- Japan

- /

- Consumer Durables

- /

- TSE:1766

Spotlight On 3 Japanese Growth Stocks With At Least 14% Insider Ownership

Reviewed by Simply Wall St

Amidst a backdrop of marginal weekly losses for Japan's Nikkei 225 and TOPIX indices, the Japanese market remains a focal point for investors closely watching the Bank of Japan's hints at potential interest rate hikes. This cautious approach by the central bank reflects broader economic uncertainties, setting a complex stage for evaluating investment opportunities in growth-oriented companies with substantial insider ownership. High insider ownership can be indicative of leadership confidence in the company’s future prospects, an important consideration under current market conditions.

Top 10 Growth Companies With High Insider Ownership In Japan

| Name | Insider Ownership | Earnings Growth |

| SHIFT (TSE:3697) | 35.5% | 27.2% |

| Hottolink (TSE:3680) | 27% | 57.3% |

| Medley (TSE:4480) | 34.1% | 23.4% |

| Micronics Japan (TSE:6871) | 15.3% | 39.5% |

| Kasumigaseki CapitalLtd (TSE:3498) | 35.5% | 44.6% |

| ExaWizards (TSE:4259) | 24.8% | 84.3% |

| Money Forward (TSE:3994) | 21.4% | 63.5% |

| Soiken Holdings (TSE:2385) | 19.8% | 118.4% |

| Soracom (TSE:147A) | 17.2% | 59.1% |

| freee K.K (TSE:4478) | 24% | 78.8% |

Let's uncover some gems from our specialized screener.

Token (TSE:1766)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Token Corporation, a construction company based in Japan, operates with a market capitalization of approximately ¥148.82 billion.

Operations: The company's operations primarily focus on construction activities within Japan.

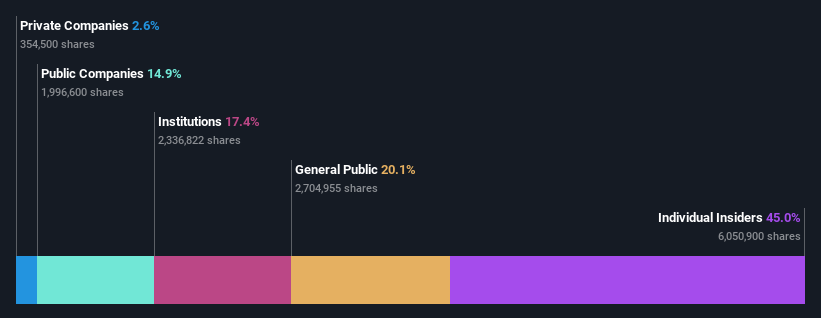

Insider Ownership: 14.5%

Token Corporation, a Japanese company, is set to see its earnings grow by 27% annually, outpacing the local market's 8.9%. However, its revenue growth at 5.2% per year is modest compared to high-growth benchmarks and profit margins have dipped from last year's 2.5% to 1.6%. Despite not being top in insider ownership dynamics, it maintains a steady dividend yield of 2.26%. No recent insider trading activity has been reported as of the latest quarter ending March 2024.

- Navigate through the intricacies of Token with our comprehensive analyst estimates report here.

- The analysis detailed in our Token valuation report hints at an inflated share price compared to its estimated value.

Avant Group (TSE:3836)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Avant Group Corporation operates in the sector of accounting, business intelligence, and outsourcing services with a market capitalization of ¥48.72 billion.

Operations: The company generates revenue through its involvement in accounting, business intelligence, and outsourcing services.

