- Japan

- /

- Consumer Durables

- /

- TSE:1808

A Look at HASEKO's (TSE:1808) Valuation Following Its Completed Share Buyback Program

Reviewed by Kshitija Bhandaru

HASEKO (TSE:1808) just wrapped up its planned buyback, repurchasing over 5.5 million shares, or about 2% of its outstanding stock. The program, finished as scheduled, may offer signals for value-focused investors.

See our latest analysis for HASEKO.

HASEKO shares have built solid momentum this year, with a year-to-date share price return of 21.8% and a standout 1-year total shareholder return of 34.5%. The recently completed buyback adds to a run of positive news and reinforces confidence in the company’s ongoing growth story.

If you’re interested in where strong momentum and strategic moves can lead, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

The question now is whether HASEKO’s recent gains and buyback activity mean there is room left for upside, or if the stock’s valuation already factors in the company’s future growth potential. Could there still be a compelling buying opportunity?

Price-to-Earnings of 18.2x: Is it justified?

With HASEKO trading at a price-to-earnings ratio of 18.2x, the stock looks significantly more expensive than similar companies in its industry, raising questions about whether investors are expecting higher growth or simply paying a premium for recent momentum. The last close price was ¥2,465.

The price-to-earnings (P/E) ratio tells investors how much they are paying for each ¥1 of the company’s earnings. For consumer durables, this is an important benchmark since earnings trends can often shift quickly with changes in demand and market cycles.

While HASEKO’s P/E is above the industry average of 11.5x and its peers' average of 10.8x, it remains below its estimated fair value ratio of 19.3x. This suggests the market may be pricing in stronger earnings potential ahead, but not to the level that the fair value analysis projects. If earnings growth or profitability does not accelerate as anticipated, the share price could face downward pressure. If expectations are met, there could be further upside.

Compared to the broader industry, HASEKO is trading at a noticeable premium. The market seems willing to pay up for HASEKO’s story, perhaps due to its recent buyback and ongoing growth signals. Notably, the fair ratio of 19.3x points to where valuation could move if performance justifies the optimism.

Explore the SWS fair ratio for HASEKO

Result: Price-to-Earnings of 18.2x (OVERVALUED)

However, slower revenue growth or a failure to meet earnings expectations could prompt the market to reassess HASEKO's premium valuation and momentum.

Find out about the key risks to this HASEKO narrative.

Another View: What Does Our DCF Model Say?

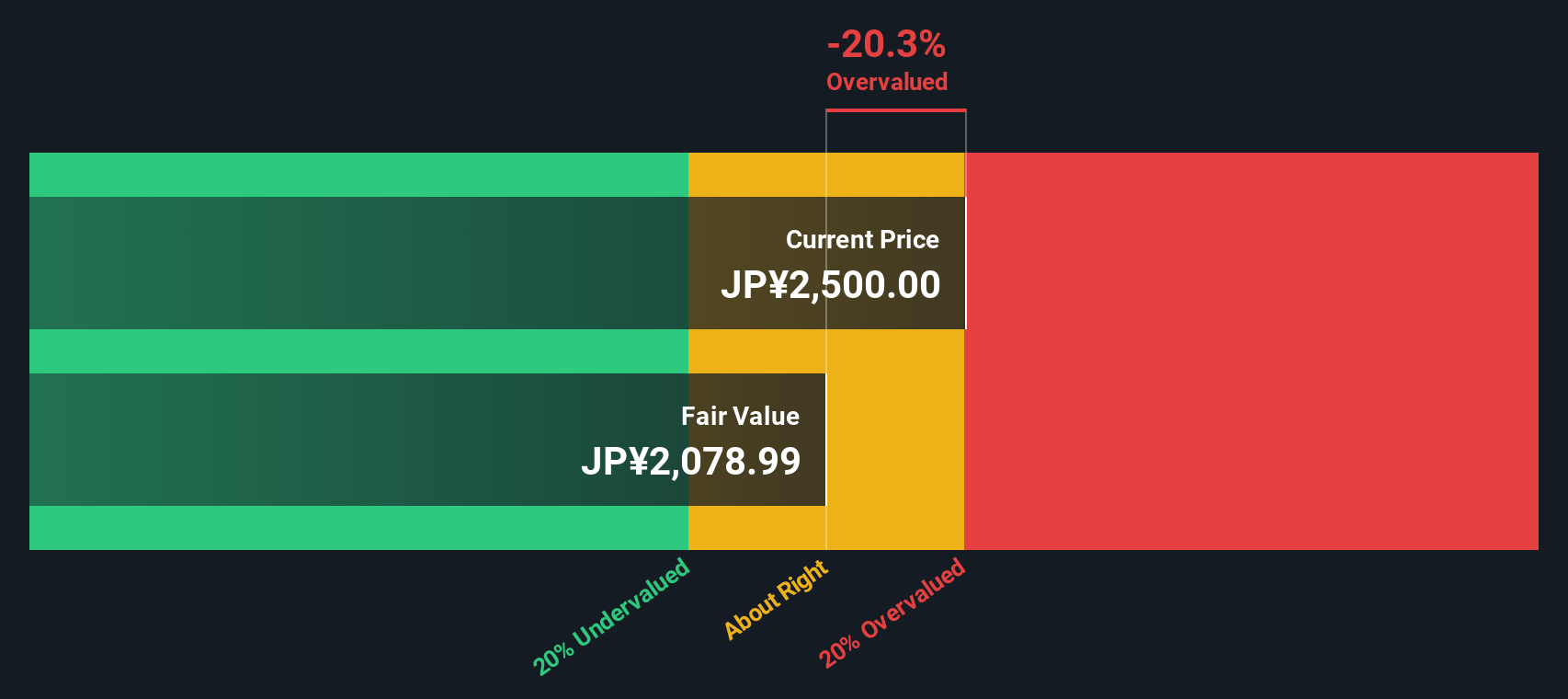

While price-to-earnings suggests HASEKO may be priced for optimism, our DCF model offers a different perspective. According to this method, the current share price of ¥2,465 is above our estimate of fair value at ¥2,065.67. This indicates the stock could be overvalued if cash flows play out as expected. Does this alternative view spell caution, or does the market know something the numbers do not?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out HASEKO for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own HASEKO Narrative

If you want to dig into the numbers for yourself or take a different approach, you can easily craft your own view of HASEKO’s valuation in just a few minutes. Do it your way

A great starting point for your HASEKO research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Step up your investing game by tapping into new opportunities that others might overlook. Find your next winning stock idea with these powerful tools:

- Capture recurring income by scanning for these 18 dividend stocks with yields > 3% offering robust yields above 3% and strong financial footing.

- Spot the future of healthcare technology by zeroing in on these 33 healthcare AI stocks making breakthroughs in medical innovation and AI-driven solutions.

- Seize bargains trading below their intrinsic value by checking out these 893 undervalued stocks based on cash flows tied to strong underlying cash flows and financial health.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HASEKO might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:1808

HASEKO

Engages in the real estate, construction, and engineering businesses in Japan and internationally.

Slight risk with mediocre balance sheet.

Market Insights

Community Narratives