- Turkey

- /

- Auto Components

- /

- IBSE:BRISA

Discover November 2024's Leading Dividend Stocks

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by busy earnings weeks and mixed economic signals, investors are increasingly focused on stable returns amid volatility. In this environment, dividend stocks can offer a compelling opportunity for income generation and potential capital appreciation.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.19% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.69% | ★★★★★★ |

| Globeride (TSE:7990) | 4.12% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.21% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.50% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.42% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.52% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.81% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.56% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.53% | ★★★★★★ |

Click here to see the full list of 1947 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Brisa Bridgestone Sabanci Lastik Sanayi ve Ticaret (IBSE:BRISA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Brisa Bridgestone Sabanci Lastik Sanayi ve Ticaret A.S. is a leading tire manufacturer in Turkey with a market cap of TRY26.18 billion, focusing on the production and distribution of various tire products.

Operations: Brisa Bridgestone Sabanci Lastik Sanayi ve Ticaret A.S. generates revenue through the production and distribution of diverse tire products in Turkey.

Dividend Yield: 3.9%

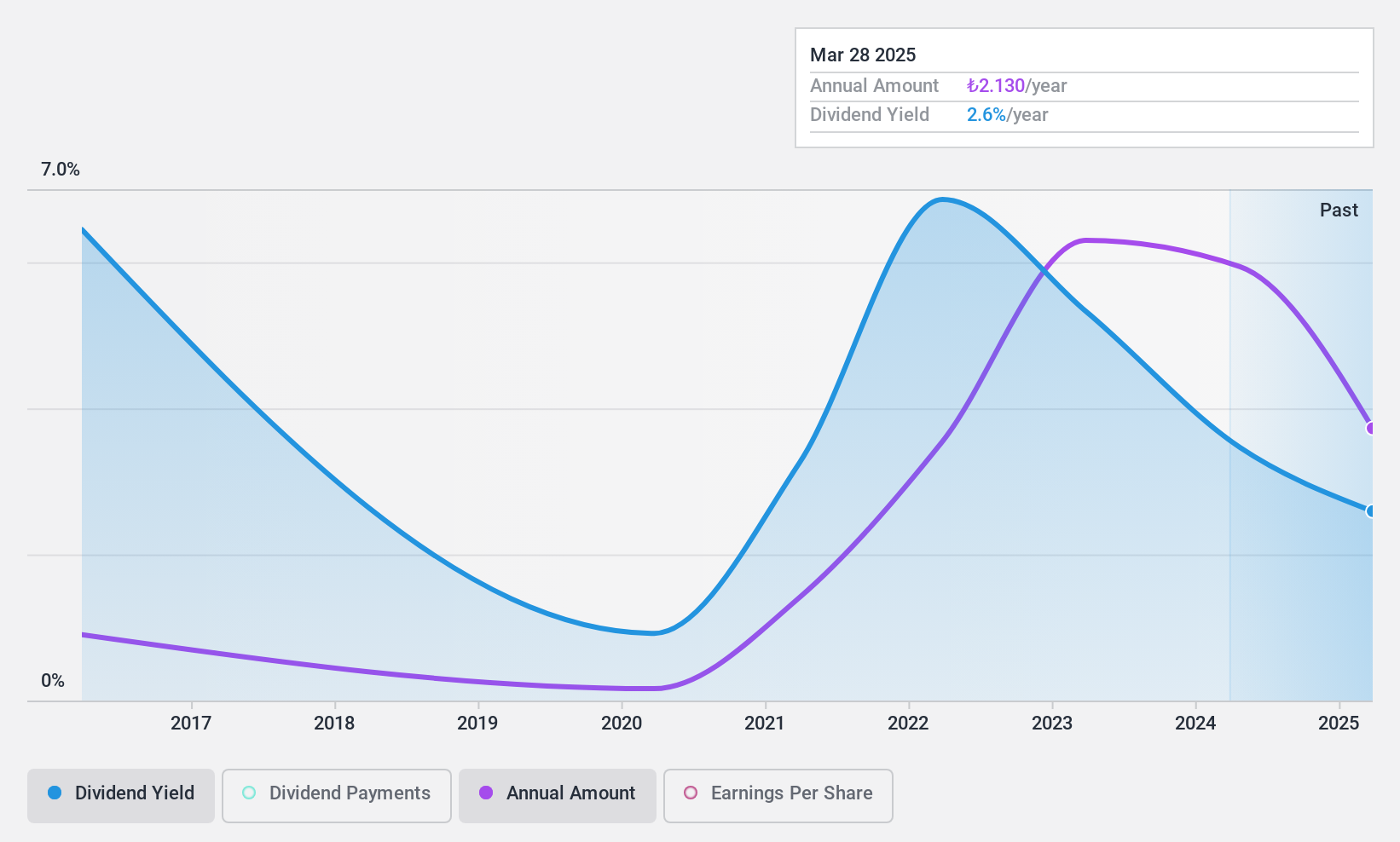

Brisa Bridgestone Sabanci Lastik Sanayi ve Ticaret's dividend yield of 3.94% ranks in the top 25% of TR market payers, but its sustainability is questionable due to a high cash payout ratio of 94%. Despite a low earnings payout ratio of 32.6%, dividends have been volatile and not reliably covered by earnings or cash flows. Recent financials show declining sales and a shift from net income to losses, raising concerns about future dividend stability.

- Navigate through the intricacies of Brisa Bridgestone Sabanci Lastik Sanayi ve Ticaret with our comprehensive dividend report here.

- Our valuation report here indicates Brisa Bridgestone Sabanci Lastik Sanayi ve Ticaret may be undervalued.

Lao Feng Xiang (SHSE:600612)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Lao Feng Xiang Co., Ltd. operates in the jewelry industry both within the People's Republic of China and internationally, with a market cap of CN¥21.39 billion.

Operations: Lao Feng Xiang Co., Ltd. generates revenue from its operations in the jewelry industry across domestic and international markets.

Dividend Yield: 3.8%

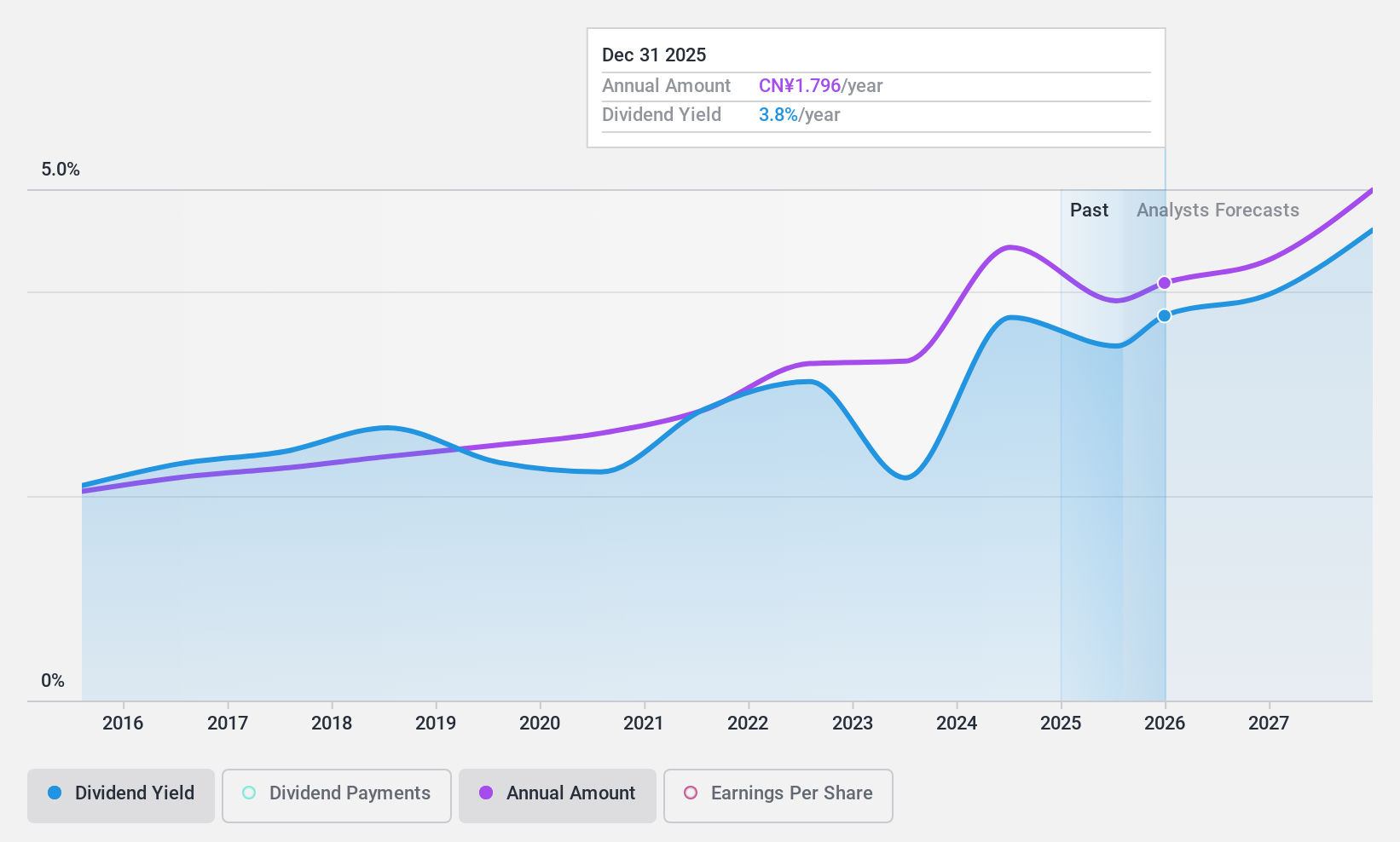

Lao Feng Xiang's dividend yield of 3.82% is among the top 25% in the CN market, supported by a sustainable cash payout ratio of 15.9% and an earnings payout ratio of 50.4%. The company has maintained stable and growing dividends over the past decade, indicating reliability. Despite recent declines in sales (CNY 52.58 billion) and net income (CNY 1.78 billion) compared to last year, its dividends remain well-covered by both earnings and cash flows.

- Click here to discover the nuances of Lao Feng Xiang with our detailed analytical dividend report.

- The valuation report we've compiled suggests that Lao Feng Xiang's current price could be quite moderate.

FujishojiLtd (TSE:6257)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Fujishoji Co., Ltd. develops, manufactures, and sells gaming machines in Japan with a market cap of ¥27.41 billion.

Operations: Fujishoji Co., Ltd.'s revenue from the Pachinko and Pachislot Machine Business is ¥31.94 billion.

