- Japan

- /

- Consumer Durables

- /

- TSE:7731

Nikon (TSE:7731) Lowers Earnings Guidance, Announces Share Buyback to Enhance Shareholder Returns

Reviewed by Simply Wall St

Nikon (TSE:7731) has recently revised its earnings guidance for the fiscal year ending March 2025, lowering expected revenue and profit figures, signaling potential challenges ahead despite strong past earnings growth. The company has affirmed its interim cash dividend and announced a significant share repurchase program aimed at enhancing shareholder returns and capital efficiency. In the discussion that follows, we will explore Nikon's strategic innovations, financial health, and the internal and external challenges it faces, including operational inefficiencies and regulatory hurdles, while also highlighting areas for potential growth and market expansion.

See the full analysis report here for a deeper understanding of Nikon.

Innovative Factors Supporting Nikon

Nikon's earnings are projected to grow at a significant 26.5% annually, outpacing the JP market average of 9.1%. This growth is underpinned by high-quality past earnings, with profits increasing by 21.4% annually over the last five years. The company maintains a strong financial position, boasting more cash than total debt and interest payments well-covered at 12.6 times. Recent product innovations, as mentioned by CEO Muneaki Tokunari, have bolstered Nikon's market share by 10%, reflecting a commitment to innovation and market expansion. Despite a high Price-To-Earnings Ratio of 26x, exceeding both peer and industry averages, the company's growth metrics suggest a strategic alignment with its valuation.

Internal Limitations Hindering Nikon's Growth

Revenue growth is anticipated to be sluggish at 2.9% annually, trailing the JP market's 4.2% average. The company's Return on Equity remains low at 3.9%, with expectations of only a slight increase to 6.1% in three years. Additionally, profit margins have contracted from 5.3% to 3.6% over the past year, indicating potential challenges in maintaining profitability. Deputy CFO Yasuhiro Omura highlighted operational inefficiencies, particularly in supply chain management, which have led to increased costs and delivery delays.

Areas for Expansion and Innovation for Nikon

Nikon is exploring new market opportunities, particularly in emerging regions, which could diversify revenue streams and reduce reliance on existing markets. Investments in AI and automation are poised to enhance operational efficiency and cost-effectiveness, as noted by Omura. Targeted marketing campaigns are also being implemented to attract younger demographics, broadening the customer base and supporting sustained growth.

Regulatory Challenges Facing Nikon

Economic headwinds pose a risk to consumer spending and demand stability, as Omura expressed caution regarding potential downturns. Regulatory changes remain a concern, with Tokunari emphasizing active engagement with policymakers to navigate these challenges. Supply chain vulnerabilities continue to be assessed to mitigate risks associated with disruptions, reflecting a strategic focus on resilience.

Conclusion

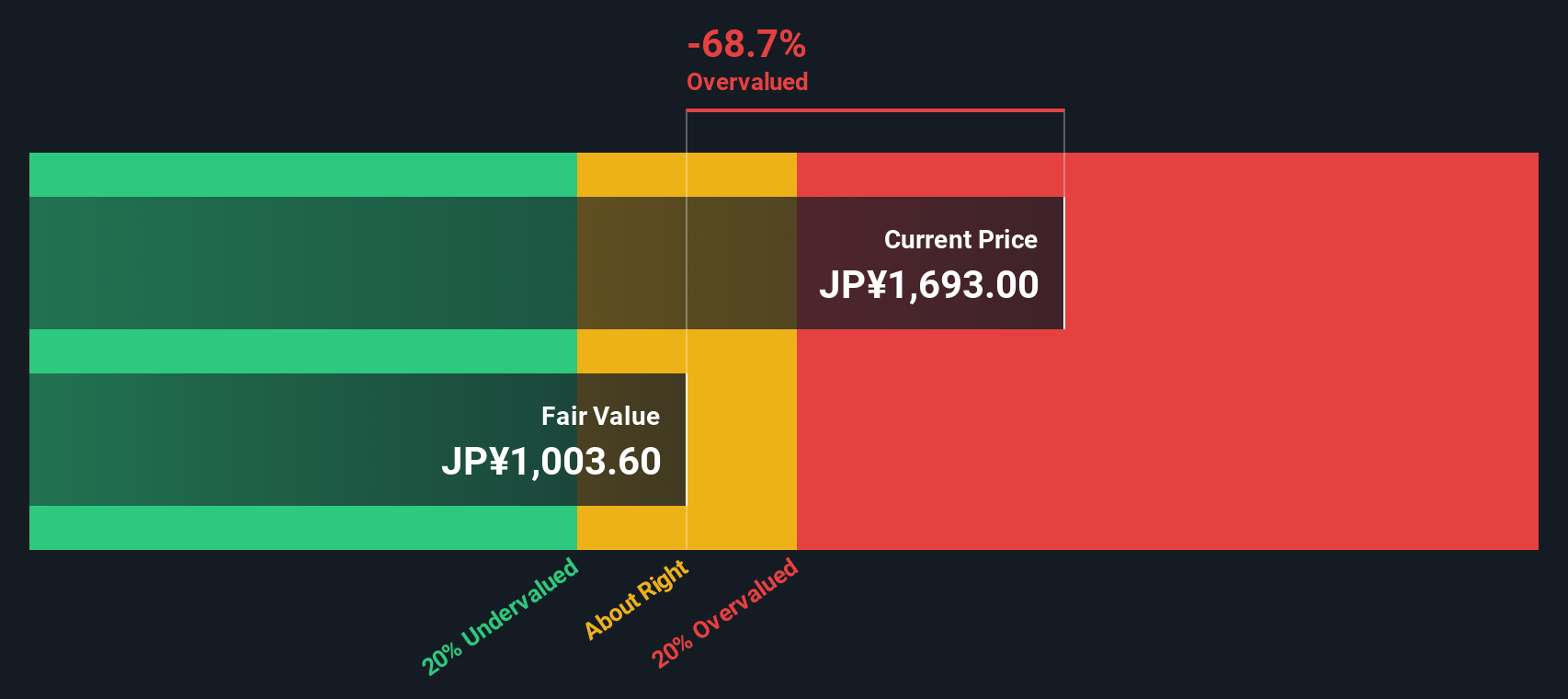

Nikon's projected earnings growth of 26.5% annually, supported by a strong financial position and successful product innovations, positions the company as a leader in market expansion. However, internal limitations such as sluggish revenue growth and low return on equity highlight operational challenges that need addressing to sustain profitability. The company's strategic focus on emerging markets, AI, and automation could mitigate these challenges by diversifying revenue streams and enhancing efficiency. Despite these growth prospects, Nikon's current Price-To-Earnings Ratio of 26x suggests that the market has already priced in these positive developments, as it significantly exceeds industry averages and trades above its estimated fair value, indicating potential caution for investors regarding future returns. Active engagement with regulatory changes and addressing supply chain vulnerabilities will be crucial for maintaining resilience in a volatile economic environment.

Seize The Opportunity

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

Valuation is complex, but we're here to simplify it.

Discover if Nikon might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About TSE:7731

Nikon

Manufactures and sells optical instruments in Japan, North America, Europe, China, Thailand, and internationally.

Excellent balance sheet with moderate growth potential.