- Japan

- /

- Consumer Durables

- /

- TSE:1757

Souken Ace Co., Ltd.'s (TSE:1757) 26% Cheaper Price Remains In Tune With Revenues

To the annoyance of some shareholders, Souken Ace Co., Ltd. (TSE:1757) shares are down a considerable 26% in the last month, which continues a horrid run for the company. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 48% share price drop.

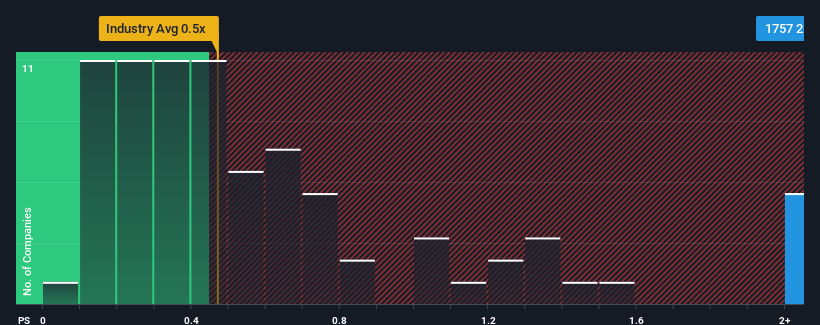

Even after such a large drop in price, when almost half of the companies in Japan's Consumer Durables industry have price-to-sales ratios (or "P/S") below 0.5x, you may still consider Souken Ace as a stock not worth researching with its 2.9x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Souken Ace

How Souken Ace Has Been Performing

For instance, Souken Ace's receding revenue in recent times would have to be some food for thought. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/S from collapsing. If not, then existing shareholders may be quite nervous about the viability of the share price.

Although there are no analyst estimates available for Souken Ace, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Souken Ace's Revenue Growth Trending?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Souken Ace's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 43%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 158% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

When compared to the industry's one-year growth forecast of 0.06%, the most recent medium-term revenue trajectory is noticeably more alluring

In light of this, it's understandable that Souken Ace's P/S sits above the majority of other companies. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

The Key Takeaway

Souken Ace's shares may have suffered, but its P/S remains high. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

It's no surprise that Souken Ace can support its high P/S given the strong revenue growth its experienced over the last three-year is superior to the current industry outlook. Right now shareholders are comfortable with the P/S as they are quite confident revenue aren't under threat. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

There are also other vital risk factors to consider and we've discovered 4 warning signs for Souken Ace (2 make us uncomfortable!) that you should be aware of before investing here.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:1757

Low with imperfect balance sheet.

Market Insights

Community Narratives