- Japan

- /

- Consumer Durables

- /

- TSE:1808

Haseko (TSE:1808) Valuation in Focus After Strong Stock Performance and Earnings Growth

Reviewed by Simply Wall St

Price-to-Earnings of 18.9x: Is it justified?

At a price-to-earnings (P/E) ratio of 18.9x, HASEKO’s shares appear expensive compared to both its peer group average and the overall industry. This suggests investors are currently paying a premium for the company’s earnings relative to sector norms.

The price-to-earnings multiple compares a company’s current share price to its per-share earnings. It is a common measure to assess whether a stock is undervalued or overvalued. In the consumer durables sector, it serves as a useful benchmark for evaluating expectations of future growth and profitability.

HASEKO’s above-average P/E ratio may indicate that the market is expecting stronger earnings ahead, or it could reflect heightened enthusiasm after recent share price gains. However, given its earnings growth outlook and recent performance, investors should weigh whether such optimism is warranted or if the valuation has outrun fundamentals.

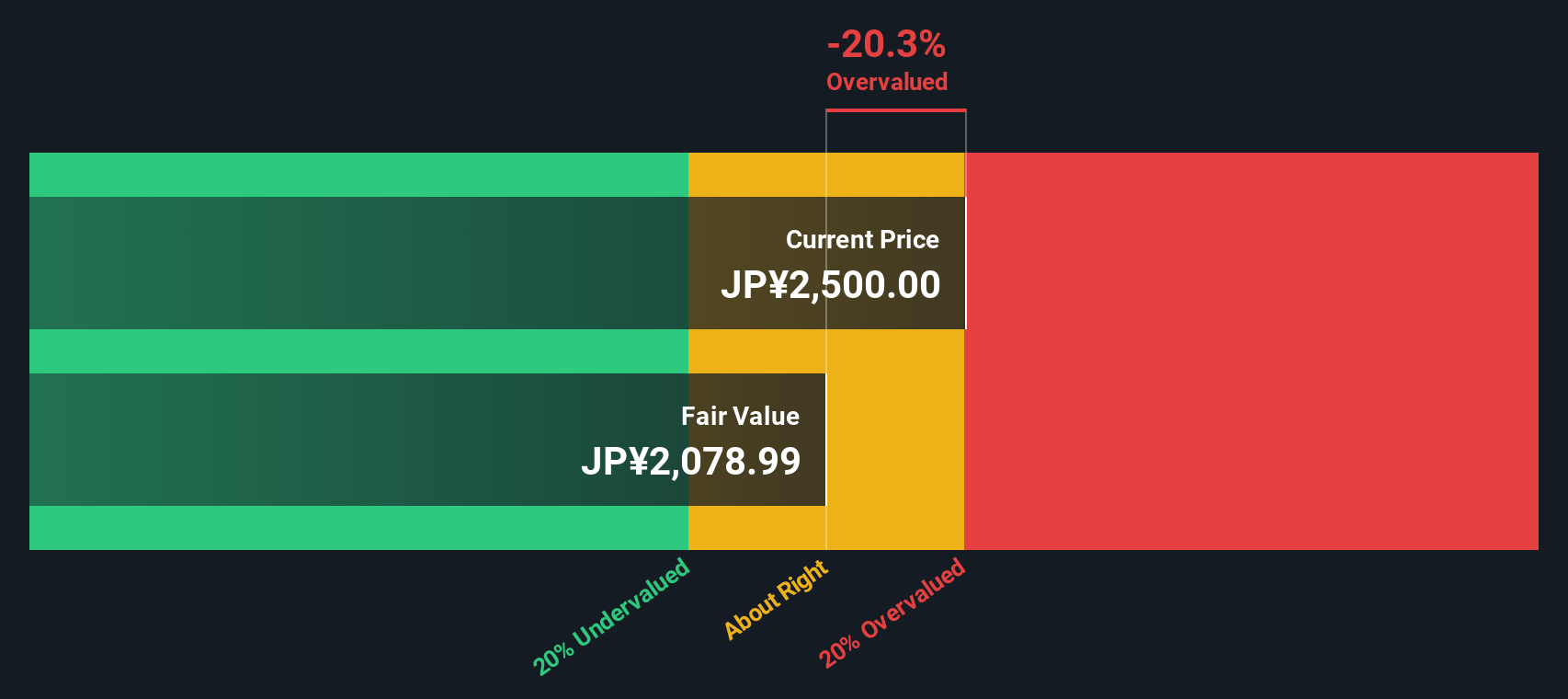

Result: Fair Value of ¥2,071.91 (OVERVALUED)

See our latest analysis for HASEKO.However, risks remain, including potential slowing revenue growth or a downturn in net income. These factors could challenge the sustainability of recent gains.

Find out about the key risks to this HASEKO narrative.Another Perspective: What Does Our DCF Model Suggest?

While the earlier valuation method signals HASEKO could be trading on the expensive side, the SWS DCF model points in the same direction. This suggests shares may also be overvalued on a cash flow basis. Do both approaches agree for the right reasons, or is there more beneath the surface?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own HASEKO Narrative

If you see things differently or want to dig deeper into the data yourself, building your own perspective takes just a few minutes. Do it your way

A great starting point for your HASEKO research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Unlock even more market opportunities by targeting high-potential stocks with smart screeners. Turn your next insight into action before others catch on.

- Uncover tomorrow's big gainers by hunting for undervalued opportunities with our undervalued stocks based on cash flows before they appear on everyone else’s radar.

- Boost your income strategy by focusing on companies offering robust payouts through dividend stocks with yields > 3% you may have overlooked.

- Feed your curiosity for innovation by checking out pioneers reshaping technology with AI penny stocks in the AI space.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HASEKO might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:1808

HASEKO

Engages in the real estate, construction, and engineering businesses in Japan and internationally.

Average dividend payer with slight risk.

Market Insights

Community Narratives