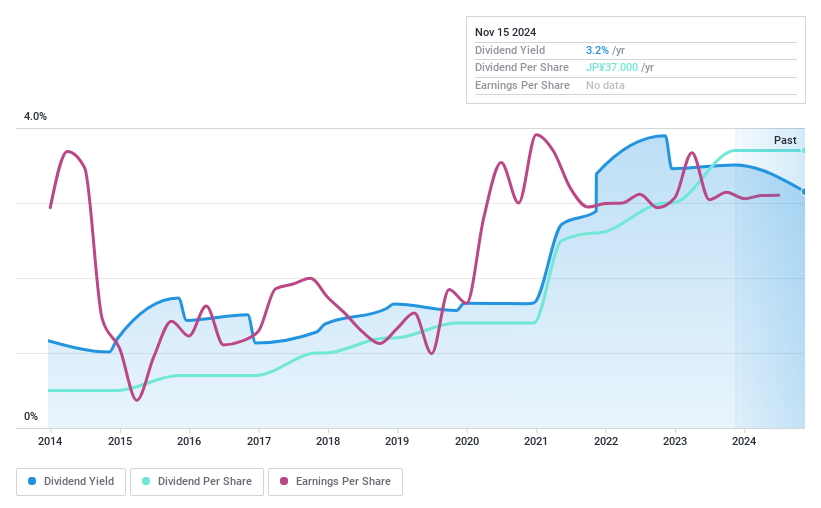

Dividend Yield: 3.3%

Asia Air Survey's dividend payments are well-supported by earnings and cash flows, with payout ratios of 30.7% and 42%, respectively. Over the past decade, dividends have been stable and growing, though the current yield of 3.31% is below the top quartile in Japan's market. The stock trades at a significant discount to its estimated fair value, potentially offering value for investors focused on income stability and growth amidst steady earnings increases.

- Get an in-depth perspective on Asia Air Survey's performance by reading our dividend report here.

- Upon reviewing our latest valuation report, Asia Air Survey's share price might be too pessimistic.

Next Steps

- Delve into our full catalog of 1951 Top Dividend Stocks here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9233

Asia Air Survey

Provides aerial surveying services and products in Japan and internationally.

Excellent balance sheet established dividend payer.