- Japan

- /

- Consumer Durables

- /

- TSE:6632

JVCKENWOOD Corporation's (TSE:6632) Shares Leap 29% Yet They're Still Not Telling The Full Story

JVCKENWOOD Corporation (TSE:6632) shares have had a really impressive month, gaining 29% after a shaky period beforehand. The last month tops off a massive increase of 113% in the last year.

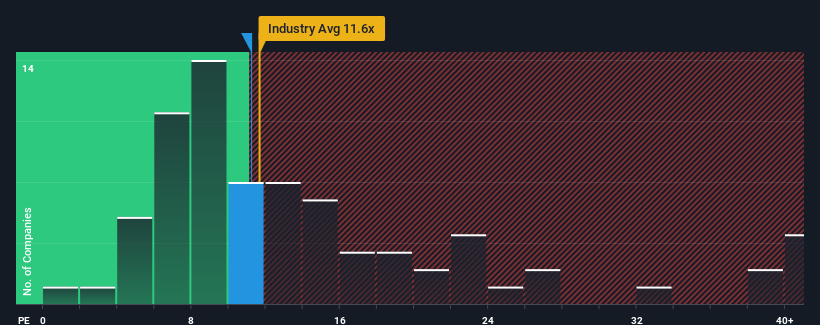

In spite of the firm bounce in price, JVCKENWOOD's price-to-earnings (or "P/E") ratio of 11.2x might still make it look like a buy right now compared to the market in Japan, where around half of the companies have P/E ratios above 15x and even P/E's above 24x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

JVCKENWOOD hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. It seems that many are expecting the dour earnings performance to persist, which has repressed the P/E. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

View our latest analysis for JVCKENWOOD

What Are Growth Metrics Telling Us About The Low P/E?

The only time you'd be truly comfortable seeing a P/E as low as JVCKENWOOD's is when the company's growth is on track to lag the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 42%. This has erased any of its gains during the last three years, with practically no change in EPS being achieved in total. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Shifting to the future, estimates from the dual analysts covering the company suggest earnings should grow by 12% per year over the next three years. With the market predicted to deliver 10.0% growth each year, the company is positioned for a comparable earnings result.

In light of this, it's peculiar that JVCKENWOOD's P/E sits below the majority of other companies. It may be that most investors are not convinced the company can achieve future growth expectations.

The Bottom Line On JVCKENWOOD's P/E

The latest share price surge wasn't enough to lift JVCKENWOOD's P/E close to the market median. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of JVCKENWOOD's analyst forecasts revealed that its market-matching earnings outlook isn't contributing to its P/E as much as we would have predicted. When we see an average earnings outlook with market-like growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

Before you take the next step, you should know about the 3 warning signs for JVCKENWOOD that we have uncovered.

If you're unsure about the strength of JVCKENWOOD's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:6632

JVCKENWOOD

Manufactures and sells products in the mobility and telematics services, public service, and media service sectors in Japan and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives