- Japan

- /

- Consumer Durables

- /

- TSE:6632

Undiscovered Gems on None in February 2025

Reviewed by Simply Wall St

As global markets grapple with tariff uncertainties and mixed economic signals, small-cap stocks have shown resilience despite recent declines in major indices like the S&P 500. With U.S. job growth cooling and manufacturing activity showing signs of recovery, investors are keenly observing how these dynamics might create opportunities for lesser-known companies to shine. In this climate, a good stock often exhibits strong fundamentals and the potential to capitalize on emerging market trends or shifts in consumer behavior. As we explore three undiscovered gems, we'll consider how these attributes align with current economic conditions and investor sentiment.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Nihon Parkerizing | 0.31% | 2.12% | 6.94% | ★★★★★★ |

| Ohashi Technica | NA | 4.58% | -14.04% | ★★★★★★ |

| Otec | 8.17% | 3.43% | 1.06% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Komori | 9.28% | 8.79% | 64.70% | ★★★★★☆ |

| CMC | 1.42% | 1.60% | 10.14% | ★★★★★☆ |

| Marusan Securities | 5.46% | 0.83% | 4.55% | ★★★★★☆ |

| Nippon Ski Resort DevelopmentLtd | 43.84% | 7.58% | 32.78% | ★★★★★☆ |

| Mr Max Holdings | 54.12% | 0.97% | 4.23% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Shanghai National Center of Testing and Inspection for Electric Cable and Wire (SZSE:301289)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shanghai National Center of Testing and Inspection for Electric Cable and Wire Co., Ltd. operates in the field of testing and inspection services for electric cables and wires, with a market capitalization of CN¥3.95 billion.

Operations: Shanghai National Center of Testing and Inspection for Electric Cable and Wire generates revenue primarily from research services, amounting to CN¥285.49 million. The company's financial performance includes a focus on net profit margin trends, which can provide insights into its profitability over time.

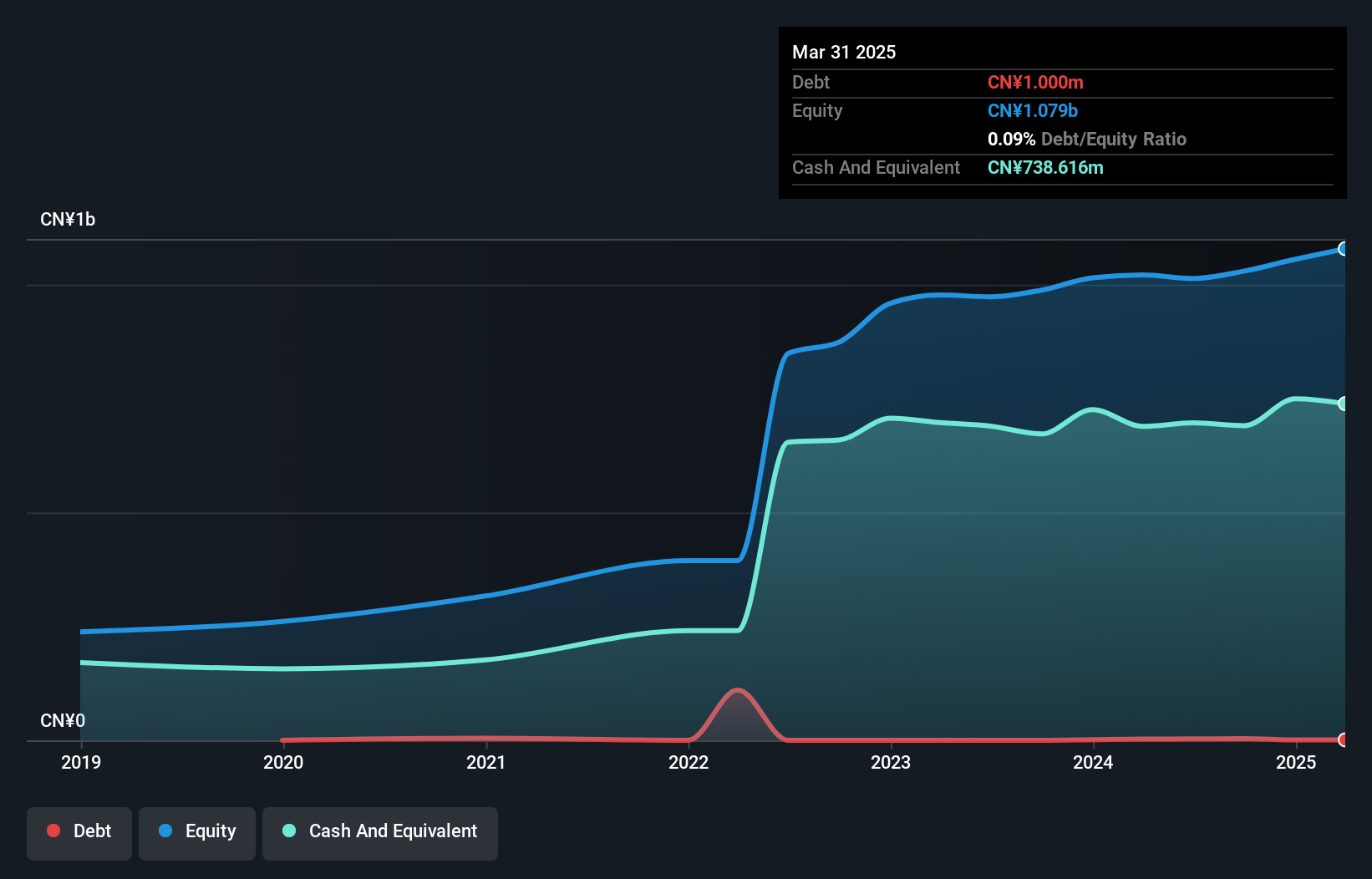

Amidst a volatile share price, Shanghai National Center of Testing and Inspection for Electric Cable and Wire has shown resilience with earnings growth of 4% over the past year, outpacing the Professional Services industry. The company boasts high-quality earnings and remains profitable, negating cash runway concerns. Its debt to equity ratio has risen slightly from 0% to 0.3% in five years, but it holds more cash than total debt, indicating financial prudence. With interest payments well-covered by profits, this small-cap entity seems poised for potential value realization within its niche market segment.

C.UyemuraLtd (TSE:4966)

Simply Wall St Value Rating: ★★★★★★

Overview: C.Uyemura & Co., Ltd. engages in the research, development, manufacturing, and sale of plating chemicals, industrial chemicals, and non-ferrous metals on a global scale with a market capitalization of ¥170.02 billion.

Operations: The primary revenue streams for C.Uyemura & Co., Ltd. include the Surface Treatment Materials Business generating ¥66.01 billion and the Surface Treatment Machinery Business with ¥12.61 billion. The Plating Processing Business contributes ¥4.32 billion, while the Real Estate Leasing Segment adds ¥0.83 billion to total revenues.

