- Japan

- /

- Consumer Durables

- /

- TSE:6952

Casio (TSE:6952): Evaluating Whether the Current Share Price Reflects True Value

Reviewed by Kshitija Bhandaru

Casio ComputerLtd (TSE:6952) shares have shown some movement lately, with investors taking a closer look at the company’s recent performance metrics and broader market trends. The past month has seen a modest decline in price.

See our latest analysis for Casio ComputerLtd.

Looking at the bigger picture, Casio ComputerLtd’s 1-year total shareholder return is slightly positive, suggesting the stock has held its ground despite modest declines in recent weeks. While share price momentum has waned after some earlier gains this year, there is still room for investors to re-evaluate its longer-term potential as market sentiment shifts.

If you’re interested in expanding your search for compelling opportunities, now is a great time to discover fast growing stocks with high insider ownership.

With shares trading below analysts’ target and recent growth in earnings, the real question is whether Casio ComputerLtd remains undervalued or if the current price already reflects all future growth prospects.

Most Popular Narrative: 6.1% Undervalued

With Casio ComputerLtd trading at ¥1,212 and the most widely followed narrative assigning fair value at ¥1,291.25, there is a modest gap between price and potential. This viewpoint sets the foundation for a deeper look at the growth engines powering sentiment behind the number.

Casio's focused investment in education technology through new calculator features, enhanced EdTech platforms (ClassPAD.net), and regional school partnerships directly aligns with accelerating digitalization in education. This enables stable or higher recurring revenue and strengthens long-term earnings resilience. Targeted marketing using global and local ambassadors, regional brand storytelling, and specialty store expansion (notably in India and ASEAN) are expected to increase brand awareness and customer engagement in underpenetrated, growing markets. This could drive both top-line revenue and gross margin improvements.

Want to know what is fueling this optimistic price target? The narrative is banking on ambitious expansion initiatives and a transformation in how Casio generates revenue. Curious about the financial leaps analysts expect from these moves? Find out what bold growth projections could be turning heads in the full narrative.

Result: Fair Value of ¥1,291.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent declines in profitability and uneven performance in key markets remain real risks that could challenge the current optimistic outlook.

Find out about the key risks to this Casio ComputerLtd narrative.

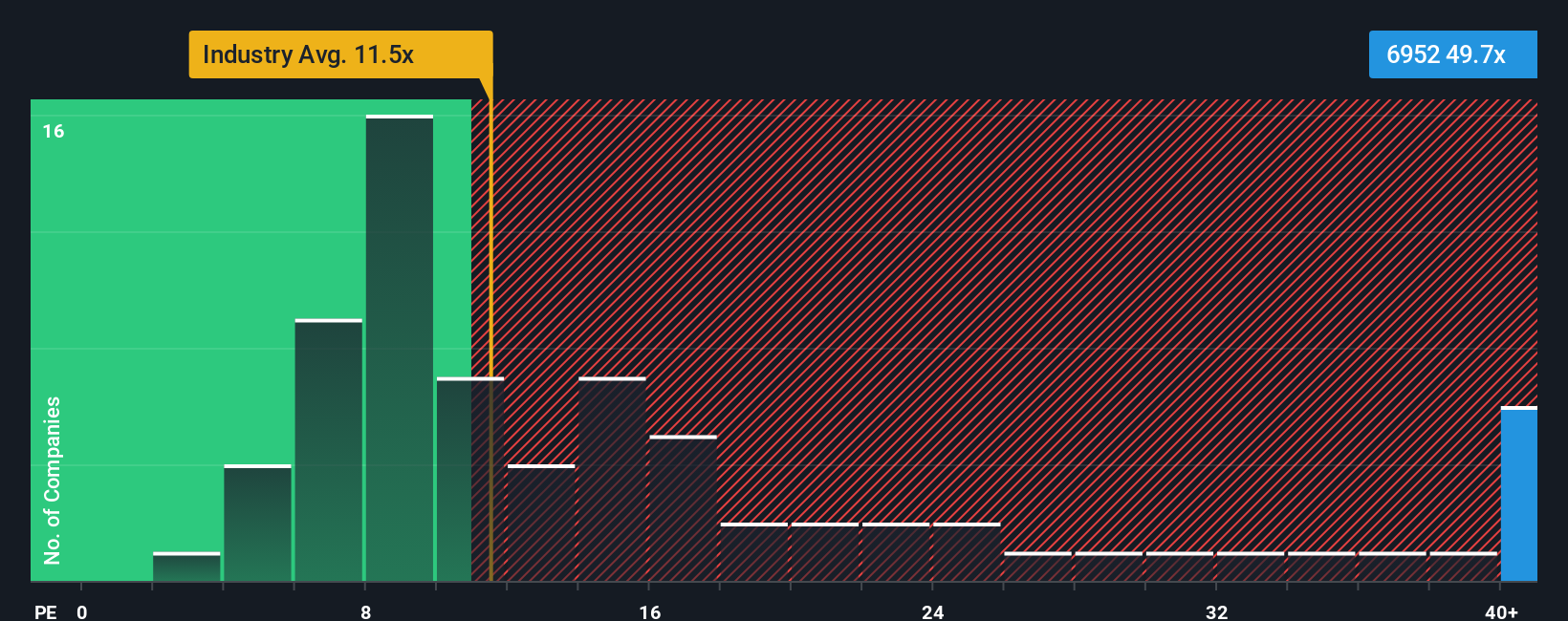

Another View: Multiples Raise Red Flags

Looking at valuation through the lens of earnings multiples tells a more cautious story. Casio ComputerLtd is trading at a price-to-earnings ratio of 49.3x, which is significantly higher than its industry average of 11.4x and its peer average of 18.8x. Even the fair ratio, which the market could eventually shift toward, stands at 20.9x. This large premium increases valuation risk if growth falls short.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Casio ComputerLtd Narrative

If you want to take a different angle or dig into the numbers yourself, you can put together your own Casio ComputerLtd story in just a few minutes with Do it your way.

A great starting point for your Casio ComputerLtd research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Want to outpace other investors? Don’t miss out on exceptional companies. Expand your search with these handpicked ways to spot powerful market trends and hidden value:

- Accelerate your growth strategy and tap into the future by checking out these 24 AI penny stocks that are redefining industries with artificial intelligence breakthroughs.

- Lock in steady income streams when you review these 19 dividend stocks with yields > 3% offering attractive yields above 3% for your portfolio resilience.

- Enhance your portfolio’s upside by selecting these 896 undervalued stocks based on cash flows that stand out for quality financials and compelling valuations based on real cash flow strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6952

Casio ComputerLtd

Engages in the development, production, sales, and services of watches, consumer products, systems, and other fields.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion