As global markets navigate a landscape marked by easing monetary policies and fluctuating trade tensions, Asian equities have become a focal point for investors seeking value amid economic uncertainties. In this context, identifying stocks priced below their intrinsic worth can offer potential opportunities for those looking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Zhejiang Century Huatong GroupLtd (SZSE:002602) | CN¥19.51 | CN¥38.36 | 49.1% |

| Yangtze Optical Fibre And Cable Limited (SEHK:6869) | HK$37.66 | HK$73.11 | 48.5% |

| Tibet GaoZheng Explosive (SZSE:002827) | CN¥38.20 | CN¥74.88 | 49% |

| Teikoku Sen-i (TSE:3302) | ¥3475.00 | ¥6755.07 | 48.6% |

| Suzhou Hengmingda Electronic Technology (SZSE:002947) | CN¥45.08 | CN¥88.92 | 49.3% |

| Ningxia Building Materials GroupLtd (SHSE:600449) | CN¥13.41 | CN¥26.46 | 49.3% |

| Lotes (TWSE:3533) | NT$1425.00 | NT$2844.95 | 49.9% |

| Kinsus Interconnect Technology (TWSE:3189) | NT$145.00 | NT$284.85 | 49.1% |

| Jiangsu Xinquan Automotive TrimLtd (SHSE:603179) | CN¥66.90 | CN¥131.11 | 49% |

| Andes Technology (TWSE:6533) | NT$270.50 | NT$532.29 | 49.2% |

Let's take a closer look at a couple of our picks from the screened companies.

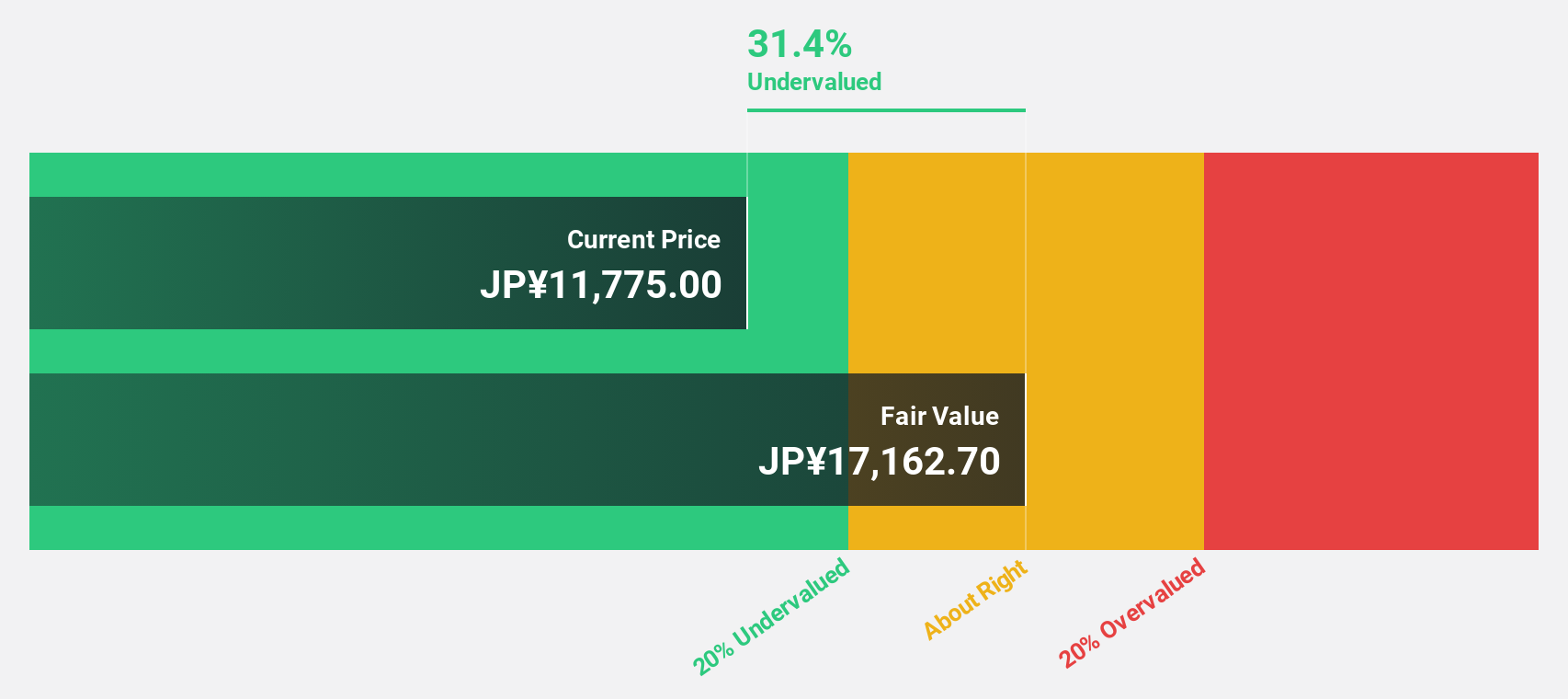

Visional (TSE:4194)

Overview: Visional, Inc., along with its subsidiaries, offers human resources platform solutions in Japan and has a market capitalization of ¥416.41 billion.

