Exploring Gunze And 2 Other Undiscovered Gems In Global Markets

Reviewed by Simply Wall St

As global markets react positively to the recent U.S.-China tariff suspension, with major indices like the Nasdaq Composite and S&P 500 showing strong gains, investors are keenly observing how these developments impact small-cap stocks. Amidst this backdrop of easing trade tensions and cooling inflation, identifying promising opportunities in lesser-known companies can be crucial for navigating the shifting economic landscape. In this context, a good stock might be characterized by its resilience to market fluctuations and potential for growth despite broader economic uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Indofood Agri Resources | 30.05% | 2.36% | 41.87% | ★★★★★★ |

| CTCI Advanced Systems | 39.96% | 21.96% | 24.04% | ★★★★★★ |

| Rimoni Industries | NA | 3.98% | 2.35% | ★★★★★★ |

| Terminal X Online | 18.34% | 17.80% | 32.47% | ★★★★★★ |

| Payton Industries | NA | 8.38% | 15.66% | ★★★★★★ |

| Formula Systems (1985) | 34.50% | 9.19% | 12.63% | ★★★★★★ |

| Malam - Team | 91.23% | 12.11% | -6.38% | ★★★★★☆ |

| Rotshtein Realestate | 185.76% | 26.38% | 18.77% | ★★★★☆☆ |

| Libra Insurance | 45.49% | 44.28% | 62.35% | ★★★★☆☆ |

| Polyram Plastic Industries | 41.71% | 10.42% | 9.94% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Gunze (TSE:3002)

Simply Wall St Value Rating: ★★★★★★

Overview: Gunze Limited operates in the functional solutions, apparel, and lifestyle creations sectors both domestically in Japan and internationally, with a market capitalization of approximately ¥97.29 billion.

Operations: Gunze Limited's primary revenue streams include apparel, generating ¥60.22 billion, and functional solutions, contributing ¥50.23 billion. The medical business and lifestyle creations segments add a combined total of approximately ¥24.69 billion to the company's revenue.

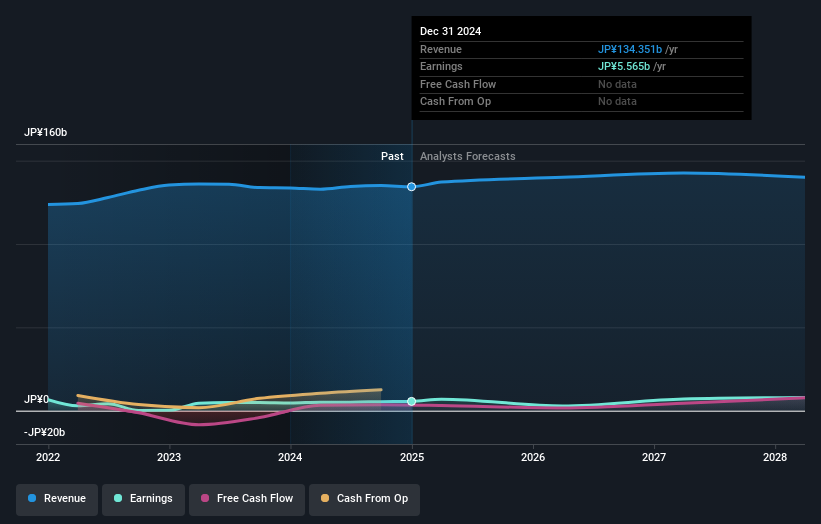

Gunze, a small cap company, is trading at 54.9% below its estimated fair value, making it an intriguing prospect. Over the past year, earnings have grown by 20.6%, outpacing the luxury industry's growth of 15.6%. The company's debt to equity ratio has impressively decreased from 28% to 13.6% over five years, indicating strong financial management. Recent corporate actions include a stock buyback of ¥2.37 billion and dividend announcements reflecting strategic shareholder returns post-stock split adjustments. With earnings forecasted to grow annually by 6.97%, Gunze's prospects seem promising amidst its current valuation advantages and sound financial health.

- Dive into the specifics of Gunze here with our thorough health report.

Evaluate Gunze's historical performance by accessing our past performance report.

Evergreen International Storage & Transport (TWSE:2607)

Simply Wall St Value Rating: ★★★★★★

Overview: Evergreen International Storage & Transport Corporation, along with its subsidiaries, offers inland container transport and container terminal operations across Taiwan, America, and internationally, with a market cap of NT$35.96 billion.

Operations: Evergreen International Storage & Transport generates revenue primarily through inland container transport and container terminal operations. The company has a market capitalization of NT$35.96 billion.

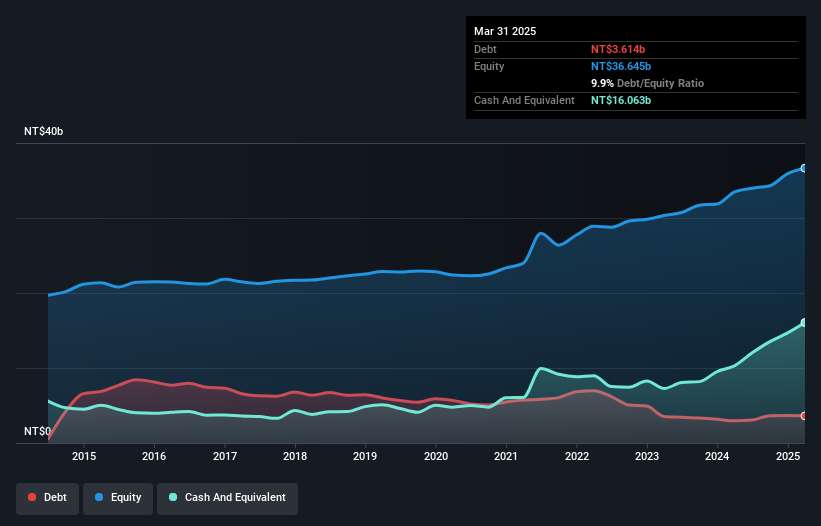

Evergreen International Storage & Transport, a smaller player in the infrastructure sector, has shown promising performance. The company reported Q1 2025 sales of TWD 4.63 billion and net income of TWD 919.88 million, reflecting solid growth from the previous year’s figures of TWD 4.49 billion and TWD 569.36 million respectively. Basic earnings per share increased to TWD 0.86 from last year's TWD 0.53, indicating improved profitability. With earnings growth outpacing the industry at 10%, Evergreen seems well-positioned in its market segment while trading at a notable discount to its estimated fair value by about 26%.

FuSheng Precision (TWSE:6670)

Simply Wall St Value Rating: ★★★★★★

Overview: FuSheng Precision Co., Ltd. operates in the golf and sports equipment sectors across Japan, the United States, and internationally, with a market capitalization of NT$47.69 billion.

Operations: FuSheng Precision generates revenue primarily from its golf and sports equipment businesses. The company's financial performance includes a notable net profit margin trend, which was 8.5% in the most recent period.