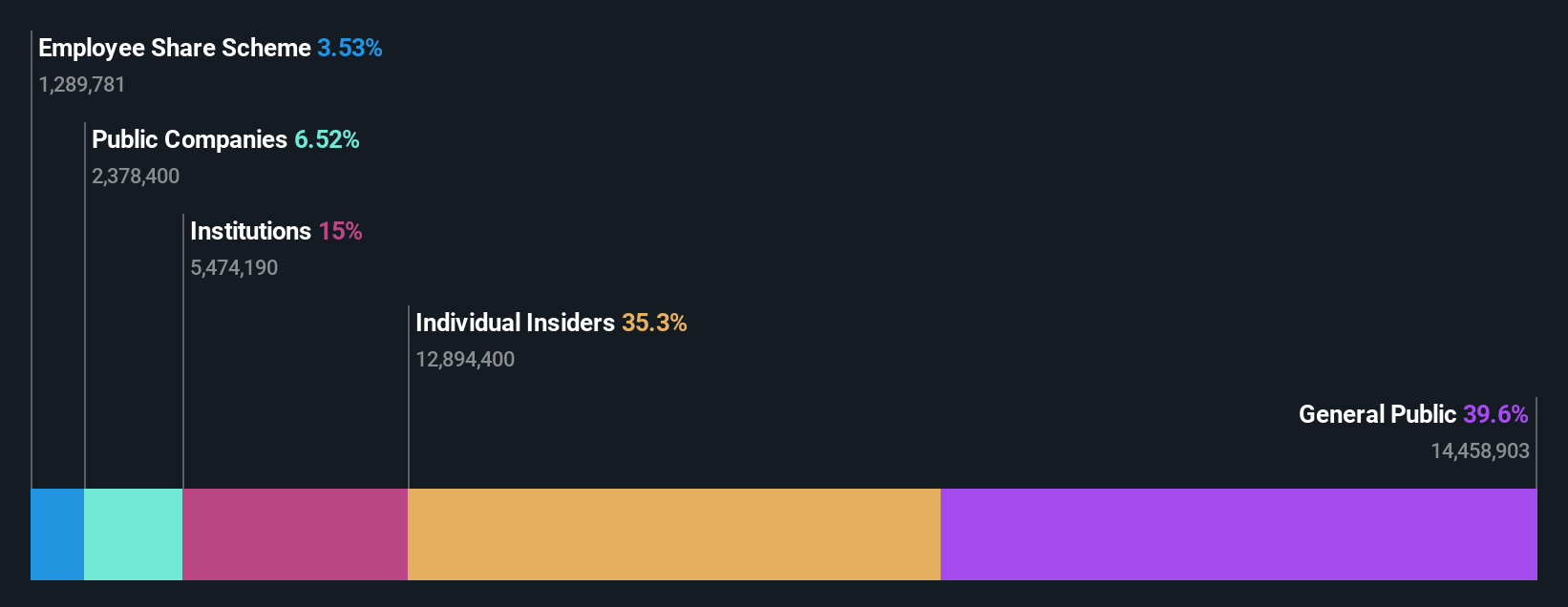

Insider Ownership: 35%

Avant Group, trading at 64.5% below its estimated fair value, is positioned for robust growth with earnings expected to increase by 21.77% annually over the next three years. This growth rate surpasses Japan's market average significantly. Although revenue growth projections of 15.5% per year do not meet the high-growth benchmark of 20%, they still outpace the broader Japanese market's forecast of 4.4%. Recently, Avant announced a share buyback program aimed at enhancing shareholder value, committing ¥1 billion to repurchase shares by November 2024.

- Click here to discover the nuances of Avant Group with our detailed analytical future growth report.

- The valuation report we've compiled suggests that Avant Group's current price could be quite moderate.

Tri Chemical Laboratories (TSE:4369)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Tri Chemical Laboratories Inc., with a market cap of ¥143.96 billion, specializes in producing chemical products used in various applications including semiconductors, coatings, optical fibers, solar cells, and compound semiconductors.

Operations: The company generates its revenue from the production of chemical products used in semiconductors, coatings, optical fibers, solar cells, and compound semiconductors.

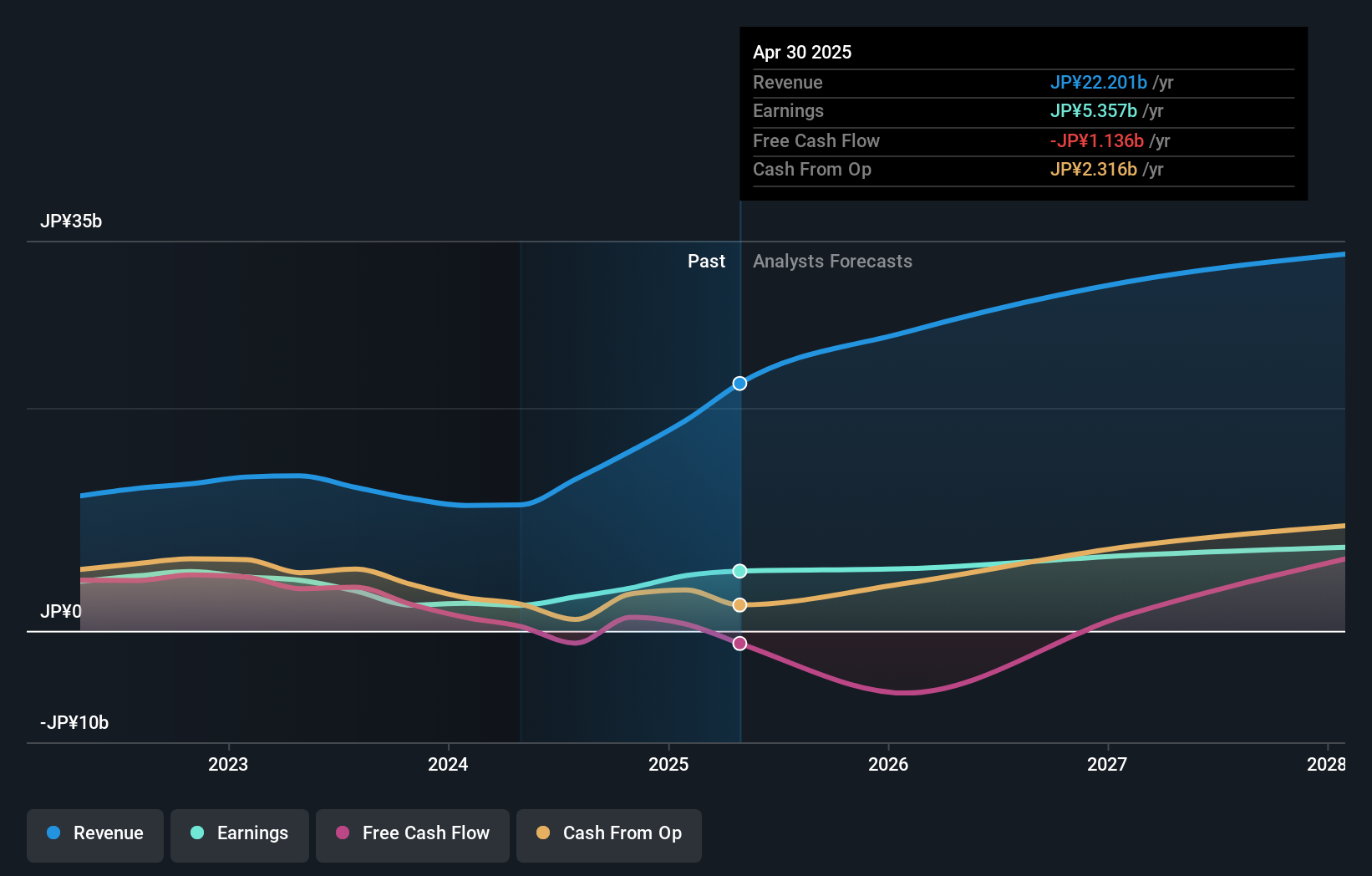

Insider Ownership: 17.4%

Tri Chemical Laboratories is valued at 22.8% below its fair value, indicating potential for market correction. The company's earnings are set to expand by 30.78% annually over the next three years, outpacing the Japanese market significantly. Despite a high volatility in share price recently and a dip in profit margins from 35% to 22%, revenue growth is robust at 25.5% per year. Additionally, consistent dividend payments and positive corporate guidance suggest steady financial management amidst aggressive growth targets.

- Click to explore a detailed breakdown of our findings in Tri Chemical Laboratories' earnings growth report.

- Our valuation report unveils the possibility Tri Chemical Laboratories' shares may be trading at a premium.

Key Takeaways

- Navigate through the entire inventory of 105 Fast Growing Japanese Companies With High Insider Ownership here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Token might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:1766

Flawless balance sheet established dividend payer.