- Japan

- /

- Consumer Durables

- /

- TSE:1808

How Investors May Respond To HASEKO (TSE:1808) Completing Its ¥12.7 Billion Share Buyback

Reviewed by Sasha Jovanovic

- HASEKO recently completed a share repurchase program, buying back 5,511,400 shares, about 2.03% of its outstanding stock, for ¥12,745.8 million, as announced earlier in 2025.

- This substantial buyback completion is often viewed as a sign of management confidence and can affect how investors interpret the company's outlook.

- With management moving forward decisively on returning capital to shareholders, we’ll consider how this may reshape HASEKO’s investment narrative.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

What Is HASEKO's Investment Narrative?

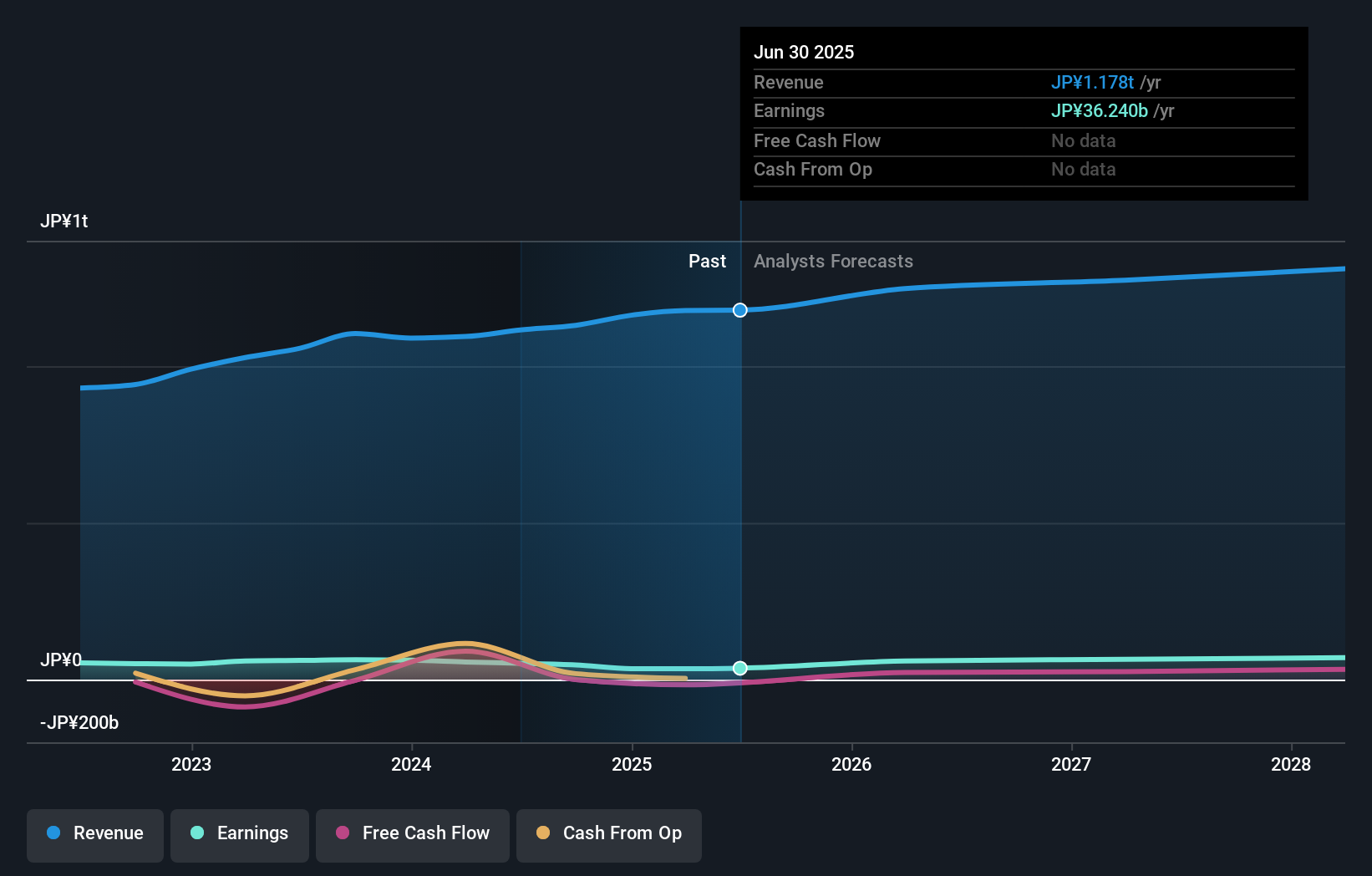

For HASEKO shareholders, the big picture remains rooted in belief in the company’s ability to deliver sustained, if modest, growth as Japan’s residential construction sector evolves. The just-completed buyback is a clear signal from management, affirming their intent to return capital; however, the scale of this repurchase, 2.03%, is unlikely to move the needle on near-term catalysts like earnings recovery, which is top of mind given last year's sharp drop connected to one-off losses. Importantly, consensus still points to a rebound in profits this fiscal year, but sluggish revenue growth and some ongoing margin compression may temper optimism. Added to that, with share price performance already strong and the stock trading near analyst targets, any disappointment in the upcoming earnings or cash flow could introduce volatility, especially with board and management changes still bedding down. The recent news supports confidence, but the fundamental risks around earnings trajectory and valuation remain firmly in focus.

But investors should pay close attention to lingering concerns about margin recovery and board independence. HASEKO's shares are on the way up, but they could be overextended by 19%. Uncover the fair value now.Exploring Other Perspectives

Explore another fair value estimate on HASEKO - why the stock might be worth 16% less than the current price!

Build Your Own HASEKO Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your HASEKO research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free HASEKO research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate HASEKO's overall financial health at a glance.

Want Some Alternatives?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HASEKO might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:1808

HASEKO

Engages in the real estate, construction, and engineering businesses in Japan and internationally.

Slight risk with mediocre balance sheet.

Market Insights

Community Narratives