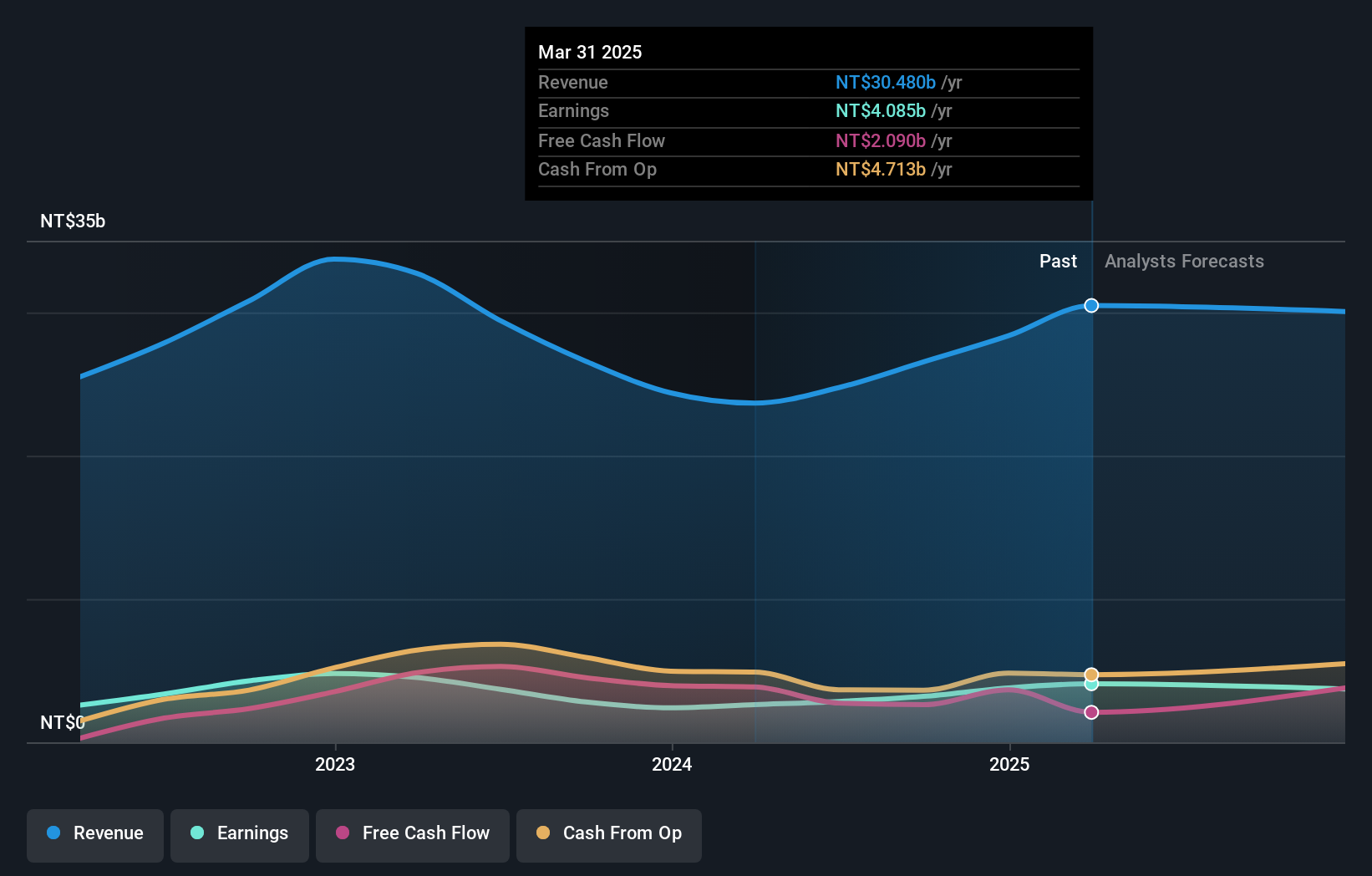

FuSheng Precision, a nimble player in its field, has shown remarkable financial growth with earnings surging 55.7% over the past year, outpacing the leisure industry average of 53.1%. The company's recent Q1 results reflect solid performance with sales reaching TWD 8.48 billion and net income at TWD 1.22 billion, marking significant improvements from the previous year. With a debt-to-equity ratio reduced to 6.9% over five years and trading at roughly 29% below estimated fair value, FuSheng appears undervalued despite forecasts suggesting a modest decline in earnings by an average of 1.8% annually for the next three years.

- Click here to discover the nuances of FuSheng Precision with our detailed analytical health report.

Assess FuSheng Precision's past performance with our detailed historical performance reports.

Make It Happen

- Explore the 3210 names from our Global Undiscovered Gems With Strong Fundamentals screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3002

Gunze

Engages in the functional solutions, apparel, and lifestyle creations businesses in Japan and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives