Amid a backdrop of heightened global market volatility and specific challenges in the technology sector, Japan's stock markets have shown resilience, albeit with some sectors facing pressure due to U.S. restrictions on semiconductor exports. In this environment, dividend stocks can offer investors potential stability and income generation opportunities.

Top 10 Dividend Stocks In Japan

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 3.87% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 3.88% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.64% | ★★★★★★ |

| Mitsubishi Shokuhin (TSE:7451) | 3.56% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.61% | ★★★★★★ |

| KurimotoLtd (TSE:5602) | 4.38% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.19% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.68% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.59% | ★★★★★★ |

| Innotech (TSE:9880) | 4.35% | ★★★★★★ |

Click here to see the full list of 421 stocks from our Top Japanese Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

Nippon Care Supply (TSE:2393)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nippon Care Supply Co., Ltd. operates primarily in the rental and wholesale of welfare equipment within Japan, with a market capitalization of approximately ¥32.17 billion.

Operations: Nippon Care Supply Co., Ltd. primarily generates its revenue from the rental and wholesale of welfare equipment in Japan.

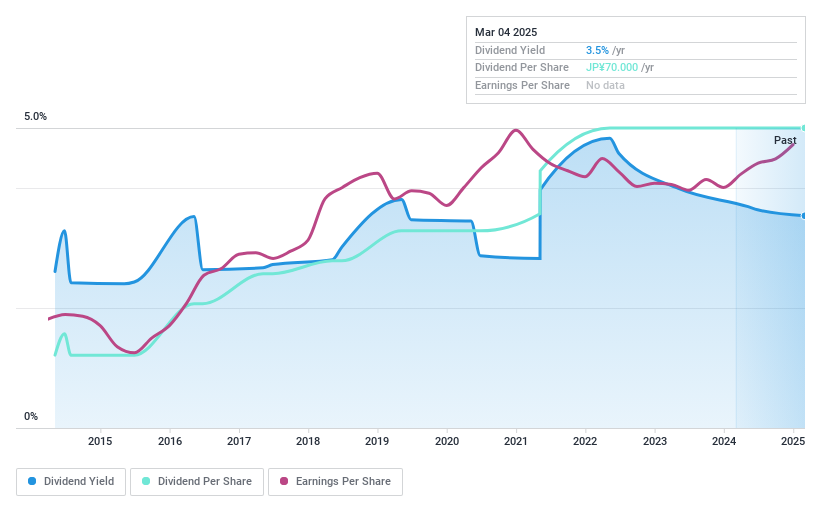

Dividend Yield: 3.5%

Nippon Care Supply has maintained stable and reliable dividend payments over the past decade, with growth in distributions during this period. However, its current yield of 3.49% is slightly below the top quartile of Japanese dividend stocks. The dividends are not well supported by free cash flows or earnings, indicating potential sustainability issues. Notably, the company's payout ratio stands at 72.8%, suggesting some coverage by earnings despite financial constraints.

- Take a closer look at Nippon Care Supply's potential here in our dividend report.

- Our valuation report here indicates Nippon Care Supply may be overvalued.

Tenryu Saw Mfg (TSE:5945)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Tenryu Saw Mfg. Co., Ltd. is a company based in Japan that specializes in the manufacturing and international sale of saw blades, with a market capitalization of ¥18.07 billion.

Operations: Tenryu Saw Mfg. Co., Ltd. generates its revenue primarily from the production and global distribution of saw blades.

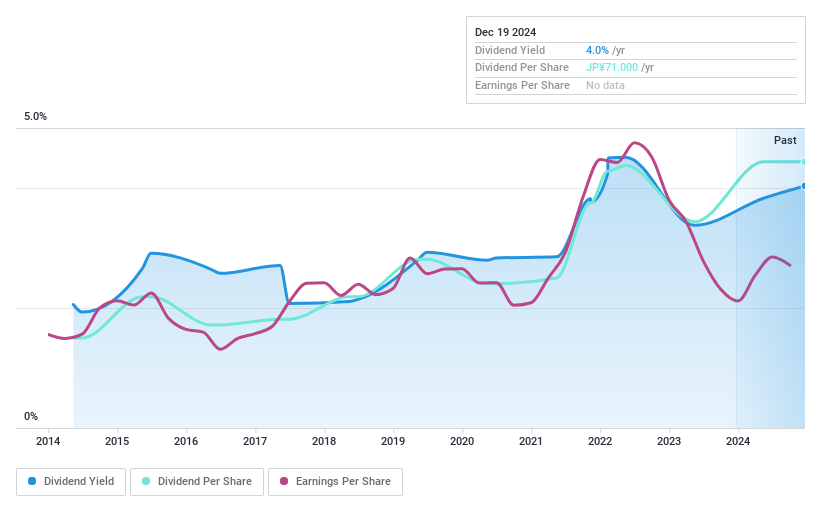

Dividend Yield: 3.5%

Tenryu Saw Mfg. has seen a decade of dividend growth, yet its current yield of 3.55% barely surpasses the top quartile in Japan's market. Despite a reasonable earnings payout ratio of 50%, the dividends suffer from poor coverage by free cash flows, with a high cash payout ratio at 118%. This financial strain hints at potential sustainability challenges for future payouts, exacerbated by historically volatile dividend payments over the past ten years.

- Unlock comprehensive insights into our analysis of Tenryu Saw Mfg stock in this dividend report.

- Our valuation report unveils the possibility Tenryu Saw Mfg's shares may be trading at a premium.

Asia Air Survey (TSE:9233)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Asia Air Survey Co., Ltd. specializes in aerial surveying services and products, operating both in Japan and internationally, with a market capitalization of ¥20.77 billion.

Operations: Asia Air Survey Co., Ltd. generates its revenue primarily from aerial surveying services and products across domestic and international markets.

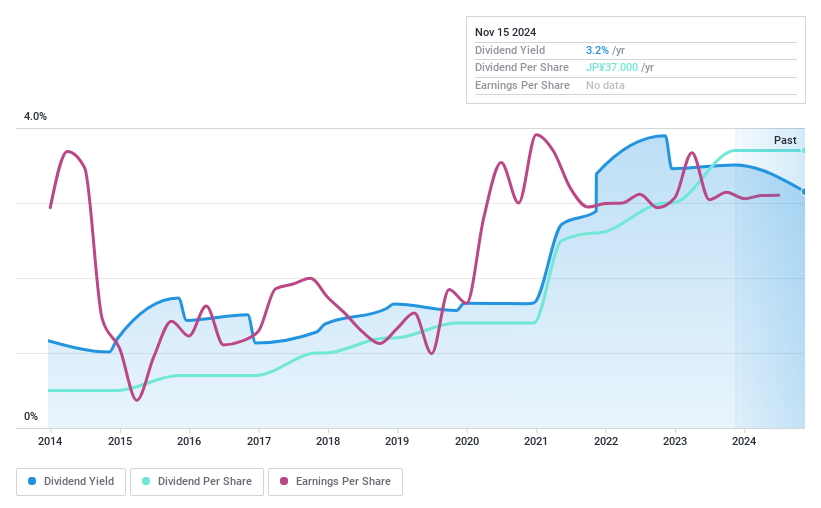

Dividend Yield: 3.3%

Asia Air Survey offers a consistent dividend yield of 3.25%, slightly below the top quartile for Japan. The company's dividends are well-supported, evidenced by a low payout ratio of 30.8% and a cash payout ratio of 41.8%, indicating sustainability from both earnings and cash flow perspectives. Over the past decade, dividends have not only been reliable but also shown growth, with stability in dividend payments throughout this period. Additionally, its price-to-earnings ratio stands at 11.3x, favorable compared to the broader Japanese market average of 14.3x.

- Click to explore a detailed breakdown of our findings in Asia Air Survey's dividend report.

- The analysis detailed in our Asia Air Survey valuation report hints at an inflated share price compared to its estimated value.

Summing It All Up

- Discover the full array of 421 Top Japanese Dividend Stocks right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tenryu Saw Mfg might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5945

Tenryu Saw Mfg

Manufactures and sells saw blades in Japan and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives