Kitanihon Spinning Co., Ltd.'s (TSE:3409) 31% Jump Shows Its Popularity With Investors

Despite an already strong run, Kitanihon Spinning Co., Ltd. (TSE:3409) shares have been powering on, with a gain of 31% in the last thirty days. The annual gain comes to 109% following the latest surge, making investors sit up and take notice.

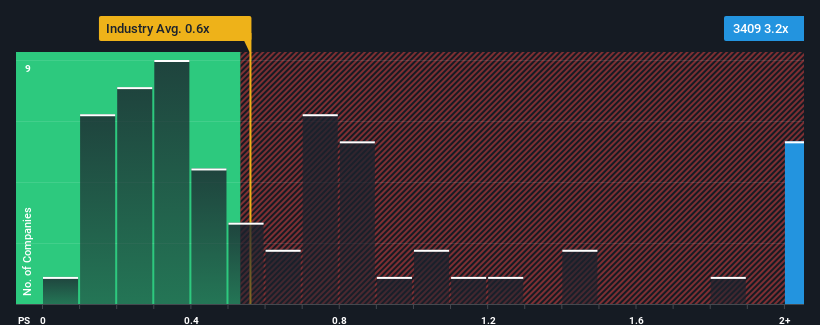

Since its price has surged higher, given around half the companies in Japan's Luxury industry have price-to-sales ratios (or "P/S") below 0.6x, you may consider Kitanihon Spinning as a stock to avoid entirely with its 3.2x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

Our free stock report includes 4 warning signs investors should be aware of before investing in Kitanihon Spinning. Read for free now.See our latest analysis for Kitanihon Spinning

How Kitanihon Spinning Has Been Performing

Revenue has risen firmly for Kitanihon Spinning recently, which is pleasing to see. It might be that many expect the respectable revenue performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Kitanihon Spinning's earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For Kitanihon Spinning?

In order to justify its P/S ratio, Kitanihon Spinning would need to produce outstanding growth that's well in excess of the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 25%. Pleasingly, revenue has also lifted 97% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Comparing that to the industry, which is only predicted to deliver 9.5% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

With this in consideration, it's not hard to understand why Kitanihon Spinning's P/S is high relative to its industry peers. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

The Final Word

The strong share price surge has lead to Kitanihon Spinning's P/S soaring as well. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

It's no surprise that Kitanihon Spinning can support its high P/S given the strong revenue growth its experienced over the last three-year is superior to the current industry outlook. At this stage investors feel the potential continued revenue growth in the future is great enough to warrant an inflated P/S. Barring any significant changes to the company's ability to make money, the share price should continue to be propped up.

Before you settle on your opinion, we've discovered 4 warning signs for Kitanihon Spinning (2 make us uncomfortable!) that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if KitaboLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:3409

KitaboLtd

Engages in the manufacturing of healthcare and recycled products.

Flawless balance sheet with slight risk.

Market Insights

Community Narratives