Dividend Yield: 4.2%

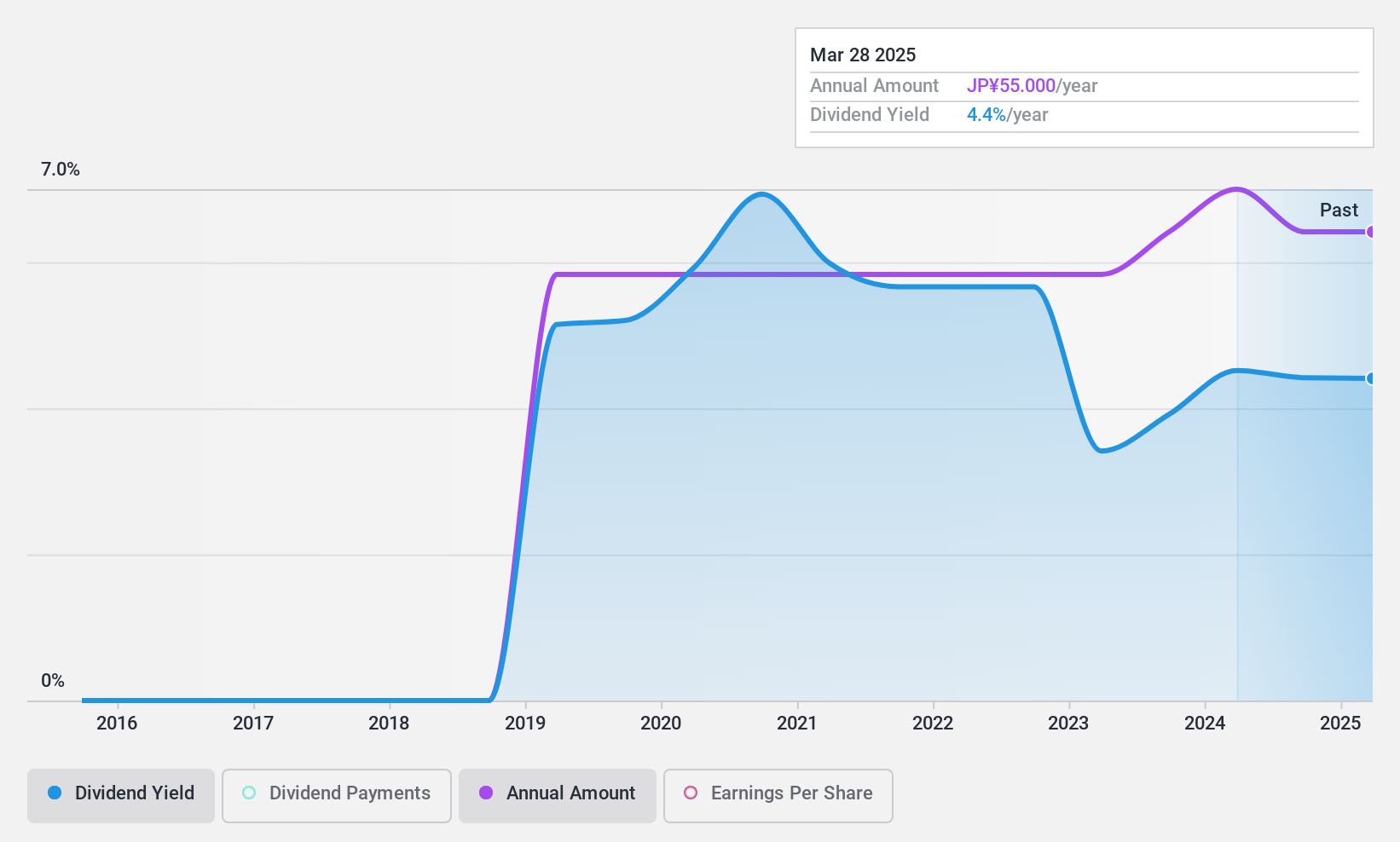

Fujishoji Ltd.'s dividend yield of 4.19% ranks in the top 25% of the JP market, with dividends covered by both earnings (payout ratio: 82.2%) and cash flows (cash payout ratio: 74.8%). However, its dividend history is marked by volatility over six years, lacking consistent growth or stability. Despite trading at a significant discount to estimated fair value, recent profit margin declines from last year may impact future payouts' sustainability.

- Get an in-depth perspective on FujishojiLtd's performance by reading our dividend report here.

- Our valuation report unveils the possibility FujishojiLtd's shares may be trading at a premium.

Make It Happen

- Delve into our full catalog of 1947 Top Dividend Stocks here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brisa Bridgestone Sabanci Lastik Sanayi ve Ticaret might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:BRISA

Brisa Bridgestone Sabanci Lastik Sanayi ve Ticaret

Brisa Bridgestone Sabanci Lastik Sanayi ve Ticaret A.S.

Flawless balance sheet established dividend payer.