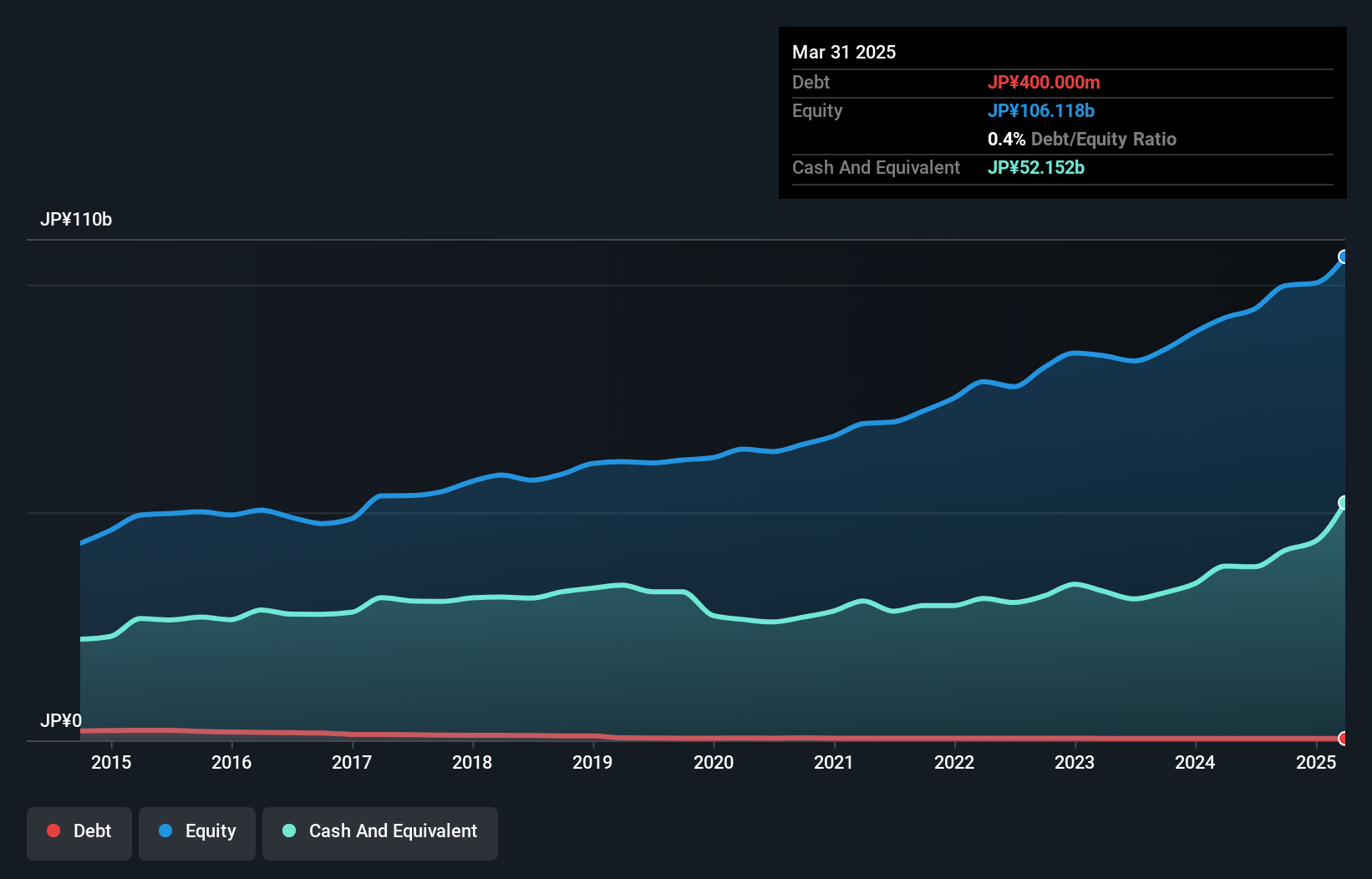

Uyemura, a smaller player in the chemicals sector, showcases impressive financial health with earnings growth of 57% over the past year, outpacing the industry's 18%. The company is trading at a significant discount of 53% below its fair value estimate. Its debt-to-equity ratio has halved from 0.8 to 0.4 over five years, indicating effective debt management. With high-quality earnings and positive free cash flow, Uyemura seems well-positioned for future growth. Interest coverage is strong as it earns more interest than it pays out, suggesting robust financial stability in its operations and potential for continued success in its market niche.

- Click to explore a detailed breakdown of our findings in C.UyemuraLtd's health report.

Evaluate C.UyemuraLtd's historical performance by accessing our past performance report.

JVCKENWOOD (TSE:6632)

Simply Wall St Value Rating: ★★★★★★

Overview: JVCKENWOOD Corporation is a global manufacturer and seller of products in the mobility and telematics services, public service, and media service sectors, with a market capitalization of ¥227.89 billion.

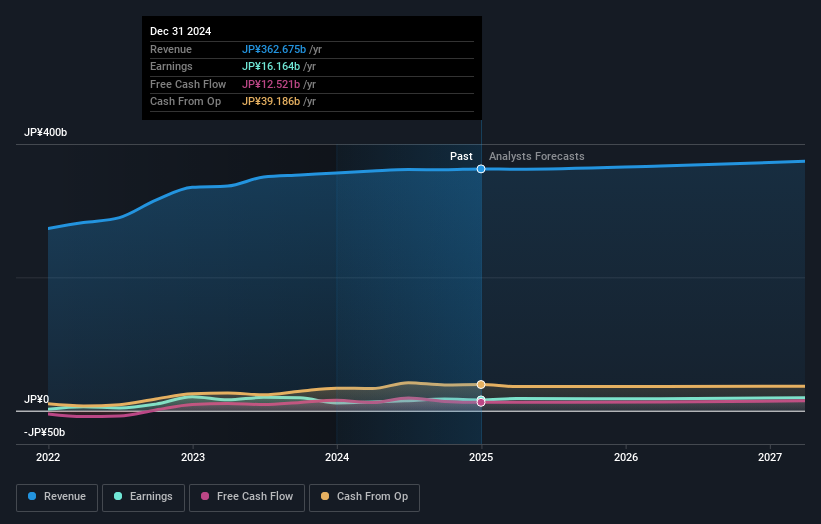

Operations: JVCKENWOOD generates revenue primarily from its Mobility & Telematics Services Area, which contributes ¥199.43 billion, followed by the Public Service Field at ¥96.93 billion and the Media Service Field at ¥55.44 billion. The company exhibits a notable net profit margin trend that warrants attention.

JVCKENWOOD, a smaller player in the Consumer Durables space, has been making waves with its impressive earnings growth of 38.9% over the past year, outpacing the industry average of 5.6%. The company is trading at a discount of 24.3% below its estimated fair value, presenting potential for value investors. Its debt management appears robust as well, with a significant reduction in the debt-to-equity ratio from 110.4% to 38.1% over five years and an EBIT interest coverage of 163 times. Recent share repurchases totaling ¥4,499 million further indicate financial confidence and shareholder value focus.

- Click here and access our complete health analysis report to understand the dynamics of JVCKENWOOD.

Examine JVCKENWOOD's past performance report to understand how it has performed in the past.

Next Steps

- Reveal the 4690 hidden gems among our Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6632

JVCKENWOOD

Manufactures and sells products in the mobility and telematics services, public service, and media service sectors in Japan and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives