- China

- /

- Semiconductors

- /

- SHSE:688256

Asian Growth Stocks With High Insider Ownership August 2025

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by shifting trade policies and evolving economic conditions, the Asian market continues to demonstrate resilience and growth potential. In such an environment, stocks with high insider ownership can be particularly appealing, as they often reflect strong confidence from those closest to the company's operations.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Techwing (KOSDAQ:A089030) | 19.1% | 68% |

| Suzhou Sunmun Technology (SZSE:300522) | 35.4% | 77.7% |

| Shanghai Huace Navigation Technology (SZSE:300627) | 24.3% | 23.9% |

| Samyang Foods (KOSE:A003230) | 11.7% | 27.2% |

| Oscotec (KOSDAQ:A039200) | 12.7% | 98.7% |

| Novoray (SHSE:688300) | 23.6% | 28.2% |

| M31 Technology (TPEX:6643) | 30.8% | 95.3% |

| Laopu Gold (SEHK:6181) | 35.5% | 43% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 32.2% |

| Fulin Precision (SZSE:300432) | 12.8% | 43.7% |

Below we spotlight a couple of our favorites from our exclusive screener.

Cambricon Technologies (SHSE:688256)

Simply Wall St Growth Rating: ★★★★★★

Overview: Cambricon Technologies Corporation Limited focuses on researching, developing, designing, and selling core chips for cloud servers, edge computing, and terminal equipment in China with a market cap of CN¥289.67 billion.

Operations: The company's revenue segments include core chips for cloud servers, edge computing, and terminal equipment in China.

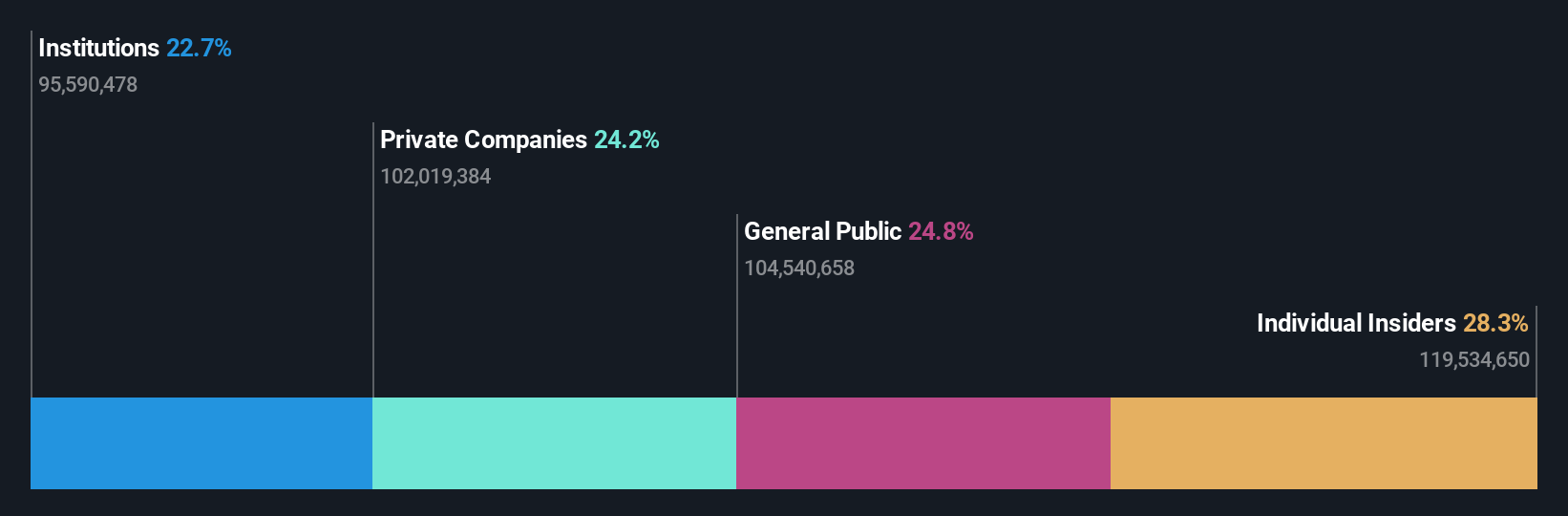

Insider Ownership: 28.6%

Cambricon Technologies has recently become profitable, with earnings expected to grow significantly at 71.1% annually over the next three years, outpacing the CN market's growth. Its revenue is also forecast to rise by 50% annually, surpassing market expectations. Despite being removed from the Shanghai Stock Exchange 180 Value Index in June 2025, insider ownership remains high. The company completed a share buyback worth CNY 20.06 million in July 2025, indicating confidence in its future prospects.

- Navigate through the intricacies of Cambricon Technologies with our comprehensive analyst estimates report here.

- The analysis detailed in our Cambricon Technologies valuation report hints at an inflated share price compared to its estimated value.

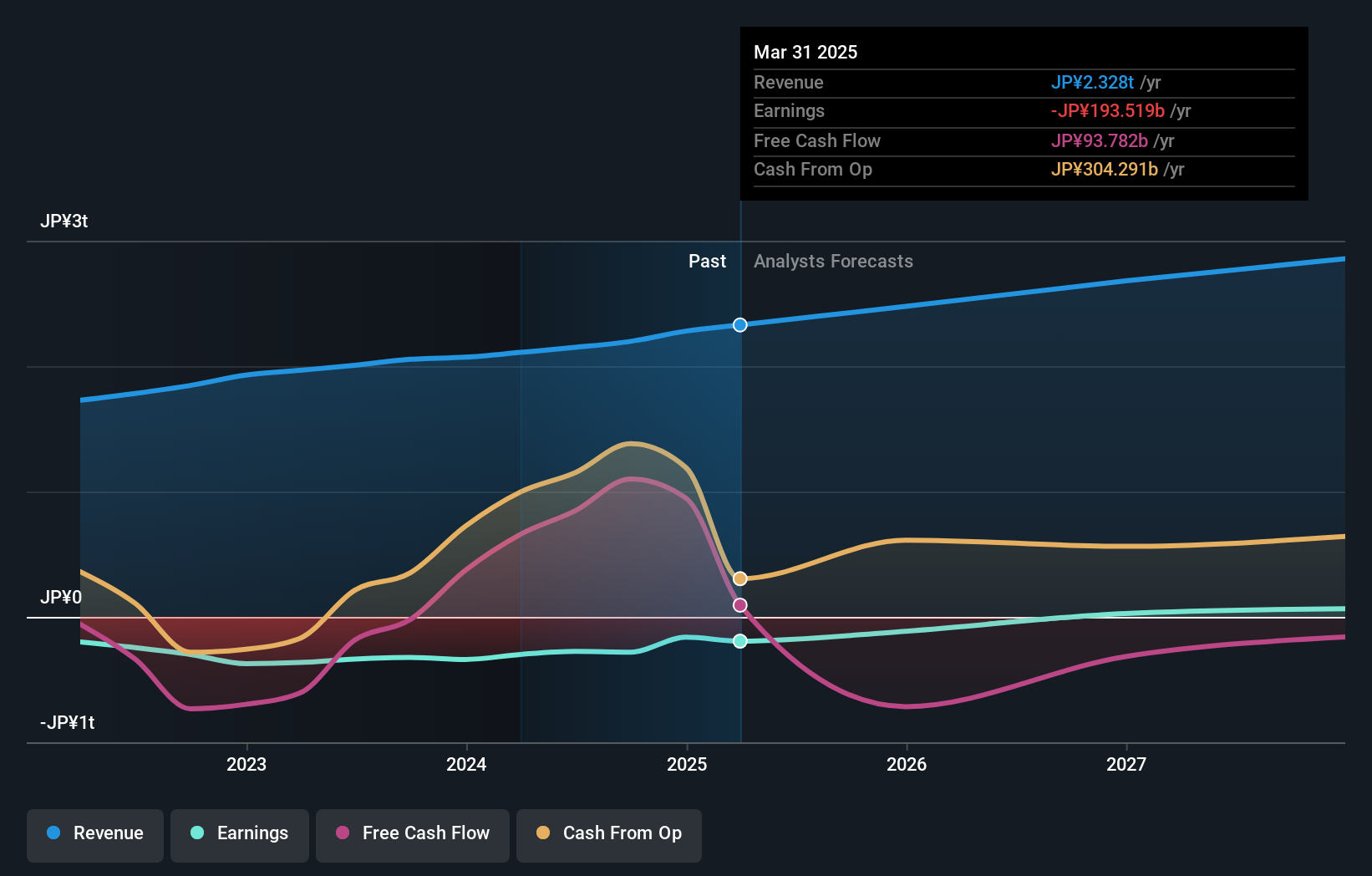

Rakuten Group (TSE:4755)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Rakuten Group, Inc. operates in e-commerce, fintech, digital content, and communications services globally with a market cap of approximately ¥1.73 trillion.

Operations: The company's revenue segments include Mobile at ¥468.73 billion, Fin Tech at ¥880.53 billion, and Internet Services at ¥1.32 trillion.

Insider Ownership: 12%

Rakuten Group anticipates becoming profitable within three years, with earnings expected to grow at 73.74% annually, exceeding the Japanese market's growth rate. Despite revenue growth forecasts of 6.6% per year being below the ideal for rapid expansion, they still surpass market averages. The company's recent product innovations in affiliate marketing and a planned merger of subsidiaries signal strategic moves for long-term growth. Rakuten trades at a significant discount to its estimated fair value, enhancing its appeal amidst high insider ownership levels in Asia.

- Delve into the full analysis future growth report here for a deeper understanding of Rakuten Group.

- In light of our recent valuation report, it seems possible that Rakuten Group is trading behind its estimated value.

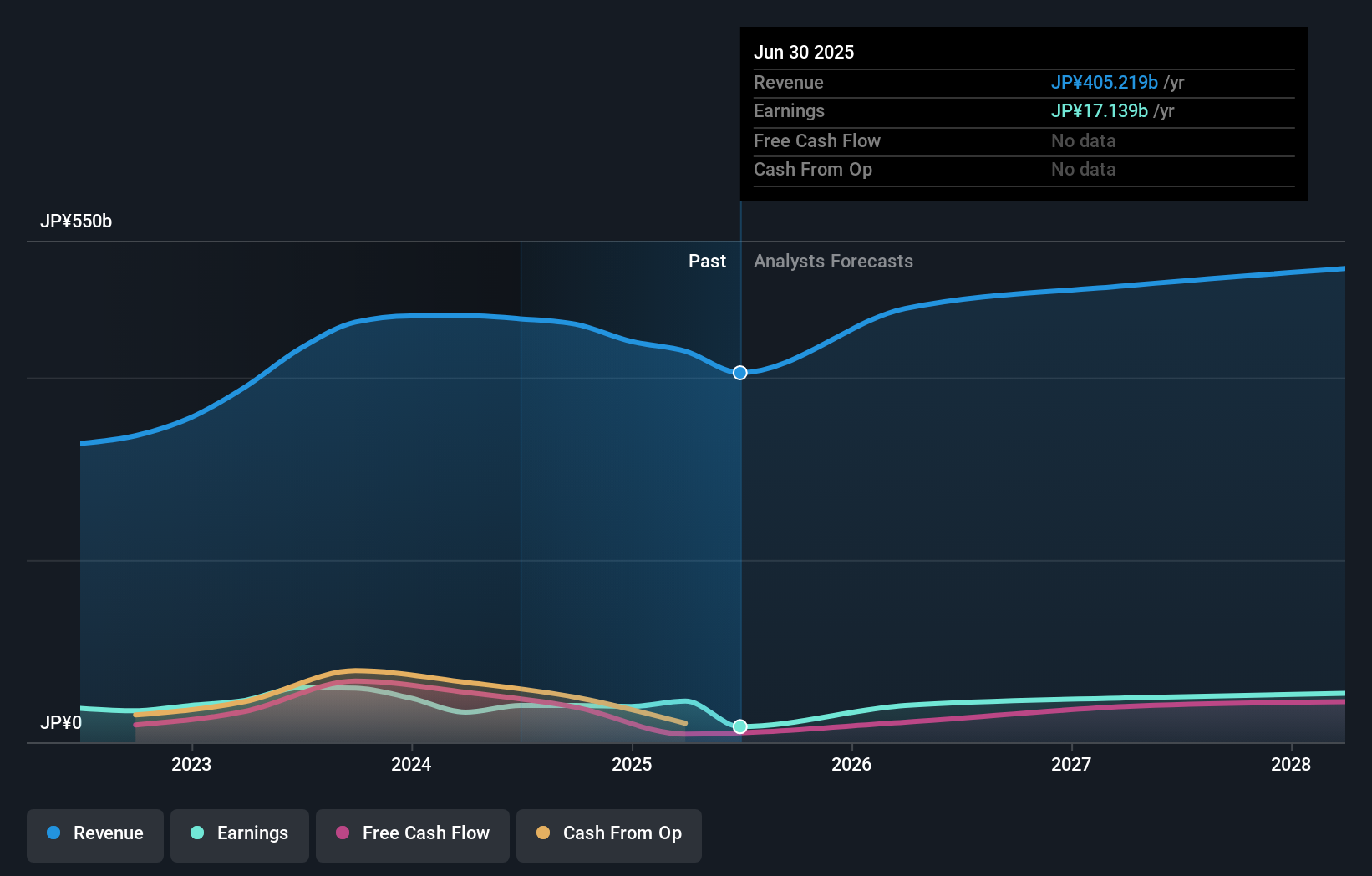

Sega Sammy Holdings (TSE:6460)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sega Sammy Holdings Inc. operates in the entertainment contents business through its subsidiaries, with a market cap of ¥694.23 billion.

Operations: The company's revenue segments include the development and sale of video games, amusement machines, and pachislot and pachinko machines.

Insider Ownership: 30%

Sega Sammy Holdings is poised for significant earnings growth, with forecasts indicating a 22.44% annual increase, outpacing the Japanese market's 8.1%. Despite recent volatility in share price and a decline in profit margins from last year, the company trades slightly below its estimated fair value. Recent strategic moves include completing a ¥11.99 billion share buyback program and considering management changes to support future growth plans amidst high insider ownership levels in Asia.

- Unlock comprehensive insights into our analysis of Sega Sammy Holdings stock in this growth report.

- Our valuation report unveils the possibility Sega Sammy Holdings' shares may be trading at a premium.

Summing It All Up

- Unlock our comprehensive list of 593 Fast Growing Asian Companies With High Insider Ownership by clicking here.

- Contemplating Other Strategies? Rare earth metals are the new gold rush. Find out which 26 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688256

Cambricon Technologies

Research, develops, design, and sells core chips in cloud server, edge computing, and terminal equipment in China.

Exceptional growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives