- Japan

- /

- Professional Services

- /

- TSE:9757

JAPAN MATERIAL And 2 Other Stocks That May Be Trading Below Fair Value

Reviewed by Simply Wall St

Japan’s stock markets have experienced notable gains recently, buoyed by optimism surrounding China’s stimulus measures and dovish commentary from the Bank of Japan. With the Nikkei 225 Index rising 5.6% and the TOPIX Index up 3.7%, investors are increasingly looking for opportunities in stocks that may be trading below their fair value. In this context, identifying undervalued stocks can present a compelling investment opportunity, especially when market conditions are favorable and economic indicators suggest potential growth.

Top 10 Undervalued Stocks Based On Cash Flows In Japan

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Hagiwara Electric Holdings (TSE:7467) | ¥3580.00 | ¥6803.36 | 47.4% |

| Densan System Holdings (TSE:4072) | ¥2689.00 | ¥5311.46 | 49.4% |

| IMAGICA GROUP (TSE:6879) | ¥519.00 | ¥1021.58 | 49.2% |

| Stella Chemifa (TSE:4109) | ¥4220.00 | ¥8074.88 | 47.7% |

| Pilot (TSE:7846) | ¥4496.00 | ¥8871.42 | 49.3% |

| Taiyo Yuden (TSE:6976) | ¥3178.00 | ¥6080.61 | 47.7% |

| Hibino (TSE:2469) | ¥3465.00 | ¥6926.53 | 50% |

| Appier Group (TSE:4180) | ¥1836.00 | ¥3492.16 | 47.4% |

| NATTY SWANKY holdingsLtd (TSE:7674) | ¥3215.00 | ¥6009.03 | 46.5% |

| Money Forward (TSE:3994) | ¥5976.00 | ¥11866.18 | 49.6% |

Let's review some notable picks from our screened stocks.

JAPAN MATERIAL (TSE:6055)

Overview: JAPAN MATERIAL Co., Ltd. operates in the electronics and graphics businesses in Japan and has a market cap of ¥199.52 billion.

Operations: The company's revenue segments include Electronics with ¥47.65 billion, Graphics Solution Business with ¥1.56 billion, and Solar Power Generation Business with ¥206 million.

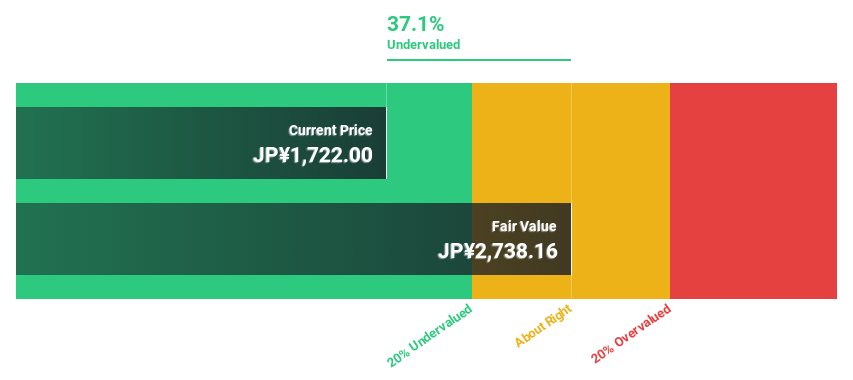

Estimated Discount To Fair Value: 29.2%

Japan Material, trading at ¥1942, is significantly undervalued based on its discounted cash flow (DCF) analysis with an estimated fair value of ¥2741.39. The company shows strong growth prospects with earnings expected to grow 24.27% annually, outpacing the Japanese market's forecasted 8.7%. Revenue growth is also robust at 14.7% per year compared to the market's 4.3%. However, the stock has experienced high volatility over the past three months and its return on equity is forecasted to be relatively low at 17.9% in three years.

- In light of our recent growth report, it seems possible that JAPAN MATERIAL's financial performance will exceed current levels.

- Click here to discover the nuances of JAPAN MATERIAL with our detailed financial health report.

BayCurrent Consulting (TSE:6532)

Overview: BayCurrent Consulting, Inc. offers consulting services in Japan and has a market cap of ¥819.30 billion.

Operations: BayCurrent Consulting, Inc. generates revenue primarily from providing consulting services within Japan.

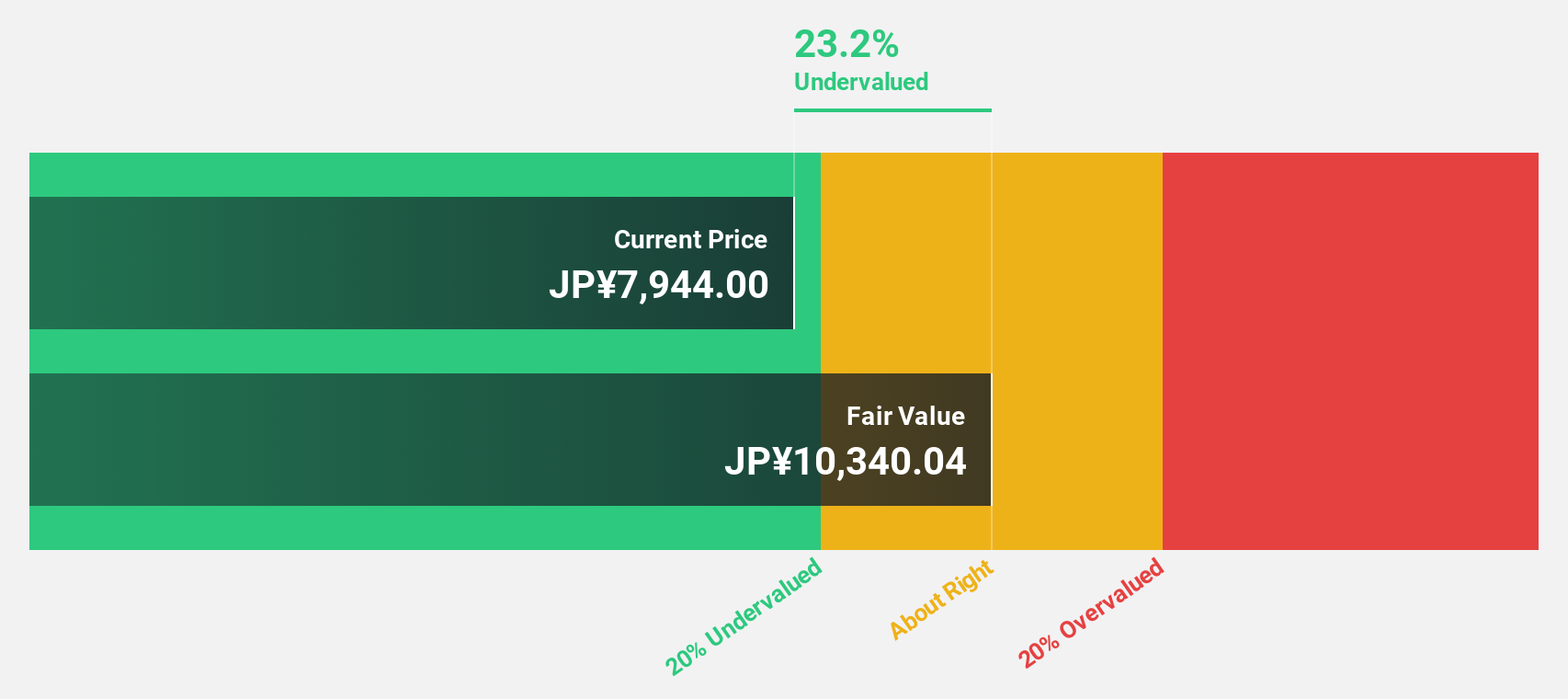

Estimated Discount To Fair Value: 43.2%

BayCurrent Consulting, trading at ¥5400, is significantly undervalued based on its discounted cash flow (DCF) analysis with an estimated fair value of ¥9499.93. The company's earnings are forecast to grow 18.4% annually, surpassing the Japanese market's 8.7%. Revenue growth is also expected at 18.4% per year, higher than the market's 4.3%. However, despite strong profit growth forecasts and a high return on equity projection of 35.5% in three years, revenue growth remains below the significant threshold of 20%.

- According our earnings growth report, there's an indication that BayCurrent Consulting might be ready to expand.

- Navigate through the intricacies of BayCurrent Consulting with our comprehensive financial health report here.

Funai Soken Holdings (TSE:9757)

Overview: Funai Soken Holdings Incorporated offers consulting services to manufacturing and retail businesses in Japan, with a market cap of ¥112.28 billion.

Operations: The company's revenue segments include Business Consulting at ¥22.26 billion, Digital Solutions at ¥5.20 billion, and Logistics Business at ¥4.48 billion.

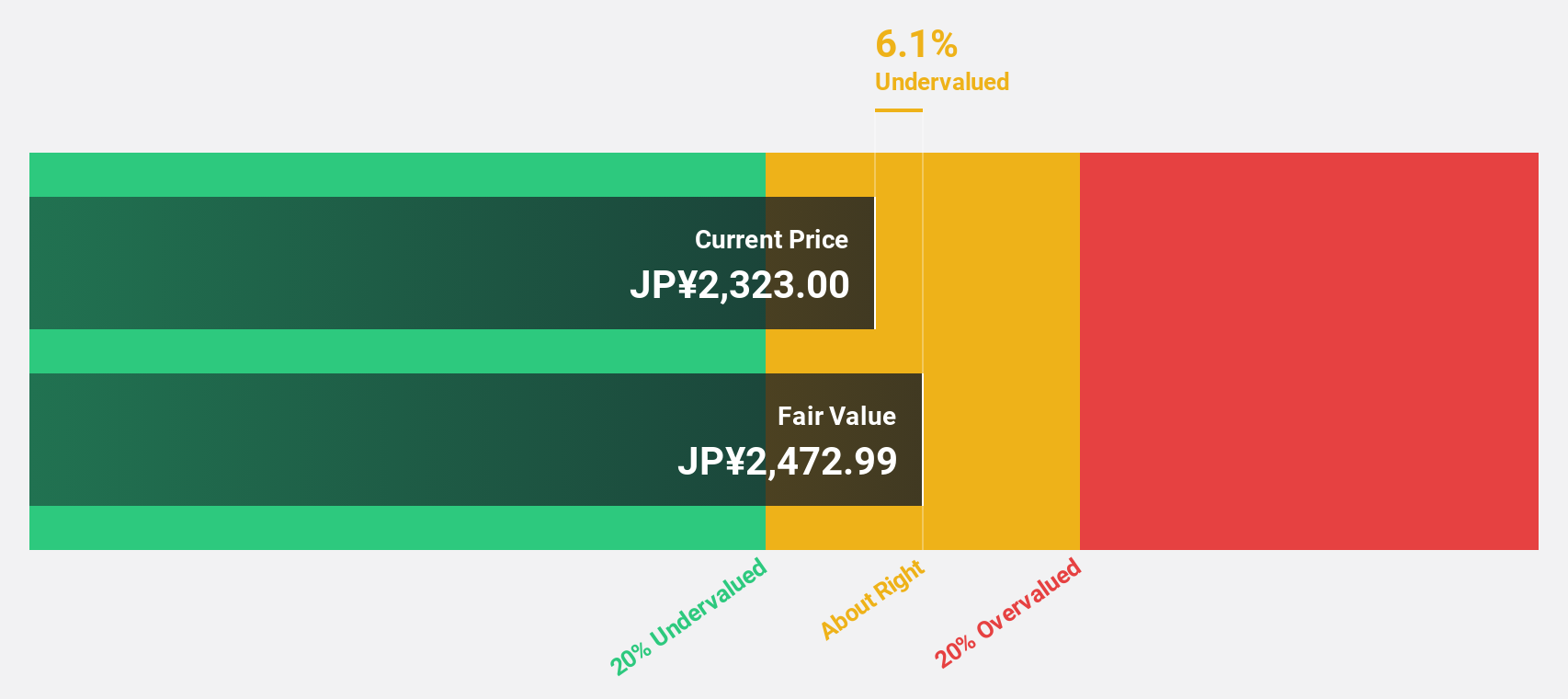

Estimated Discount To Fair Value: 26.6%

Funai Soken Holdings is trading at ¥2422, significantly below its estimated fair value of ¥3300.1 based on discounted cash flow (DCF) analysis. The company's earnings are forecast to grow 9.31% annually, outpacing the Japanese market's 8.7%. Recent buybacks totaling ¥2.85 billion and a dividend increase to ¥37 per share highlight shareholder returns, though the dividend track record remains unstable. Despite slower revenue growth at 8.8%, it surpasses the market average of 4.3%.

- Our earnings growth report unveils the potential for significant increases in Funai Soken Holdings' future results.

- Dive into the specifics of Funai Soken Holdings here with our thorough financial health report.

Next Steps

- Discover the full array of 81 Undervalued Japanese Stocks Based On Cash Flows right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9757

Funai Soken Holdings

Provides consulting services to manufacturing and retail businesses in Japan.

Outstanding track record with flawless balance sheet and pays a dividend.