Operations: The company's revenue is primarily derived from its HR Tech segment, which generated ¥77.10 billion, and its Incubation segment, contributing ¥3.14 billion.

Estimated Discount To Fair Value: 47.3%

Visional, Inc. is trading at ¥10,385, significantly below its estimated fair value of ¥19,703.21. Earnings are projected to grow 14% annually, surpassing the Japanese market's growth rate of 8.1%. Recently added to the FTSE All-World Index, Visional anticipates net sales of ¥99.2 billion and operating profit of ¥23.1 billion for the fiscal year ending July 2026. The stock is valued at 47.3% below its fair value estimate based on discounted cash flow analysis.

- Insights from our recent growth report point to a promising forecast for Visional's business outlook.

- Delve into the full analysis health report here for a deeper understanding of Visional.

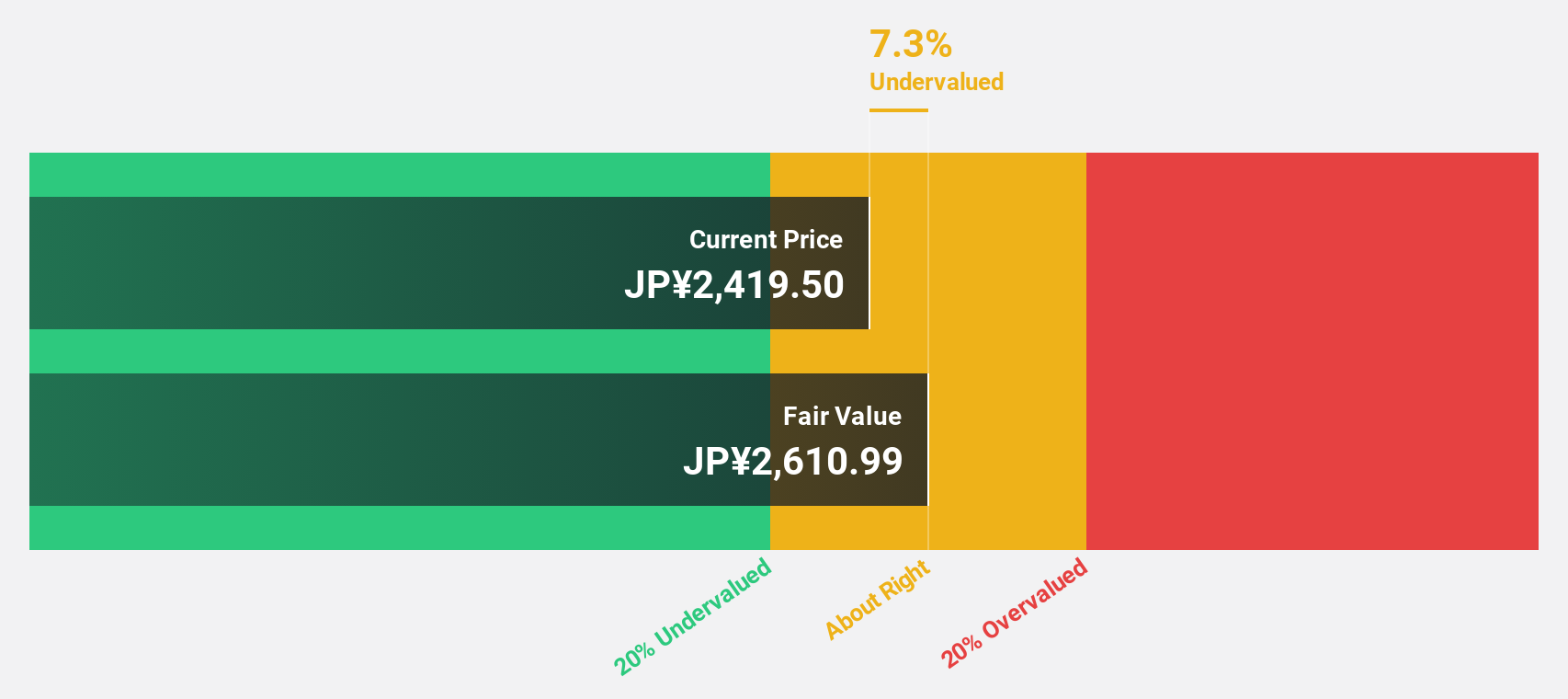

Dexerials (TSE:4980)

Overview: Dexerials Corporation manufactures and sells electronic components, bonding materials, optics materials, and other products in Japan with a market cap of ¥395.42 billion.

Operations: The company's revenue is derived from Optical Materials and Components, generating ¥50.01 billion, and Electronic Materials and Components, contributing ¥60.06 billion.

Estimated Discount To Fair Value: 10.2%

Dexerials is trading at ¥2,359, slightly below its fair value estimate of ¥2,626.95. Despite high share price volatility recently, its earnings are expected to grow 9% annually, outpacing the Japanese market's 8.1% growth rate. Revenue growth is forecast at 7.2% per year, also above the market average of 4.5%. However, it has an unstable dividend history and only a modest undervaluation based on discounted cash flow analysis.

- Our earnings growth report unveils the potential for significant increases in Dexerials' future results.

- Click here and access our complete balance sheet health report to understand the dynamics of Dexerials.

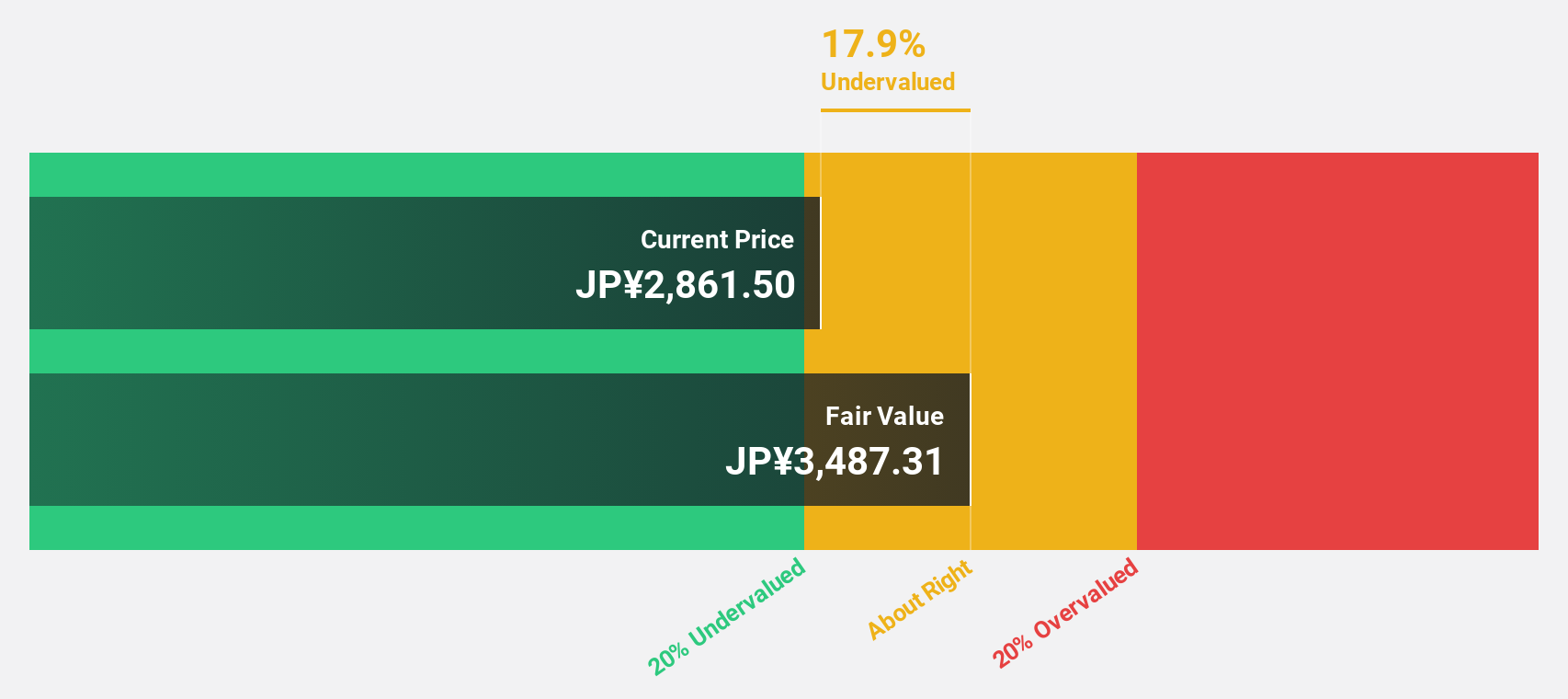

Sega Sammy Holdings (TSE:6460)

Overview: Sega Sammy Holdings Inc., with a market cap of ¥620.66 billion, operates through its subsidiaries in the entertainment contents business.

Operations: The company's revenue segments consist of the Entertainment Contents business at ¥317.28 billion, Pachislot & Pachinko Machines at ¥79.40 billion, and the Gaming Business at ¥6.14 billion.

Estimated Discount To Fair Value: 10.1%

Sega Sammy Holdings, trading at ¥2,953.5, is slightly undervalued compared to its fair value estimate of ¥3,284.48. While earnings are expected to grow significantly at 22.8% annually over the next three years—outpacing the Japanese market's 8.1% growth rate—profit margins have decreased from 8.7% to 4.2%. The dividend yield of 1.86% lacks coverage by free cash flows, and revenue growth is forecasted at a moderate 7% per year.

- The analysis detailed in our Sega Sammy Holdings growth report hints at robust future financial performance.

- Dive into the specifics of Sega Sammy Holdings here with our thorough financial health report.

Make It Happen

- Unlock more gems! Our Undervalued Asian Stocks Based On Cash Flows screener has unearthed 270 more companies for you to explore.Click here to unveil our expertly curated list of 273 Undervalued Asian Stocks Based On Cash Flows.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6460

Sega Sammy Holdings

Through its subsidiaries, engages in the entertainment contents business.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives