- Japan

- /

- Semiconductors

- /

- TSE:6055

3 Value Stocks Including Xi'an Manareco New MaterialsLtd Priced Below Estimated Worth

Reviewed by Simply Wall St

As global markets navigate a landscape marked by inflation concerns and political uncertainty, value stocks have shown resilience compared to their growth counterparts. In this environment, identifying undervalued stocks can be particularly rewarding for investors who focus on companies with strong fundamentals that are priced below their estimated worth.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Hunan Jiudian Pharmaceutical (SZSE:300705) | CN¥17.11 | CN¥34.17 | 49.9% |

| Türkiye Sise Ve Cam Fabrikalari (IBSE:SISE) | TRY39.32 | TRY78.59 | 50% |

| Decisive Dividend (TSXV:DE) | CA$5.96 | CA$11.89 | 49.9% |

| Helens International Holdings (SEHK:9869) | HK$1.93 | HK$3.85 | 49.9% |

| Elekta (OM:EKTA B) | SEK61.10 | SEK122.02 | 49.9% |

| Tongqinglou Catering (SHSE:605108) | CN¥21.93 | CN¥43.78 | 49.9% |

| Meriaura Group Oyj (OM:MERIS) | SEK0.49 | SEK0.98 | 50% |

| Constellium (NYSE:CSTM) | US$10.32 | US$20.58 | 49.9% |

| W5 Solutions (OM:W5) | SEK47.20 | SEK93.96 | 49.8% |

| Andrada Mining (AIM:ATM) | £0.0235 | £0.047 | 49.8% |

Let's dive into some prime choices out of the screener.

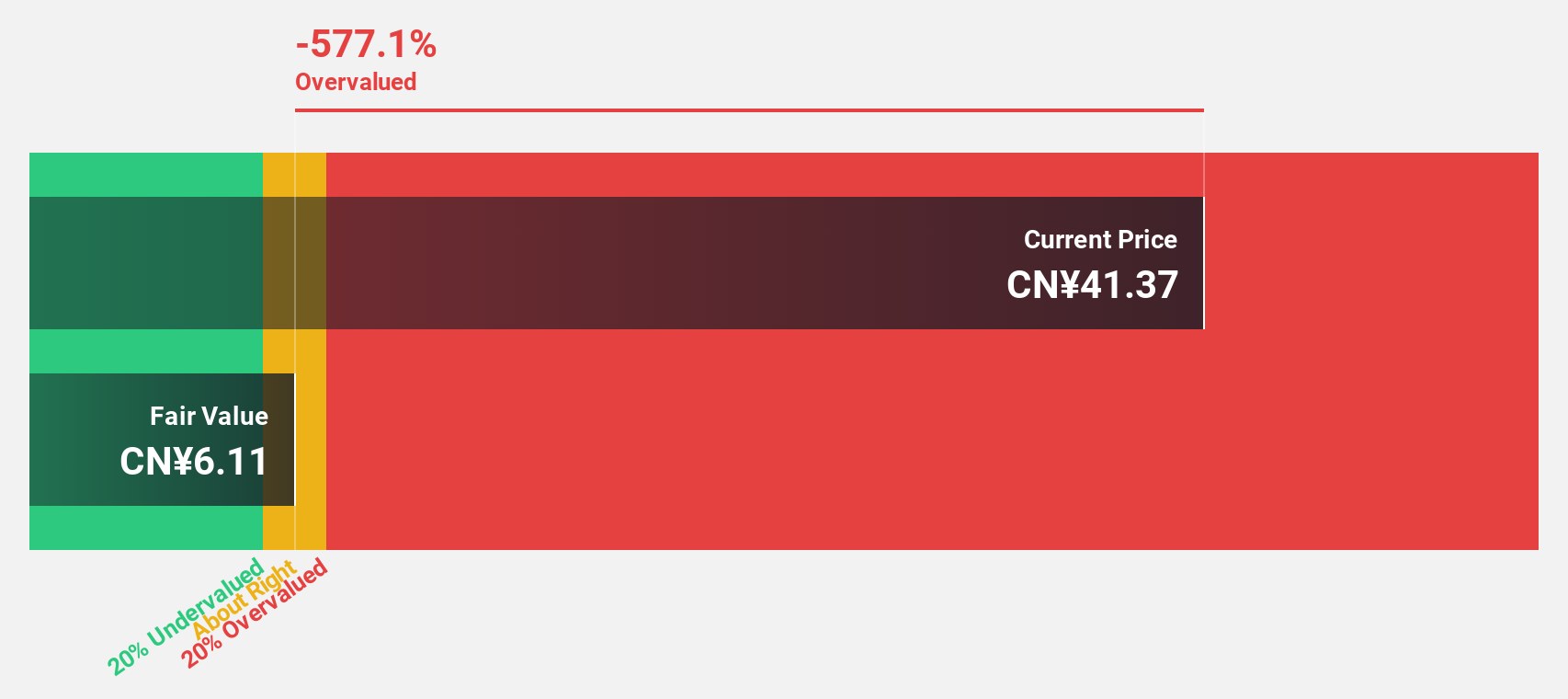

Xi'an Manareco New MaterialsLtd (SHSE:688550)

Overview: Xi'an Manareco New Materials Co., Ltd specializes in the manufacturing and marketing of liquid crystal materials, OLED materials, and drug intermediates, with a market cap of CN¥5.24 billion.

Operations: The company's revenue from Specialty Chemicals amounts to CN¥1.37 billion.

Estimated Discount To Fair Value: 45.9%

Xi'an Manareco New Materials Ltd. appears undervalued, trading at 45.9% below its estimated fair value of CNY 55.96, with a current price of CNY 30.3. The company reported strong earnings growth of 63.5% year-over-year and is forecast to continue growing earnings by 25% annually, outpacing the Chinese market's average growth rate. Despite a low forecasted return on equity, revenue is expected to grow significantly at an annual rate of 23.9%.

- Our expertly prepared growth report on Xi'an Manareco New MaterialsLtd implies its future financial outlook may be stronger than recent results.

- Delve into the full analysis health report here for a deeper understanding of Xi'an Manareco New MaterialsLtd.

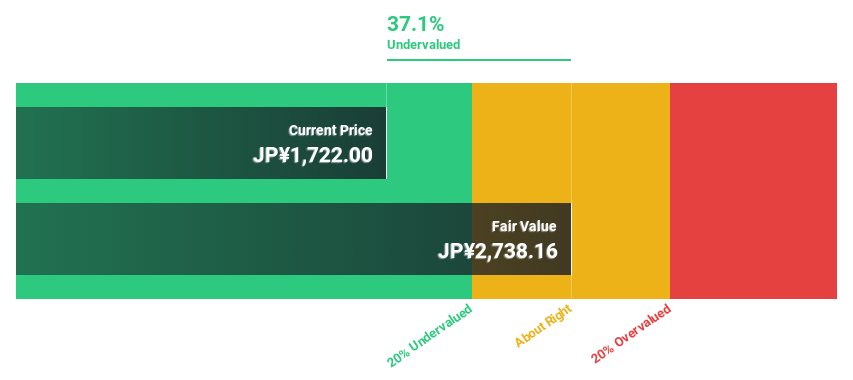

JAPAN MATERIAL (TSE:6055)

Overview: JAPAN MATERIAL Co., Ltd. operates in the electronics and graphics sectors in Japan, with a market cap of ¥184.14 billion.

Operations: The company's revenue is primarily derived from the Electronics segment, which generated ¥46.94 billion, followed by the Graphics Solution Business with ¥1.67 billion and the Solar Power Generation Business contributing ¥205 million.

Estimated Discount To Fair Value: 36%

Japan Material is trading at ¥1,792, significantly below its estimated fair value of ¥2,800.99. The company is expected to see substantial earnings growth of 20.6% annually over the next three years, surpassing the Japanese market's average growth rate. Revenue is also forecast to grow at 14.1% per year but remains below the 20% mark for high growth classification. Despite recent share price volatility and a modest return on equity forecasted at 17.4%, Japan Material presents an opportunity for investors focusing on undervalued stocks based on cash flows due to its current valuation discount and strong projected earnings trajectory.

- Insights from our recent growth report point to a promising forecast for JAPAN MATERIAL's business outlook.

- Unlock comprehensive insights into our analysis of JAPAN MATERIAL stock in this financial health report.

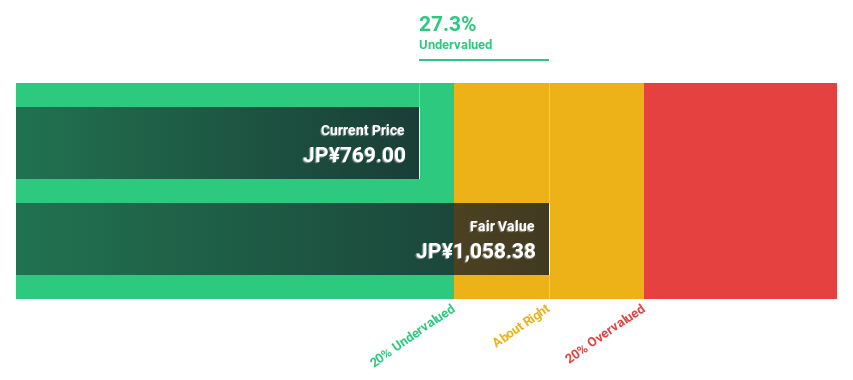

NOMURA (TSE:9716)

Overview: NOMURA Co., Ltd. specializes in research, planning, consulting, design, layout, production and construction, as well as operation and management for space creation both in Japan and internationally, with a market cap of approximately ¥103.63 billion.

Operations: Revenue Segments (in millions of ¥): NOMURA Co., Ltd. derives its revenue from research, planning, consulting, design, layout, production and construction, and operation and management services related to space creation both domestically and internationally.

Estimated Discount To Fair Value: 10.9%

Nomura is trading at ¥929, slightly below its fair value estimate of ¥1,042.7. The company forecasts significant earnings growth of 27.95% annually over the next three years, outpacing the Japanese market's average growth rate. Despite a low return on equity forecasted at 11%, recent upward revisions in earnings guidance and dividend increases highlight positive cash flow prospects, driven by large-scale projects in various markets including urban redevelopment and Expo 2025 Osaka-Kansai initiatives.

- Our comprehensive growth report raises the possibility that NOMURA is poised for substantial financial growth.

- Click to explore a detailed breakdown of our findings in NOMURA's balance sheet health report.

Seize The Opportunity

- Take a closer look at our Undervalued Stocks Based On Cash Flows list of 870 companies by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6055

JAPAN MATERIAL

Operates in the electronics and graphics businesses in Japan.

Flawless balance sheet with solid track record and pays a dividend.