Fujibo Holdings, Inc. (TSE:3104) Stocks Shoot Up 26% But Its P/E Still Looks Reasonable

Fujibo Holdings, Inc. (TSE:3104) shareholders would be excited to see that the share price has had a great month, posting a 26% gain and recovering from prior weakness. Looking back a bit further, it's encouraging to see the stock is up 60% in the last year.

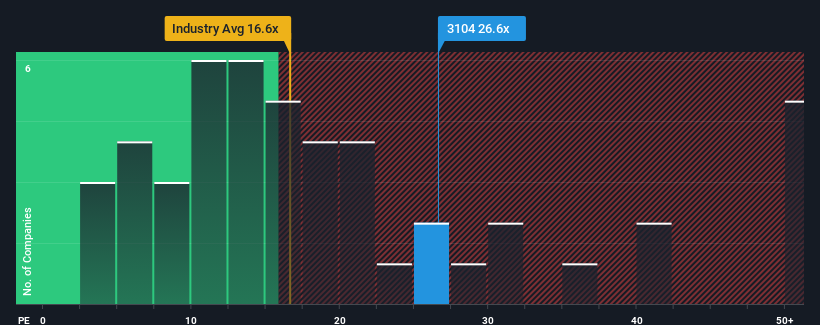

After such a large jump in price, Fujibo Holdings' price-to-earnings (or "P/E") ratio of 26.6x might make it look like a strong sell right now compared to the market in Japan, where around half of the companies have P/E ratios below 14x and even P/E's below 9x are quite common. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Fujibo Holdings hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. One possibility is that the P/E is high because investors think this poor earnings performance will turn the corner. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Fujibo Holdings

What Are Growth Metrics Telling Us About The High P/E?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Fujibo Holdings' to be considered reasonable.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 38%. This means it has also seen a slide in earnings over the longer-term as EPS is down 51% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Looking ahead now, EPS is anticipated to climb by 35% per year during the coming three years according to the two analysts following the company. That's shaping up to be materially higher than the 9.5% each year growth forecast for the broader market.

With this information, we can see why Fujibo Holdings is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

Shares in Fujibo Holdings have built up some good momentum lately, which has really inflated its P/E. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Fujibo Holdings' analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

You always need to take note of risks, for example - Fujibo Holdings has 2 warning signs we think you should be aware of.

If these risks are making you reconsider your opinion on Fujibo Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:3104

Fujibo Holdings

Manufactures and sells polishing pads, industrial chemical products, and apparel products in Japan and internationally.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives