- Japan

- /

- Marine and Shipping

- /

- TSE:9107

Top Dividend Stocks To Consider For Your Portfolio

Reviewed by Simply Wall St

In the wake of recent market fluctuations driven by uncertainties surrounding policy changes in the U.S. and fluctuating global economic indicators, investors are increasingly seeking stability through dividend stocks. These stocks can offer a reliable income stream and potential for capital appreciation, making them an attractive option in today's unpredictable financial landscape.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.21% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.97% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.12% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.63% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.18% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.79% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.48% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.80% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.44% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.51% | ★★★★★★ |

Click here to see the full list of 1969 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

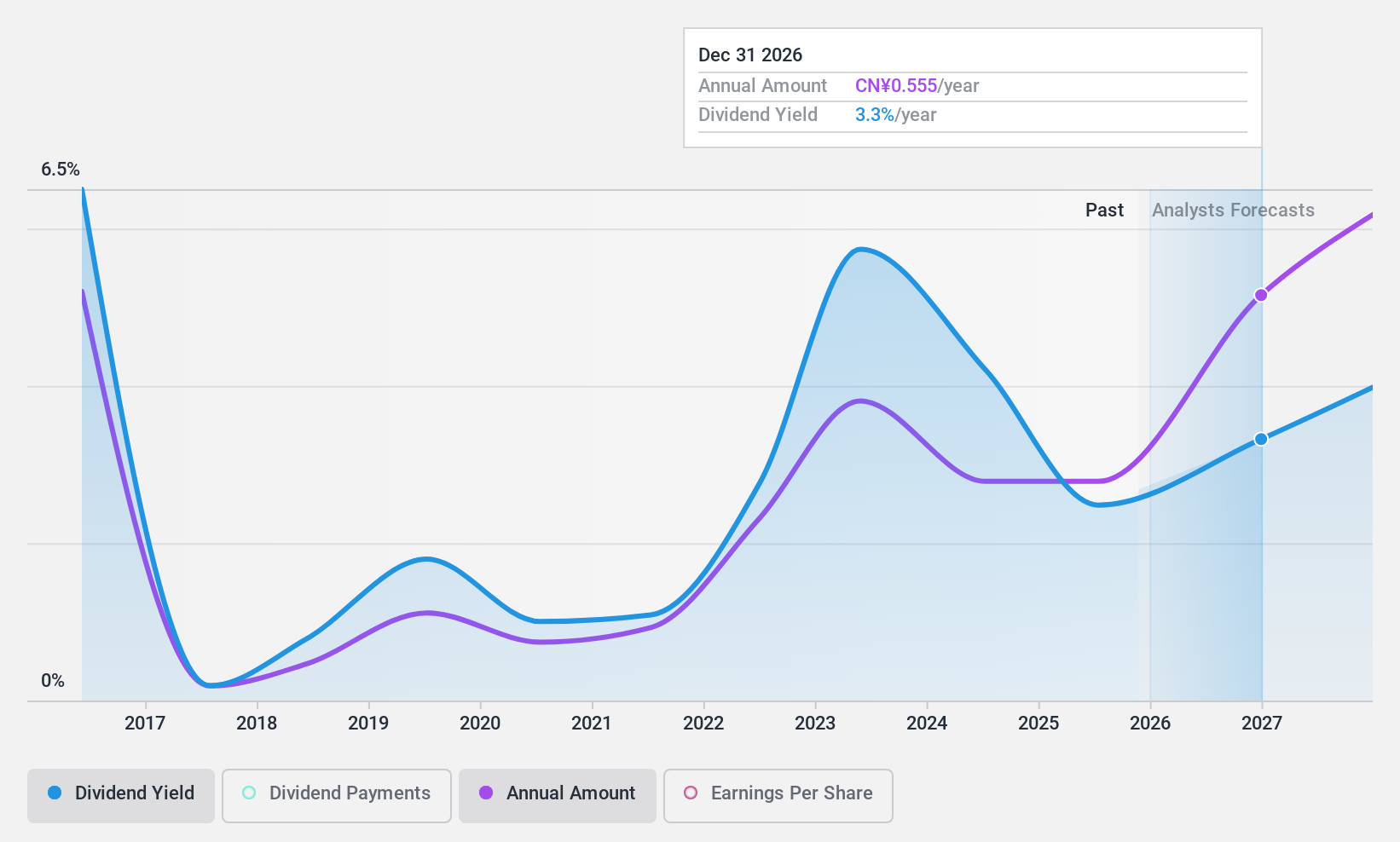

Qingdao East Steel Tower StockLtd (SZSE:002545)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Qingdao East Steel Tower Stock Co. Ltd manufactures and markets steel structure products in the People’s Republic of China, with a market cap of CN¥9.43 billion.

Operations: Qingdao East Steel Tower Stock Co. Ltd generates its revenue primarily from the manufacturing and marketing of steel structure products within China.

Dividend Yield: 4%

Qingdao East Steel Tower Stock Ltd. has a dividend payout ratio of 63.1%, indicating dividends are covered by earnings, and a cash payout ratio of 40%, suggesting strong cash flow coverage. Despite its top-tier dividend yield within the CN market, past payments have been volatile and unreliable over the last decade. The company's price-to-earnings ratio of 15.9x suggests it trades at good value compared to the broader CN market average of 35.3x.

- Navigate through the intricacies of Qingdao East Steel Tower StockLtd with our comprehensive dividend report here.

- According our valuation report, there's an indication that Qingdao East Steel Tower StockLtd's share price might be on the cheaper side.

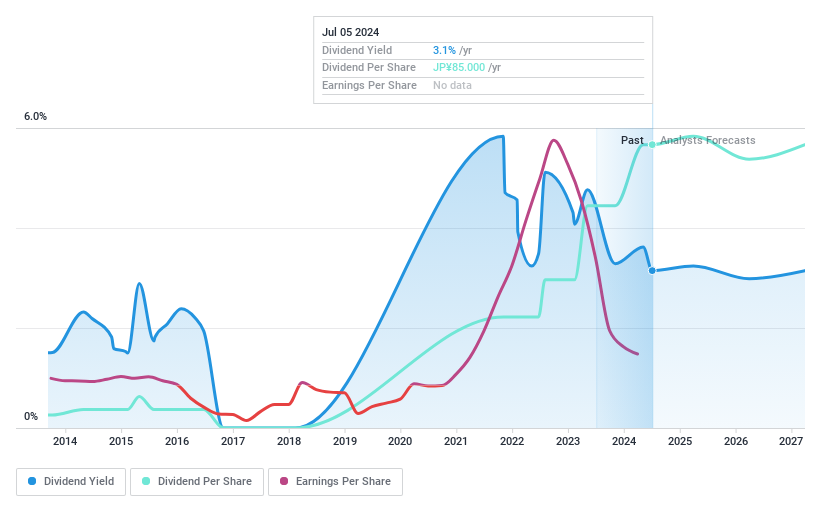

Foster Electric Company (TSE:6794)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Foster Electric Company, Limited produces and sells loudspeakers, audio equipment, and electronic equipment in Japan and internationally with a market cap of ¥40.62 billion.

Operations: Foster Electric Company, Limited generates revenue through its production and sale of loudspeakers, audio equipment, and electronic equipment both domestically in Japan and internationally.

Dividend Yield: 3.3%

Foster Electric Company recently doubled its dividend to JPY 20.00 per share for the second quarter, with a year-end forecast of JPY 30.00 per share, reflecting a significant increase from last year. Despite past volatility in payments, dividends are well-covered by earnings and cash flows, with payout ratios of 9.4% and 70.1%, respectively. The stock trades below estimated fair value, but its dividend yield remains modest compared to top payers in Japan's market.

- Unlock comprehensive insights into our analysis of Foster Electric Company stock in this dividend report.

- In light of our recent valuation report, it seems possible that Foster Electric Company is trading behind its estimated value.

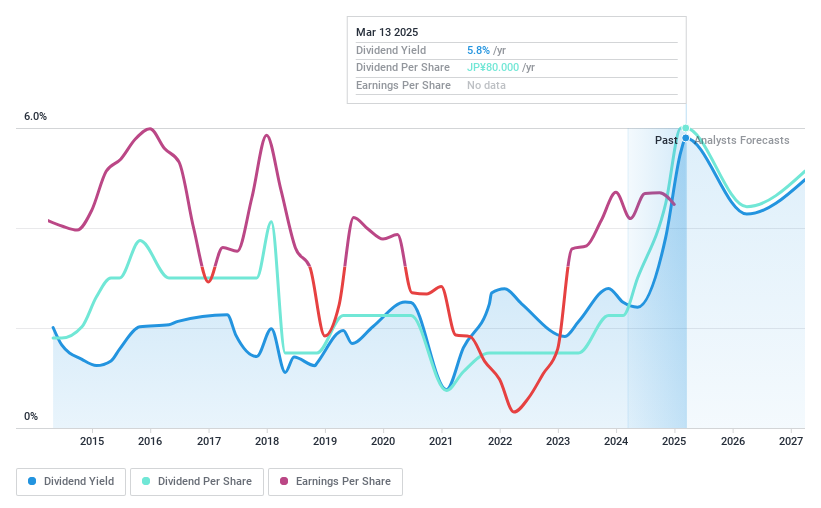

Kawasaki Kisen Kaisha (TSE:9107)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Kawasaki Kisen Kaisha, Ltd. is a company that offers marine, land, and air transportation services across Japan, the United States, Europe, Asia, and internationally with a market cap of ¥1.42 trillion.

Operations: Kawasaki Kisen Kaisha, Ltd.'s revenue segments include Dry Bulk at ¥329.04 billion, Resource at ¥106.31 billion, and Product Logistics at ¥600.11 billion.

Dividend Yield: 4.6%

Kawasaki Kisen Kaisha's dividend yield ranks in the top 25% of Japan's market, supported by a low earnings payout ratio of 30.9% and a reasonable cash payout ratio of 66.4%. However, its dividend history is unstable with past volatility. Recent announcements include a share buyback program to enhance shareholder returns and potential revisions to its dividend forecast for fiscal year ending March 2025, indicating proactive measures in managing capital distribution.

- Get an in-depth perspective on Kawasaki Kisen Kaisha's performance by reading our dividend report here.

- Upon reviewing our latest valuation report, Kawasaki Kisen Kaisha's share price might be too optimistic.

Make It Happen

- Gain an insight into the universe of 1969 Top Dividend Stocks by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kawasaki Kisen Kaisha might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9107

Kawasaki Kisen Kaisha

Provides marine, land, and air transportation services in Japan, the United States, Europe, Asia, and internationally.

Flawless balance sheet established dividend payer.