- Japan

- /

- Consumer Durables

- /

- TSE:6952

Sumco (TSE:3436) Faces Dividend Cut and Financial Challenges Despite Strong Growth Prospects

Reviewed by Simply Wall St

Sumco (TSE:3436) has recently revised its earnings guidance for the nine months ending September 30, 2024, projecting net sales of JPY 298,200 million and an operating profit of JPY 27,800 million. Despite a decrease in interim dividends from JPY 42.00 to JPY 15.00 per share, the company remains focused on strategic growth, with a notable expansion in its customer base and promising future prospects in emerging markets. Readers should expect a detailed discussion on Sumco's financial health, challenges, and strategic initiatives in the upcoming report.

Take a closer look at Sumco's potential here.

Competitive Advantages That Elevate Sumco Corporation

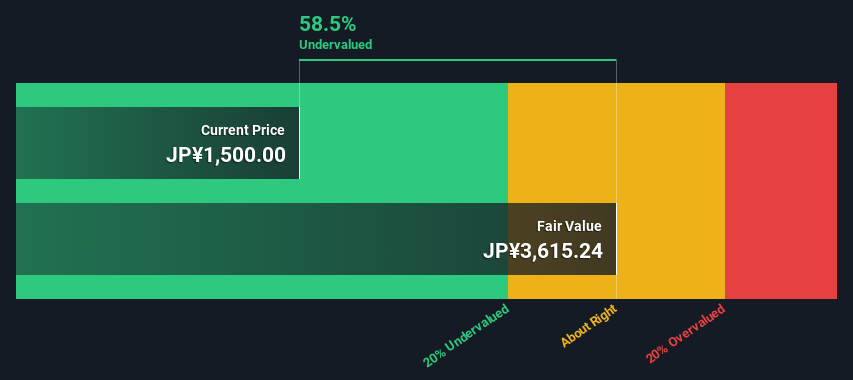

Sumco Corporation demonstrates strong financial health, with an expected annual profit growth of 24.9%, significantly outpacing the JP market's 8.8%. This is underpinned by a 15% year-over-year revenue increase, as mentioned by CEO Takayuki Komori, reflecting strong demand. The company's strategic expansion of its customer base to over 1 million active users further solidifies its market position. Innovation remains a key pillar, with recent product launches receiving positive feedback, as highlighted by Chairman Mayuki Hashimoto. The management's average tenure of 2.8 years contributes to strategic stability, ensuring that shareholders have not faced meaningful dilution recently. However, the share price, though 20% below the target, is deemed expensive based on its SWS fair ratio compared to industry averages.

Challenges Constraining Sumco Corporation's Potential

Sumco faces notable challenges. The current net profit margin of 6.7% has decreased from last year's 19.5%, highlighting financial pressures. Earnings have seen a 69.7% decline over the past year, and a return on equity of 5% is below industry standards. CFO Shinichi Kubozoe noted rising operating costs due to increased raw material prices, a significant concern. Additionally, dividend payments have been unreliable, with a high payout ratio of 91.2% and a recent decrease to JPY 15.00 per share from JPY 42.00. These financial challenges are compounded by the company's valuation, which, while lower than the target price, remains expensive in terms of its Price-To-Earnings Ratio.

Future Prospects for Sumco Corporation in the Market

Looking ahead, Sumco is well-positioned to capitalize on emerging opportunities. A revenue growth forecast of 10% annually surpasses the JP market's average of 4.2%, indicating potential for significant earnings growth over the next three years. The company's strategic initiatives, such as partnerships with tech firms, are expected to enhance product offerings and drive future growth, as noted by CFO Shinichi Kubozoe. Additionally, the exploration of new markets in Asia and Europe, as discussed by Chairman Mayuki Hashimoto, aligns with global trends towards sustainable products, offering further expansion potential.

Key Risks and Challenges That Could Impact Sumco Corporation's Success

Sumco faces several external threats that could impede its success. The entry of new competitors poses a significant risk to its market share, as highlighted by CEO Takayuki Komori. Economic uncertainty could also affect consumer spending and overall sales, a concern echoed by CFO Shinichi Kubozoe. Furthermore, regulatory changes could impact operational processes and costs, as noted by Chairman Mayuki Hashimoto. The share price's volatility over the past three months and a low dividend yield of 1.91% compared to the top 25% of JP market dividend payers further underscore the challenges ahead. Analysts' lack of consensus on target pricing adds to the uncertainty surrounding Sumco's future performance.

To gain deeper insights into Sumco's historical performance, explore our detailed analysis of past performance. To dive deeper into how Sumco's valuation metrics are shaping its market position, check out our detailed analysis of Sumco's Valuation.Conclusion

Sumco Corporation's projected annual profit growth of 24.9% and strategic customer base expansion underscore its potential for market leadership, yet financial pressures such as a reduced net profit margin and declining earnings pose significant hurdles. While the company is poised to leverage emerging opportunities, including partnerships and market expansion in Asia and Europe, the challenges of rising costs and competitive threats cannot be overlooked. The current share price, though 20% below the target, remains high relative to its Price-To-Earnings Ratio, suggesting that despite growth prospects, investors may need to weigh the risks of financial instability and market volatility when considering future performance.

Summing It All Up

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About TSE:6952

Casio ComputerLtd

Develops, produces, and sells consumer, system equipment, and other products.

Flawless balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives